Some Things to Consider About a Rising Rate Environment

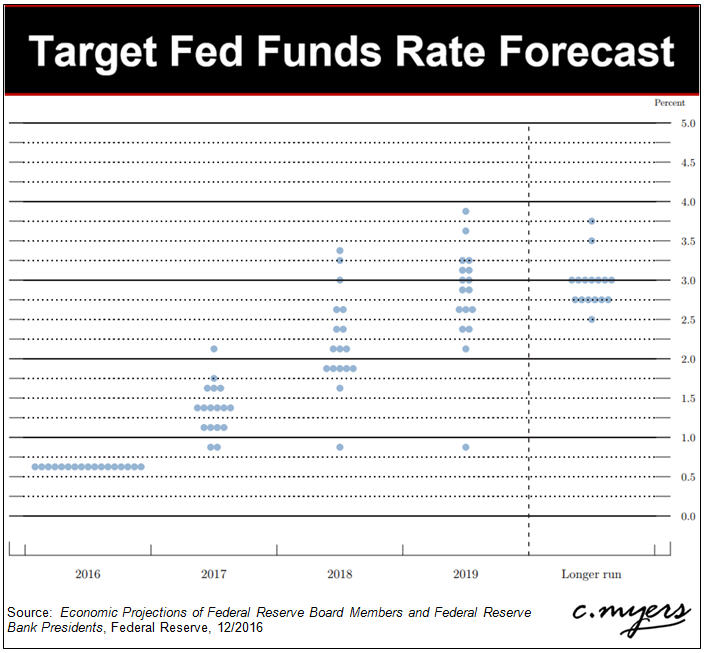

The Federal Reserve increased the federal funds target rate to a range of 50-75 bps at its mid-December meeting. In its forecast (the “dot plot” shown below), the Fed indicates further tightening in 2017.

While credit unions have certainly lived through rising rate environments in the past, few have managed a credit union through a rising rate environment coming from the lowest interest rates our markets have ever experienced. Combine this with how dramatically the world has changed since the last time rates went up (setting aside the 25 bps increase in December 2015, the last rising rate environment experienced came during 2004 to 2006) and the future is nearly unprecedented. Can you believe that Apple’s first iPhone came out in 2007 (Source: Time)?

Now that smartphones are ubiquitous and members have access to every financial services “app” in the known universe right in the palm of their hands, what might a rising rate environment mean for your credit union? Will your members behave differently now than they did in the past?

Using your asset/liability model proactively will allow you to see a range of potential outcomes before they happen. This will better prepare management and board for both the risks and the opportunities that are out there.

Some questions to consider and then turn into scenarios to model include:

- Will we be able to increase loan rates? Or will competition for loans from FinTechs or traditional competition, or the level of long-term rates, keep loan rates stable?

- When, and by how much, will deposit rates need to increase? How might this impact our deposit mix?

- What things are outside of our control – such as a competitor’s liquidity position and the potential impact to us if they have to raise deposit rates dramatically to attract funds? Or new competition, possibly from non-traditional sources?

- If deposit rates increase, but loan rates do not, what additional efficiency can the credit union create to have sustainable earnings with a tighter margin?

- Given the ease of moving money across institutions, are we at risk of seeing members move funds from our credit union? Or, what if consumers move funds to our credit union that we may not be able to lend out?

- There are always opportunities. What opportunities lie ahead for our credit union in this environment?

This list of questions is not meant to be all inclusive, but answering these questions is a great place to start. There are many more questions to be answered.