Liquidity: Another Thing to Worry About?

Imagine a scenario where it is difficult to find deposits. Suppose the stock market is booming and members are taking funds out of your credit union. Even if you don’t have liquidity issues, what if your competitors do and deposit rates are higher as a result?

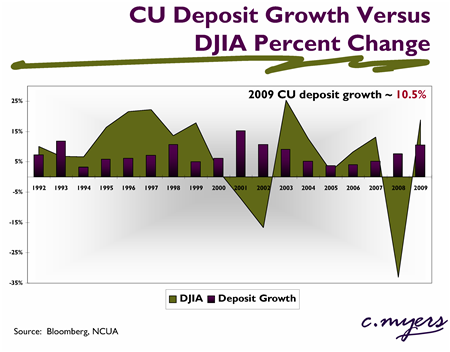

Is this hard to imagine given all the liquidity you have now? Consider the relationship between the change in the Dow Jones Industrial Average and credit union deposit growth. In the past, strong stock markets have typically been accompanied by reduced deposit growth. This pattern has yet to repeat in 2010, but what if it does? What would your liquidity position be if you lost the funds you have gained in the last year?

Also consider that this time your external sources of liquidity may not be available. What if a new corporate credit union structure included a reduced ability for corporates to lend funds? How about the FHLB? What if they are not able to lend funds at the level they have in the past?

The recently finalized Interagency Policy Statement on Funding and Liquidity Risk Management underscores this importance of liquidity planning. This policy statement specifically requires financial institutions have contingency funding plans (CFPs). We recommend you prepare for potential future periods of reduced liquidity now rather than wait for your regulator to request a CFP, or worse yet, to face a period of tight liquidity without a plan.