Strategic Thinking: Not Just Another Payment Competitor

A little more than 10 years ago, Apple® announced the creation of the first iPhone®. The ability to move seamlessly between phone calls, music, and browsing the web, all from a handheld portable device using our fingertips was a revolutionary concept at the time, and has forever changed the way consumers interact both at a personal and professional level.

the creation of the first iPhone®. The ability to move seamlessly between phone calls, music, and browsing the web, all from a handheld portable device using our fingertips was a revolutionary concept at the time, and has forever changed the way consumers interact both at a personal and professional level.

Today, as more and more consumers move their entire lives onto (and into) their smartphones, Apple® is pondering taking its imprint a couple steps forward, potentially offering all iPhone users the ability to send digital payments to other iPhone users and, further, the possibility of issuing an Apple prepaid debit card.

Apple has long been rumored to be yet another competitor for the traditional financial marketplace, analyzing ways to build its own money transfer service. Recent news indicates that Apple has, once again, begun looking into ways that would allow iPhone owners to send money digitally to other iPhone owners, offering a service akin to Square Cash and Venmo, but with the financial backbone of Apple behind it. It’s no wonder, too, with a vast marketplace of loyal users already at its fingertips. As consumers move towards a more digital experience, including paying for things – like a portion of the dinner bill – through payment transfer apps that bypass normal interchange channels, apps and devices that make this process both easier and more convenient will no doubt have an advantage. With this in mind, it’s no stretch to imagine Apple, with its already strong consumer base, diving deeper into money transfer systems in an attempt to both grow market share and provide its consumers with yet another reason to choose Apple.

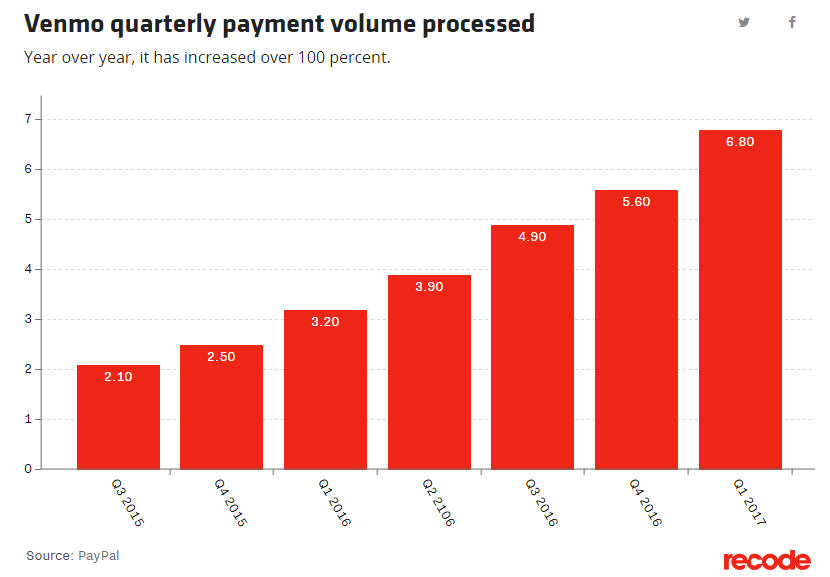

Venmo, for instance, a subsidiary of PayPal, reported quarterly payment volume processed of nearly $7 billion in Q1 2017, double what was processed in Q1 2016 ($3.2 billion).

And yet, even if it’s not Apple, it’s likely only a matter of time before the next competitive threat enters the arena of payment transfers, and continues to whittle away at some of the sources of income that credit unions rely upon to fund their business model.

Though there are numerous challenges that Apple faces in getting such a service off the ground and in the hands of iPhone users (estimated at over 100 million users in the US alone), the scope of Apple’s potential marketplace shouldn’t be lost on your credit union as you regularly analyze and plan to respond to threats from non-traditional avenues and FinTechs.

In analyzing threats of this nature, it’s useful to employ some multidimensional thinking exercises in order to better analyze the situation. Consider the following questions and ideas:

- In an ever competitive race to be top of wallet, how would Apple’s new potential money transfer system impact your credit union’s bottom line?

- One potential target audience for this service would be the underbanked (or unbanked) segment of our society, or even college-aged young adults adept at using technology and unafraid of eschewing traditional banking methods. Take time to consider the profitability of this segment and the revenue streams they bring into the credit union, as well as the costs inherent to building a system that is, for all intents and purposes, a pure cost center that rarely helps the bottom line. As technological change marches forward, the choices of how and what you embrace will become even more important than ever.

- If Apple (or Amazon, or X corporation) issues a prepaid debit card that becomes top of wallet for that consumer, how will your credit union respond? Or, will your credit union respond by not engaging that segment of the population? Consider that there were 9 million unbanked households in 2015, roughly, or 7% of US households, while another 25 million households, or about 20% of US households, were considered underbanked. (Source: 2015 FDIC National Survey of Unbanked and Underbanked Households)