Deposit Disruption, 2019 Edition

January 16, 2019

The following blog post was written by c. myers and originally published by CUES on January 2, 2019.

How will you respond?

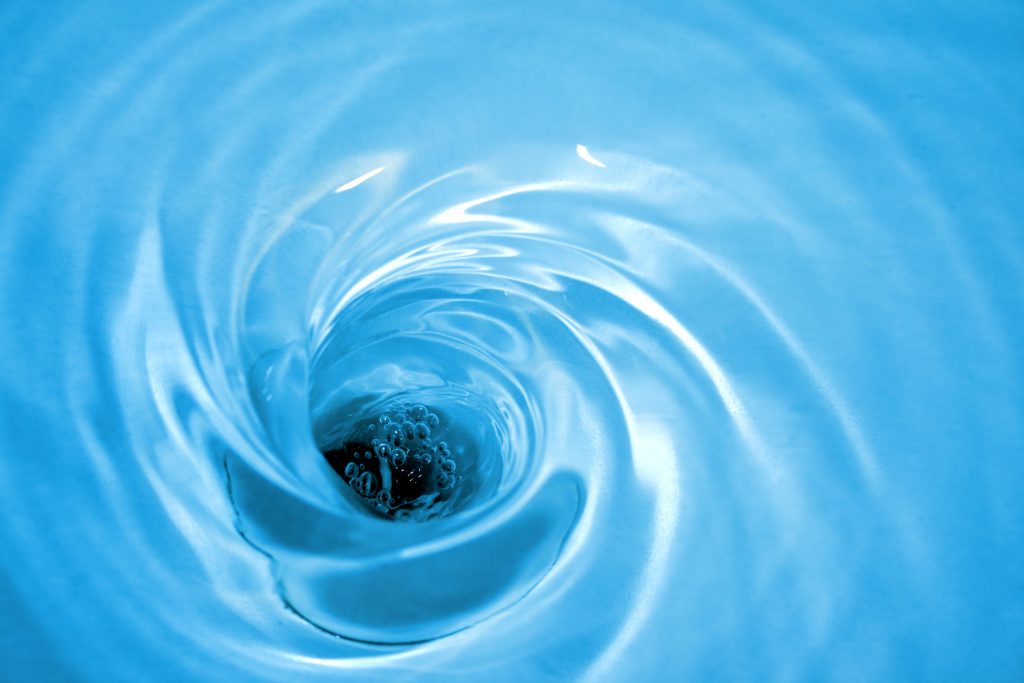

Imagine a world where member deposits are harder and harder to come by—a world in which slow leaks in the potential deposit pool have become a steady drain. As you imagine that world, the time to think strategically about how you could respond is now, before it actually happens.

People have been moving away from cash and checks as payment methods for years and it’s no surprise that the trend is more pronounced with younger age groups. At the same time, the available alternatives for payments have been exploding. Consider the ways in which the following could stealthily shift significant funds away from credit unions in the long term:

- Retailers’ reloadable account programs hold customers in place with discounts, rewards and convenience. Starbucks, Target, and Amazon all offer perks to folks who are willing to load funds and store them, at least temporarily, for later purchases. Back in 2016, The Wall Street Journal reported that Starbucks held more than $1 billion in its app and on gift cards. That’s over $1 billion—probably more today—that is not going into a credit union.

- Fintech payment providers hold customer balances. Apple Pay Cash and Venmo are two of the well-known players. The cash that passes through these accounts is often thought of as transitory, but some customers store funds in them. According to Logica Research, when asked if they were given an extra $500, 18 percent of Americans and 27 percent of millennials would put it in their PayPal account. At the end of 2017, Venmo and its owner, PayPal, held more than $18 billion in “funds receivable and customer accounts.”

Credit unions have been wrestling with ways to keep members from straying too far. Person-to-person payments are an example of the conundrum this represents. P2P platforms cost money but are thought to build relationships and keep members engaged. They may even prevent members from shifting some of their deposits away from the credit union. But are the trade-offs worth it?

The following strategic thinking exercise is a thought-provoking way to explore possibilities and test drive the future so that decisions can be made swiftly and with confidence when the future suddenly arrives. For this to be effective, ask your team to really put themselves into the future, think deeply and be as specific as possible when answering the questions.

Imagine it is 2025 and 20 percent of deposit funds have drained away:

- Will we rely more heavily on such non-deposit funding sources as borrowings or sale of loans? If so, which funding sources will we use?

- What is our true value proposition for a member with respect to deposits? Consider rates, engaging digital channels, unique products, etc.

- How will we adjust our business model to offset increased funding costs? Be specific.

- Which members will still keep their money with us? Why?

- Are we okay to simply house the member transaction accounts that connect to other payment services like Venmo, Apple Pay and Amazon? If so, how can we make those relationships profitable?

- How will our answers change if the funding drain is 50 percent?

- What other questions should we be asking?