Strategic Budgeting/Forecasting Questions: Linking the Appetite for Risk

The fifth entry in our 6 blog series about Strategic Budgeting/Forecasting Questions addresses the institution’s appetite for risk and how it should connect to the budget or forecast.

Question 5 – How is the budget and forecasting linking to our appetite for risk?

A few short months from now, every credit union will be going through the annual ritual of creating a budget for 2018. Many leaders and boards not only struggle with this process, but may also consider it a drain on resources and time that take away from more important day-to-day business. And yet, looked at from a long-term strategic view of the organization, strategic budgeting and forecasting is a key component of a high functioning organization. Even so, one way boards and credit union leaders can make this coming year’s budget even more effective is to align the budget and forecasting with the credit union’s appetite for risk.

Step back and think through last year’s budgeting process and ask yourself some of the following questions:

- Did you adequately capture the credit union’s appetite for risk and align the budget to support that appetite?

- What are your concerns (both internally and externally) and are they being appropriately built into the budget?

- Are your forecasts aligned with the risks that the credit union is willing to take?

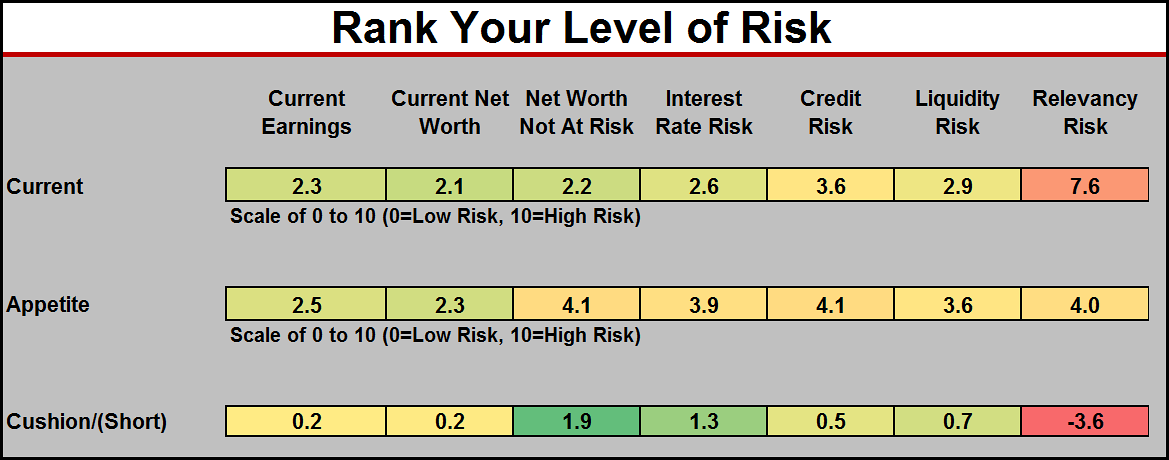

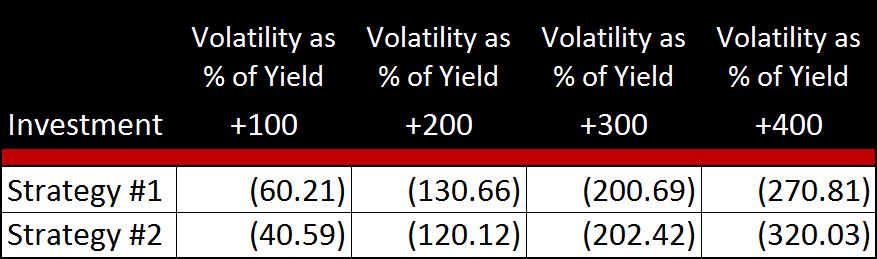

Take, for example, a credit union that goes through a typical “Appetite for Risk” exercise and arrives at the end of the exercise realizing that there are some opportunities to take on additional interest rate and credit risk. Further, consider that this credit union, like many others, wants to maintain their current earnings. Given the relevancy concerns noted in the following table, taking on some of this credit risk might well serve some of the needs this credit union has.

As you put yourself in this credit union’s shoes, consider some specific challenges that will play into their budget as they look to align their risk tolerances with their annual forecasts:

- Does the budget account for potential increases in lower quality paper and additional losses from bringing on more credit challenges?

- Do the yields on these loans adequately cover the additional risk the credit union is willing to bring on and are they being built into the budget?

- If this credit union decides to combine some additional credit risk with some additional interest rate risk, will either of these impact the credit union’s current earnings?

Now, imagine if you have already walked through the multiple steps and questions required to analyze taking on additional credit or interest rate risk and you feel well positioned to move forward and finalize your budget. Additionally, you feel as though you’ve fully vetted the budget for any potential weaknesses and believe that it’s aligned both with the credit union’s current strategy and appetite for risk. At that point, the next logical question then becomes: What’s next? How do you really know if your budget and the things you are planning for are aligning with the appetite for risk?

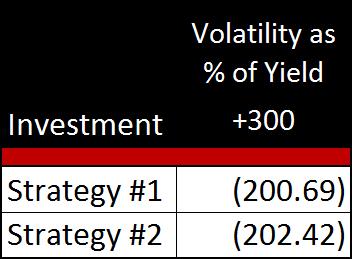

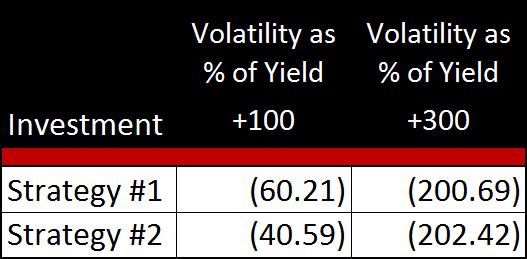

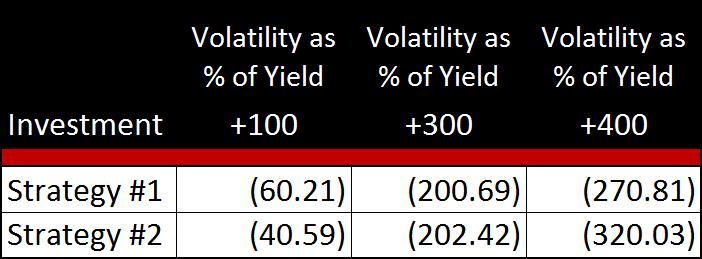

Outside of letting the budget play itself out and seeing if it comes to fruition, one effective way of analyzing its potential impact on the organization is to test the budget and its assumptions in your risk model. To do this, have the starting point of the risk model be the ending targets of the forecast. This process can help you evaluate whether the forecast is adding too much risk or leaving room for more risk, enabling decision-makers to see and sign off on the potential risk before it is actually added to the structure. It goes without saying, but it’s a lot easier to say no to a budget ahead of time than it is to unwind risks after they are added to the structure.

In effect, a process of presenting a budget along with the simulated risk, enables you to rehearse tomorrow today. Doing so will position the credit union to be in a much better strategic position going forward.