Opportunities within the Treasury Yield Curve

February 15, 2018

Much has been written about the U.S. Treasury yield curve recently – it’s narrowing, it’s widening. It’s nearly impossible to predict. While there will always be uncertainty regarding market interest rates, the current shape of the yield curve offers credit unions some opportunities to explore.

Consider the decision to borrow funds. Many credit unions are feeling liquidity pressure and structured borrowings are a viable option to help improve liquidity. Along with borrowings comes the important decision of term. Depending on the risks that the institution is looking to address, the yield curve is creating unique cost versus risk trade-offs to consider.

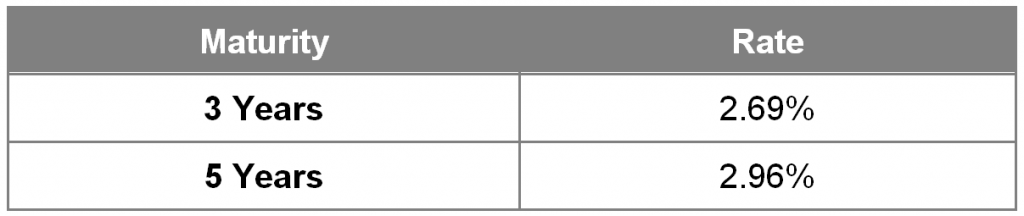

For example, in the following table let’s evaluate two potential borrowing terms, 3- and 5-year Federal Home Loan Bank (FHLB) fixed-rate advances:

FHLB Dallas – Fixed-Rate Advances (as of 02/13/18)

As expected, the 5-year borrowing rate is higher than the 3-year borrowing rate. However, the difference between the 2 rates is at some of its narrowest levels in the past 10 years. The credit union pays an extra 0.27% per year for 2 additional years of funding and protection from rising market interest rates. However there is always a trade-off, and market interest rates could stay relatively flat or not increase as much as expected. The possibility needs to be understood and tested with what-if scenarios. That being said, some decision-makers are finding the risk return trade-off between these 2 points along the yield curve is quite advantageous for their risk profiles.

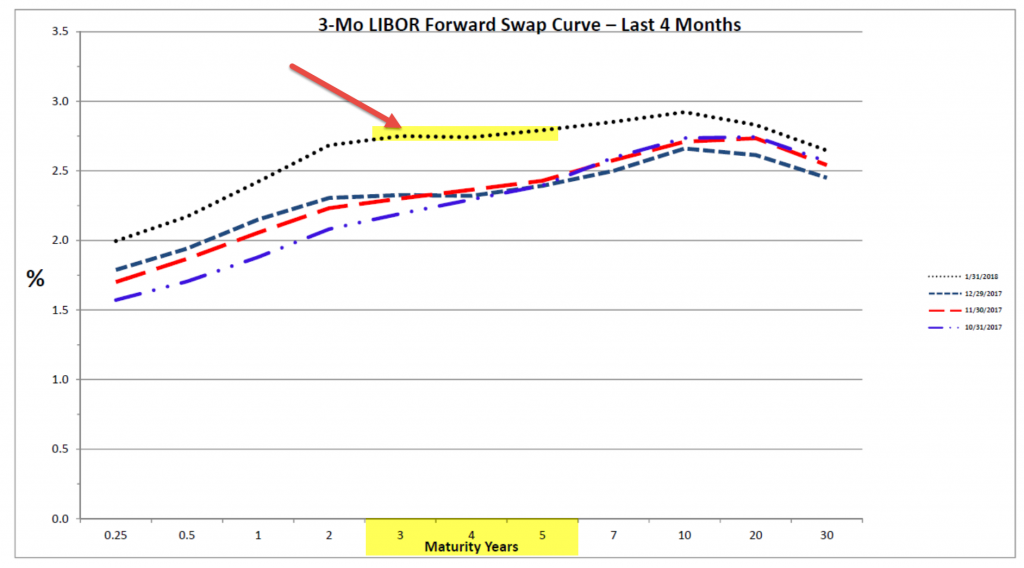

Likewise, there are similarities with the Libor Swap Curve. Notice in the graph below that the highlighted points between the 3- and 5-year Libor Swap Curve are among the flattest of any point along the 30-year curve.

Note: Analytics Provided by The Yield Book® Software

Note: Analytics Provided by The Yield Book® Software

Swaps and other derivatives are additional tools that can decrease interest rate risk in a rising rate environment. The challenge for some can be that along with derivatives comes material increases in operating expenses like accounting costs, expertise in the form of staffing, and additional A/LM analysis, to name a few. With that in mind, the flatness in the swap curve is an opportunity some feel could be a good fit for their risk profile.

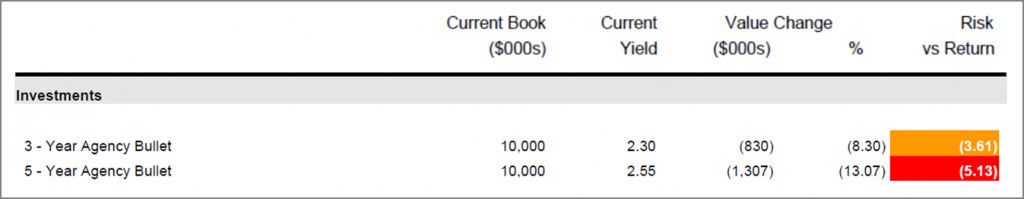

Another area impacted by the slope of the yield curve is the investment portfolio. For example, a simple fixed-rate, 3-year agency bullet is currently yielding roughly 2.30%, while a 5-year agency bullet is yielding close to 2.55%. As demonstrated in the following table, the risk versus return of the 3-year agency bullet is more favorable now, in a +300 bp shock, than the risk versus return of the 5-year agency bullet.

The yield curve will continue to change, along with the unique opportunities it creates. While the actions of the Federal Reserve and the level of interest rates continue to get most of the attention, it is important for credit unions to look for opportunities created by the differences between short-, intermediate- and long-term rates. In addition, twists and changes in the yield curve also need to be modeled routinely as part of asset/liability and interest rate risk management.