Who’s Afraid of the Big Bad FinTechs? A Powerful Value Proposition Can Calm the Fear

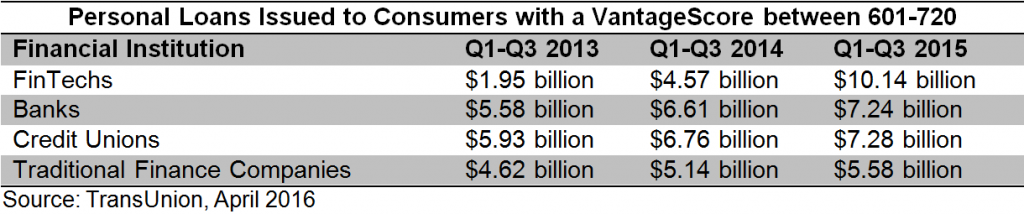

A lot of financial institutions are concerned about the competition brought by FinTechs that seem to be rewriting the script for how financial business gets done. How can a credit union without a tremendous development budget hope to compete with their slick technology? The concern is well-placed, but perhaps, not for the right reasons.

Yes, FinTechs have advanced technology and they are capturing significant market share, but the financial services industry isn’t really competing with their technology; it’s competing with new customer expectations. Remember when mail order meant filling out a paper form, mailing it, and waiting 6 to 8 weeks? People were content with it because that’s what they expected and they did not know anything different was possible. Fast forward to today; thanks to players like Amazon, customers now expect delivery in a few days, even as quick as one hour in some cases.

What the FinTechs have done is change how people expect to do business. Now that they know it is possible to have a much faster and simpler banking experience, there is no going back. We can never go back to 6 to 8 week mail order deliveries, even if Amazon goes away tomorrow. And if today’s FinTechs don’t survive, customer expectations are still forever changed.

So are faster and simpler processes a requirement for most people? Yes. Does that mean you need to look like a FinTech? That depends on your value proposition. If a FinTech’s value proposition is the ability to get a loan in pajamas, quickly, without talking to anyone, what is your value proposition? There’s room in the marketplace for more than one. If your value proposition is very low loan rates, helping people with credit issues, or building strong relationships, focus on delivering that flawlessly. If it is clear and powerful enough to truly resonate with your target market (and that target market is big enough to sustain the organization), you shouldn’t feel the need to copy the FinTechs; own your value proposition.

At the same time, you will still have to respond to those changes in member expectations; the questions are how and when. Most of that leading-edge technology is available today – for a price. Going back to the shipping example, there are plenty of successful online retailers that do not offer 2-day deliveries as a standard, but very few are in the 6 to 8 week range. Using your value proposition as a filter will result in a more strategic allocation of resources by choosing the right offerings to meet your unique membership’s expectations and support your value proposition.

Remaining relevant to your membership requires thoughtful adjustment as the world around us changes, but the key is to have a clear, powerful value proposition – and deliver on it.