Be Clear on Your Objective of Doing a Core Deposit Study

Earlier this week we presented at a virtual roundtable with 100+ CFOs, and one of the most common questions centered around the benefits, or lack thereof, of doing core deposit studies for use in net economic value (NEV).

It is important to study member behavior with respect to deposits, including migration, pricing strategy, and competitive and economic environments.

Below are just a few examples of this type of information for the credit union industry. It is prudent for each credit union to understand its unique patterns of member behavior.

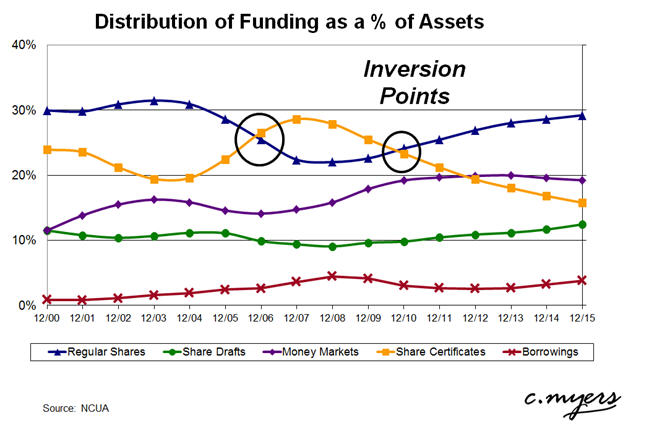

Example: Distribution of deposits has changed over time and through various economic cycles.

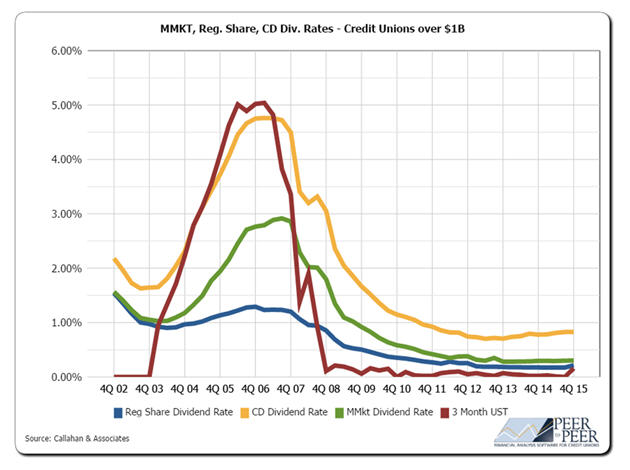

Example: Pricing strategy has changed through various economic cycles.

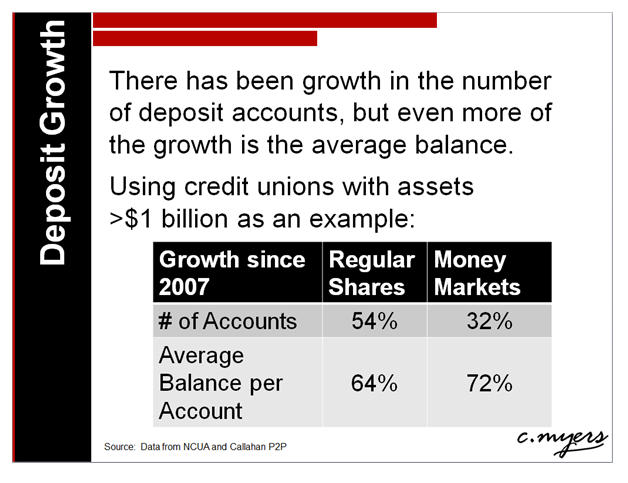

Example: Average balances relative to new accounts has changed since the last rate peak.

If you are willing to dig deeper, it is extremely valuable to understand how your deposit balances by age have changed over time ̶ a potential looming issue is that for most credit unions, large deposits are held by the older generation.

The objective of this type of business intelligence is to inform strategy. These risks can impact the credit union’s cost of funds in different environments (impacting profitability), and can be critical in identifying liquidity risks. These issues are very different than the objective of typical core deposit studies, which is to estimate decay rates and maturities of non-maturity deposits to be used most often in NEV. NCUA has released a new NEV test that standardizes the value of non-maturity deposits in the current rate environment and +300 bp shock.

So, if you are thinking about studying your deposits, be clear on your objective before spending money. If your primary objective is to use NEV, you may want to evaluate the cost/benefit in light of NCUA’s new standardization.