Thought Leadership

You are here: Home1 / Thought Leadership2 / Who’s Afraid of the Big Bad FinTechs? A Powerful Value Proposition Can C...

602-840-0606

Toll-Free: 800-238-7475

contact@cmyers.com

602-840-0606

Toll-Free: 800-238-7475

contact@cmyers.com

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Who’s Afraid of the Big Bad FinTechs? A Powerful Value Proposition Can Calm the Fear

Consumer Behavior and Technology, Economy, Strategic Planning Blog PostsA lot of financial institutions are concerned about the competition brought by FinTechs that seem to be rewriting the script for how financial business gets done. How can a credit union without a tremendous development budget hope to compete with their slick technology? The concern is well-placed, but perhaps, not for the right reasons.

Yes, FinTechs have advanced technology and they are capturing significant market share, but the financial services industry isn’t really competing with their technology; it’s competing with new customer expectations. Remember when mail order meant filling out a paper form, mailing it, and waiting 6 to 8 weeks? People were content with it because that’s what they expected and they did not know anything different was possible. Fast forward to today; thanks to players like Amazon, customers now expect delivery in a few days, even as quick as one hour in some cases.

What the FinTechs have done is change how people expect to do business. Now that they know it is possible to have a much faster and simpler banking experience, there is no going back. We can never go back to 6 to 8 week mail order deliveries, even if Amazon goes away tomorrow. And if today’s FinTechs don’t survive, customer expectations are still forever changed.

So are faster and simpler processes a requirement for most people? Yes. Does that mean you need to look like a FinTech? That depends on your value proposition. If a FinTech’s value proposition is the ability to get a loan in pajamas, quickly, without talking to anyone, what is your value proposition? There’s room in the marketplace for more than one. If your value proposition is very low loan rates, helping people with credit issues, or building strong relationships, focus on delivering that flawlessly. If it is clear and powerful enough to truly resonate with your target market (and that target market is big enough to sustain the organization), you shouldn’t feel the need to copy the FinTechs; own your value proposition.

At the same time, you will still have to respond to those changes in member expectations; the questions are how and when. Most of that leading-edge technology is available today – for a price. Going back to the shipping example, there are plenty of successful online retailers that do not offer 2-day deliveries as a standard, but very few are in the 6 to 8 week range. Using your value proposition as a filter will result in a more strategic allocation of resources by choosing the right offerings to meet your unique membership’s expectations and support your value proposition.

Remaining relevant to your membership requires thoughtful adjustment as the world around us changes, but the key is to have a clear, powerful value proposition – and deliver on it.

6 Questions Credit Unions Should Answer to Strengthen Their Strategy

Strategic Planning Blog PostsIt is no secret that decisions are more complex and far-reaching, and margins are razor thin. Traditional and non-traditional opponents on the battlefield keep multiplying and plotting to get your members’ business, all while credit unions have to allocate their finite resources to the regulatory avalanches, such as NCUA’s NEV test, RBC, and CECL.

Below are six questions to answer in order to develop a relevant and sustainable business model:

Evaluating the business model includes an understanding of who is in the target market, as well as reaching clarity on the value proposition, competitive positioning, and internal core differentiators.

Having the right amount of talent is critical. A good balance of critical and strategic thinkers, problem-solvers, who can motivate people to get the right things done and in the right order, will generate success within the ever-changing environment.

As consumer adoption of technology continues to cause the competitive landscape to change, actionable business intelligence will be essential for credit unions going forward. There is often a treasure trove of data at the credit union’s disposal, but turning it into revenue and generating opportunities timely will be the challenge.

The majority of credit unions have dozens of third parties that are essential for a wide range of services, and many of these third parties directly impact a credit union’s brand. Optimizing requires critical thinking and deliberate human resource allocation.

Often, decision-makers say they want their organizations to be innovative. Being innovative means trying new things and if appropriate, failing fast, learning, and applying the learnings to the next pilot program. However, many are truly afraid to make mistakes, and fear of mistakes is in direct conflict with being innovative. This is not to say that decision-makers should be reckless. Rather, to pilot new things on a smaller scale and then, if appropriate, roll them out. If the pilot does not meet stated objectives, then fail fast and move on.

As consumer behaviors change and attention spans shrink, it is essential to adjust marketing efforts. Targeted and purposeful marketing is no longer an option. Consumers are inundated with marketing messages from just about every sector. Additionally, credit unions should ensure that their operations support their marketing efforts. It would be unfortunate if the marketing efforts generated a great amount of consumer interest, and the credit union was not operationally ready. It is not uncommon for us to see follow up on opportunities from digital channels inappropriately handled.

Answering these six questions can strengthen a credit union’s strategy. The best way to approach this is to begin and have fun as you explore the answers and evolve your strategic thinking.

5,875 – The Number of Credit Unions with Assets Less Than What?

ALM, Consumer Behavior and Technology, Economy, Liquidity, Strategic Planning Blog PostsCan you guess what this number represents? You probably would not have guessed that this is the number of credit unions with assets less than the balances held on the Starbucks app and gift cards, which as of the first quarter 2016 totaled $1.2 billion (Source: marketwatch.com). As a point of comparison, this is more than double the balances held on prepaid cards issued by Green Dot Corporation. Perhaps even more surprising is that a whopping 41% of all Starbucks transactions are completed using a Starbucks card or their mobile app (Source: marketwatch.com). Starbucks has announced plans to introduce a prepaid Visa rewards card through a partnership with Chase at the end of the year (the full article can be found here).

In the grand scheme of things, the $1.2 billion balances held by Starbucks, while impressive, is a small piece of the American deposit base, which totals more than $12 trillion (Source: bankregdata.com). However, the continued disruption of traditional banking should be what gets the attention of credit union decision-makers, as these types of alternatives are growing quickly and are being offered by a more diverse group of companies that generally have had nothing to do with traditional financial services in the past.

It would be a good strategic thinking exercise to consider how these kinds of trends could impact the credit union’s financial structure, both over the shorter-term, but in particular over a longer period of time, such as 3-5 years.

Consider not only what the impacts could be to your financial structure, but how could this impact your strategy, and how might your credit union respond to these types of threats?

What-Ifs Help the Budget Process

ALM, Budgeting, Interest Rate Risk Blog PostsTesting ideas and running what-ifs is a powerful way for decision-makers to understand the impact of decisions under consideration in real-time (for more on this, please refer to our blog, Has your ALM technology Emerged from the Dark Ages?). The power of what-ifs can also be applied to the budgeting process, and help link decisions made in the budget to the impact on a credit union’s risk by answering three risk-related business questions:

Budgets help answer the first question and don’t address the next two questions. The answers to these two questions could impact the credit union’s ability to deliver on its strategy.

Credit unions should create a target financial structure by running their budget through their risk model to understand the overall risk of the budget coming true (for more on this, please refer to our blog, Testing the Budget’s Interest Rate Risk). What-ifs help decision-makers evaluate the risk trade-offs of key decisions and forecasts during the budgeting process.

Not all decisions need to be run through the risk model during the budget process – this is how the target financial structure is helpful. Rather, decision-makers can test three or four of the key decisions or expectations that are driving the budget, both for revenue and expenses, and run a what-if to quickly understand the risk impact.

An example might be that the lending department believes they can generate a high amount of growth in mortgages in the coming year. This would be a key driver of revenue for the credit union. Decision-makers can run a what-if on this expectation and determine if they are comfortable with the risk/return trade-off.

Using what-ifs allow decision-makers to be more nimble during the budgeting process, and make changes along the way if they determine the risk/return trade-offs of key initiatives are out of their comfort zone.

Long-Term CDs – Questionable Cost of Funds Protection

ALM, Interest Rate Risk, Strategic Planning Blog PostsThe 10-year Treasury closed below 1.40% 3 days in July!

The flattening of the yield curve has many folks worried about further pressure on net interest margins. Some, though, are hoping to extract a benefit by locking in long-term funding at historically low interest rates. As an Asset/Liability Management (A/LM) strategy, this approach employs the trade-off between paying something more today for protection in a potential rising rate environment in the future.

The use of long-term, competitively priced Certificates of Deposit (CDs) is one common approach to achieving this goal. But there are risks in making that strategy work.

Consider a credit union offering these competitive CD rates:

How would a member be expected to react?

from the table above plus the 100 bp market interest rate increase), versus the 1.80% currently being earned.

The credit union paid the member a higher CD rate during the first 2 years for protection it did not receive in years 3-7 when CD market interest rates had increased.

Why did the strategy not work?

The opportunity to earn more interest on a new CD when market interest rates increased greatly outweighed the penalty to early withdrawal. This is an issue for any long-term CDs that include an option for early withdrawal. If market interest rates become more favorable early into the life of the CD, the number of years remaining will often create a benefit that outweighs typical early withdrawal penalties. Contributing to the issue is the flat yield curve, which means even small market interest rate increases can create a net member benefit using shorter-term CDs.

In fact, using the example above, at the beginning of the 7-year term the market interest rate would only need to go up 13 bps for there to be an advantage for the member to withdraw early.

By the end of year 2, with 5 years remaining on the CD, the rate would only need to go up 19 bps.

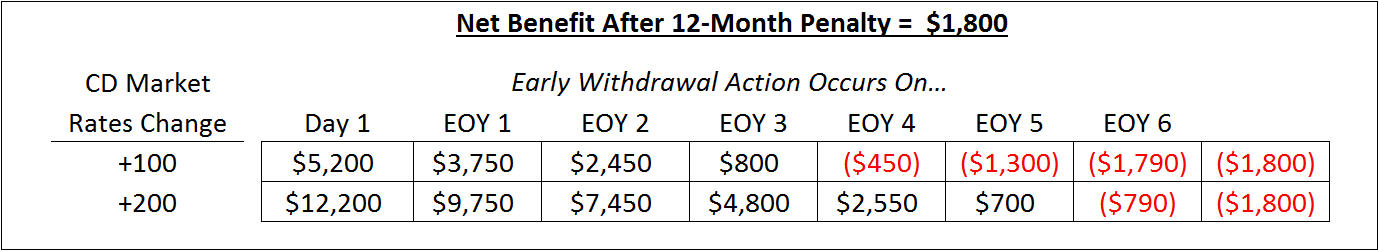

Consider again the 7-year $100,000 CD, and let’s look at the net benefit to the member each year if CD market interest rates changed by +100 bps or +200 bps. The net benefit is calculated simply as:

In the table above, notice that when using a 6-month penalty, the member benefit is positive until the end of year 4 for a +100 bp rate increase. This means that if the CD market interest rate were to go up by 100 bps in any of the first 4 years, the member could reasonably be expected to close the CD. Beyond the end of year 5, in a +100 bp rate increase, the early withdrawal penalty provides a disincentive to close the CD. Notice too, that a 6-month early withdrawal penalty leaves the member with a positive benefit through year 6 in a +200 bp rate increase.

The following tables increase the penalty by an additional 6 months each. A 12-month penalty creates disincentive after 3 years in a +100 bp rate in increase, and begins to create some disincentive after 5 years in a +200 bp rate increase. An 18-month penalty encourages the member to stay in the CD for 2 years in a +100 bp rate change.

The point is that the longer the CD, the more difficult it can be to design it to provide effective cost of funds protection in a rising interest rate environment. Typical early withdrawal penalties are not likely to be enough to make the interest rate risk strategy successful.

Credit unions may need to consider stiffer penalties for members that want to lock in a long-term investment. If the objective is risk mitigation, an option could be to have the penalty be half the term. Another option that is more complicated to explain and disclose, is to have the penalty equal to the replacement cost (present value). Each option has a trade-off and it is important to balance member perspective. An option is to have a materially lower rate with the traditional penalty and then label the more aggressive rate an investment CD (stiffer penalty). Of course, management might also consider other A/LM tools, such as long-term, non-callable borrowings, to help protect the cost of funds in a rising rate environment.