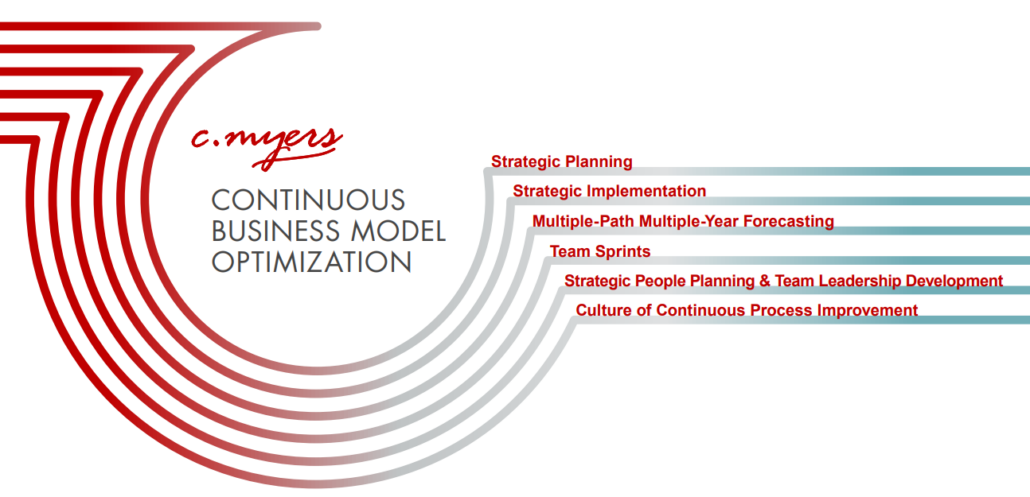

Our strategic engagements are designed for high-impact results. Continuous Business Model Optimization is key for enabling financial institutions to maintain long-term relevancy. Our solutions for business model optimization help move organizations toward their desired culture, create greater clarity and alignment, and improve their execution.

Our Continuous Business Model Optimization process is intentionally designed to be customized for each organization. Decision-makers choose the components of the process that are relevant to their needs.

STRATEGIC PLANNING

We help financial institutions reach consensus on their next big moves. Some are redefining their purpose and value proposition; others need to gain clarity on their 3–5 year strategic direction and initiatives. Wherever you are in your strategic process, we will help you customize your path so that you have meaningful strategic progress – timely.

STRATEGIC IMPLEMENTATION

A brilliant strategy without successful implementation is really just a collection of terrific ideas. Taking action that is aligned with strategy is key to achieving desired results.

We address a range of needs, including:

- Developing a process designed to help ensure the organization has the structure, skills, practices, and plans in place to execute on the strategy

- Identifying strengths and gaps in the execution of the strategic plan and recommendations to close the gaps

- Teaching a strategic approach to project portfolio management

MULTI-PATH MULTI-YEAR FORECASTING

Every day, our consultants help numerous Leadership Teams get their arms around options for syncing today’s financial realities with their desired financial and strategic performance.

Our forecasting models are so fast that you can see the possible financial outcomes as the team discusses ideas they are exploring.

Clients tell us that this powerful combination allows them more time to think and take a much more strategic approach to the big financial decisions they are facing

TEAM SPRINTS

Sprints are shorter facilitated sessions that can be used for many objectives. Examples include:

- Critical and strategic thinking which helps people rehearse for tomorrow today without the burden of having to make decisions

- Reaching consensus on the next big initiatives in light of strategy

- Pre-planning and strategic discovery to help participants be better prepared for big decision-making during their Strategic Planning process

- Project portfolio management updates and course corrections

- Financial considerations and KPIs in these wild rate environments

STRATEGIC PEOPLE PLANNING & TEAM LEADERSHIP DEVELOPMENT

Accelerating growth of leaders and emerging leaders, creating strong Leadership Teams, and having a well-defined strategic approach to people planning and development are top priorities for many CEOs.

Whether we work with individuals, or the whole Leadership Team, our clients quickly see the benefits. They appreciate that we intently listen to their unique organizational objectives and that we are able to work with them to co-create customized, and often individualized, growth and development strategies.

Leadership also includes the Board. Many Boards are genuinely interested in becoming a highly-effective strategic Board. They’re just not sure where to start. We help boards articulate what it means to to be strategic. Building on that understanding, we help develop and implement their next steps.

CULTURE OF CONTINUOUS PROCESS IMPROVEMENT

This is not like a typical process improvement initiative.

We know that creating a culture that is avid about unparalleled experiences where they truly matter, requires intense dedication and buy-in across the organization. And it can be fun!

The teams we work with often tell us that our combination of helping people elevate their critical thinking skills, gaining shared clarity around ultimate desired impact, and using relatable communication that is designed for various audiences, makes the difference.

This combination turns typical process improvement initiatives into creating a sustainable culture of making life better every day for customers and team members.