3 minute read – With the Federal Reserve using monetary policy and increasing rates to combat inflation, there will be different winners and losers. Every financial institution has a unique exposure to rising interest rates. Some financial structures will experience an increase in earnings from higher fed funds and prime rates while others could see earnings squeezed.

Interest rate risk (IRR) analysis can help provide insights on the financial impact of increased rates. However, it is important to remember that as the environment changes, if rates increase, the IRR shocks themselves start to go higher, which can mean more pressure for many decision-makers.

For example, consider a traditional IRR test of a +300 basis point (bp) rate shock. Over the past two years, short-term market interest rates have been close to 0%. Since the onset of the pandemic, a +300 bp IRR shock increased short-term rates to roughly 3%. But if some of the projections come true and short-term rates are 2% by year end, the same IRR shock of +300 bps now takes short-term rates to 5%. Both tests are for a +300 bp shock in rates, but the pressure of short-term rates at 3% versus 5% can be vastly different.

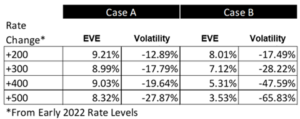

Notice the IRR shock results for Case A and B, two financial institutions with very different balance sheet structures.

If they both had a policy limit of 5% EVE ratio and -40% volatility, both institutions would be within their policy limits if rates stay at current levels. However, if rates continue to increase, and therefore the shocked environment increases, Case B would be out of policy.

The Point at Which You Address a Problem…

…is directly related to the number of viable options you will have to solve it. This is one of the many truisms that our founder, Cliff Myers, instilled into our culture.

This forward view helps decision makers get an early glimpse of what may happen and help reduce potential surprises. While both institutions are currently within their policy limits, the leadership team at Case B should start discussions to evaluate whether they would like to take actions today to reduce their risk in higher rate environments. If they would like to reduce their risk, the next step would be to evaluate the risk-return trade-offs of different options. There are always trade-offs to different decisions, and evaluating this earlier can lead to an increase of viable options.

We also recommend exploring different twists in the yield curve when evaluating the potential impact of rate changes. The current environment, along with some of the expectations of where rates may go, provide a reminder about the importance of testing twists in the yield curve. Different shifts in short- and long-term rates when evaluating rate increases may reveal more or less sensitivity to the environment. Seeing the impact of different yield curves should be incorporated in your frequent discussions about interest rate risk.

For more food for thought, you can listen to c. myers live – An Insightful Conversation About Inflation