Interest Rate Risk in an Auto Loan – Really?

The competitive landscape for auto loans has fundamentally changed over the last 15 years. There are more non-traditional lenders vying for autos and non-credit union lenders have been saturating the indirect lending market.

These trends put pressure on pricing and take a bite out of the auto lending pie. As a result, financial institutions are getting creative with pricing and terms. As this occurs, questions to consider need to evolve.

One example is the increase in 10-year auto loans, which we are seeing as we conduct interest rate risk simulations.

Consider:

- How might prepayments differ from a shorter-term auto loan?

- Is it reasonable to assume that a consumer wanting a 10-year auto will prepay the loan at the same rate as a 5-year auto loan?

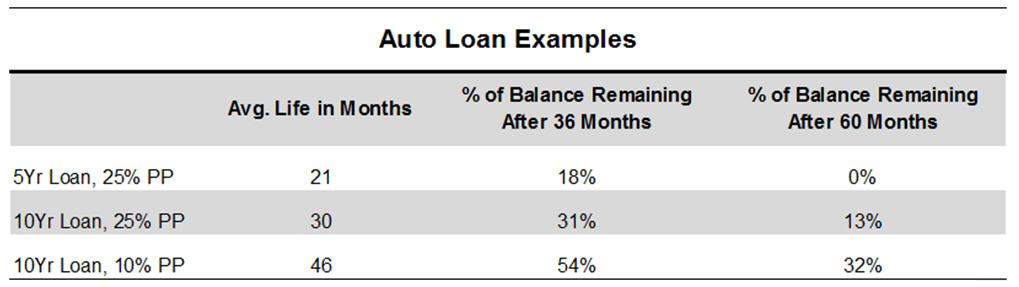

There is not an abundant amount of prepayment data on this type of loan to answer the questions above, so, test the impact. In the table below, notice the escalation in average life as well as the balance remaining after three years and five years. If the prepayment rate on this term of auto loan is 10% then more than half of the balance would remain after three years, and nearly one-third would remain after five years.

So yes, these loans bring more interest rate risk. If these types of loans become more prevalent, it will be important to change mindsets with respect to interest rate risk and auto loans, not to mention the risk of negative equity that comes hand in hand with the extended term.

Consider the potential impact of CECL on longer-term auto loans. For example:

- What if the auto loan is actually underwater for a material portion of the time it is outstanding?

- Do the potential risks mean financial institutions should not do long-term auto loans? There is no easy answer or one-size-fits-all response. Each executive team needs to decide their product offering in light of their value proposition, appetite for risk, and financial strength.

What we do know is that the questions need to evolve to appropriately identify and manage the risk.