Balancing Credit Union IT Projects Using A Member-Centric Approach

Technology innovation is exciting! The newest technologies can change credit union business models, create a new customer experience, improve service, and reduce costs. Consumers have more choices for ways to conduct their financial transactions than ever before, and we are a culture that values choices.

Leaders face questions about how to best utilize the credit union’s limited resources to keep up with the newest technologies, while having to make educated bets on which ones will survive long term. In many cases, implementing new technologies does not mean replacing and removing older technologies (e.g., the costs for new technologies are not being offset by retiring old technologies).

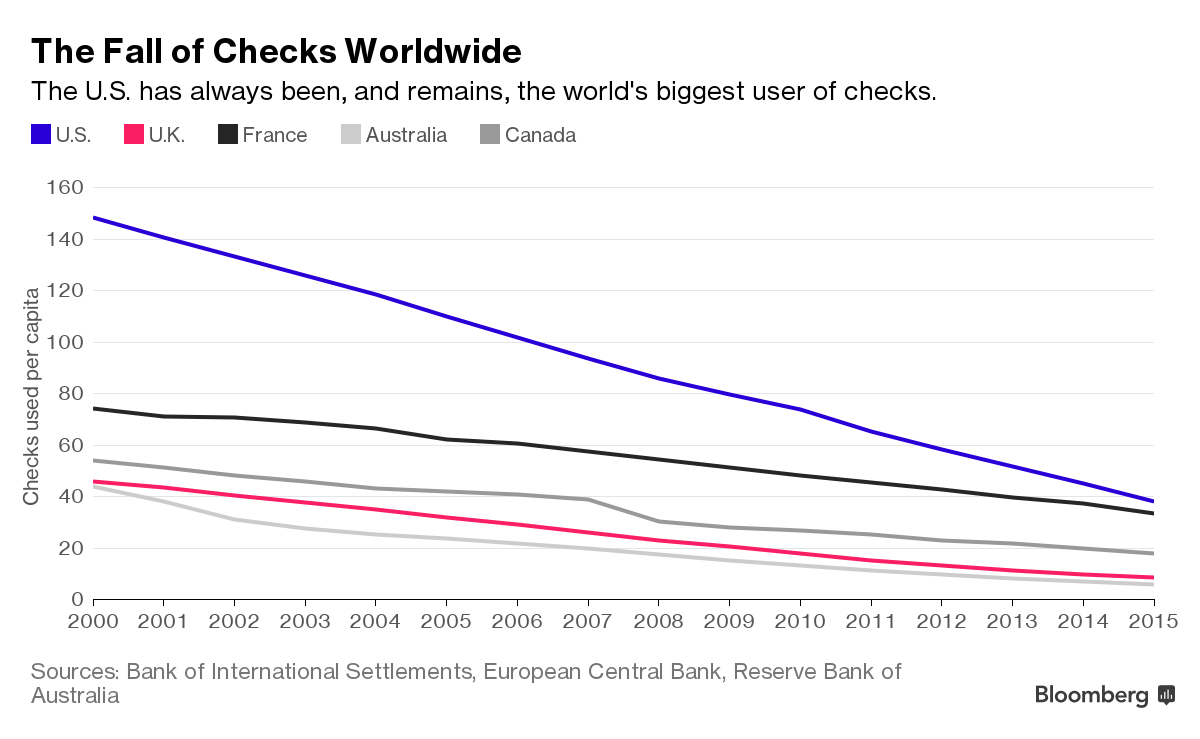

For credit unions, navigating today’s digital transformation can be challenging. Consider payment processing where a wide array of products are available including, among others, checks, ACH, wire transfer, debit card, credit card, bill pay, interactive voice response (IVR), remote deposit capture (RDC), PayPal™, Apple Pay®, mobile wallets, person-to-person (P2P), Bitcoin, etc. Many of the newest technologies are growing in acceptance rapidly. Older payment methods, like paper checks, also continue to have a following even though they’re clearly less efficient for the credit union, the member, and the payee. In fact, some innovations in recent years have focused on making paper checks more efficient, while other innovations look to supplant paper checks altogether. As shown below, while declining materially, check volumes continue to be a significant number of payment transactions.

Both new and legacy systems require development and infrastructure for ongoing support, as well as integration to work together seamlessly with the member’s account. Front-line staff need training to support every product. As members’ expectations drive new technology, what can credit unions do to prioritize their portfolio of projects and limit their support of legacy services?

A member-centric approach can be the foundation for establishing the long-term technology strategy and making tough technology decisions. As credit unions are compelled to invest in a broader array of products to serve members, a parallel effort to better understand member demographics and behaviors can serve as a navigation beacon. By deepening the understanding of the membership and the target market, credit unions can be better prepared to simplify and narrow their product offerings while maximizing member service. It begins by gathering relevant data.

What are the utilizations of the credit union’s products? Typically, it’s a straightforward exercise to determine the number of transactions that occur for a particular product. Does the credit union have this information for all of the product offerings? Is the number of transactions increasing or decreasing over time? What is the trend of utilization? Are there products today that are minimally used by the membership? If so, what is the cost of that ongoing support (i.e., technology support, front-line support, training, risk, etc.)?

Beyond general utilization metrics, which members are using the products? This information requires more effort, but the value can be significant. By understanding which products and services members use, analytics can be applied to assess each member’s overall participation in the cooperative while identifying opportunities to increase engagement. By associating usage with individual members, data can be further refined by demographic segments, revealing which segments are using products more or using them less.

Armed with a better understanding of their membership along with their preferred products and behaviors, the credit union could then look to its target market strategy. Where will membership growth come from? How does the credit union market to acquire new members? What is the ideal product suite to support the credit union’s target market? By blending a deeper understanding of the credit union’s unique membership and target market, credit unions can better inform their long-term technology strategy.

For some credit unions whose membership is comprised of more early adopters of technology, this analysis will confirm the need for strategy to address quicker implementation of new trends. For others, continued investment in maintaining and integrating legacy systems may need to remain a key focus. In either case, the credit union could begin making decisions today to promote certain technologies in support of their target market, while establishing longer-term objectives to retire other products and services that are waning in use and not aligned with the credit union’s future strategy.

Managing the portfolio of current and potential projects to keep up with technology can seem overwhelming. Technology and member expectations are moving fast, and member expectations are being influenced by experiences in all their consumer activities, not just financial services. The environment today is creating greater challenges for leaders to make effective, timely technology strategy decisions. By remaining member-centric and developing a deeper understanding of member and target market behaviors and expectations, credit union leaders can be better prepared to successfully navigate technology strategy and associated decisions.