3 Step Balancing Act – Risk, Strategy, and Financial Performance

November 8, 2023

|

|

6 minute read – The following blog post was written by c. myers and originally published by CUES on October 12, 2023.

Strategic plans are all about possibilities, but the possibilities for risks to get in the way are also part of the equation. Knowing that there are risks and knowing that they can impact financial performance means that choices must be made. Those choices are better made after reaching as much clarity and alignment as possible, especially in a changing or uncertain environment. Stakeholders who follow a defined process to address the most concerning risks and their effects on financial performance, have more clarity and confidence in how resilient their plans are and whether they need to be adjusted.

Step 1: Agree on Risk Appetite and Current Level of Risk

This step not only allows decision-makers to articulate their appetite for different types of risk, it also fosters alignment around how much risk is actually present. Start by identifying your major areas of risk, then determine how much risk various stakeholders are comfortable with in each area and how much risk they perceive the institution has taken on. This is a targeted way to uncover where risk appetites and perceptions of current risk diverge so they can be brought out for discussion. The value is in the conversation, which typically leads to better alignment.

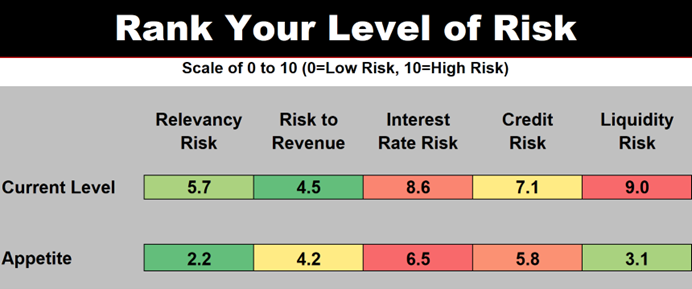

In this example, each team member was asked to rate their appetite for and perceived current level of risk on a scale of 0-10 for each category. Here, we’re showing the average of the team’s rantings. The team’s appetite for risk to revenue is very close to the perceived current level of risk. Liquidity risk is a different story. Conversations can center around why the appetite for this risk is relatively low and why the perceived current level is high. It’s also helpful to discuss wide variations in individual scores, such as why one person believes the current level is high while another rates it low. See our blog, Linking Revenue Opportunities with Appetite for Risk, for more ideas.

Step 2: Ready the Strategic Financial Plan

Many organizations already have a longer-term financial view of the strategic plan, often called a strategic financial plan or financial roadmap. This is an important tool when balancing risk, strategy, and financial performance. The plan looks out 3-5 years and provides a high-level financial view that builds upon the current structure and trends, and layers on the financial consequences and timing of the strategy. This provides a view of the institution’s expectations for a likely scenario. The fact that none of us can accurately predict the future means that it serves as an excellent starting point but is definitely not set in stone. Rather, it is a valuable base for alternative outcomes or what-ifs for Step 3. See our blog, Why a Financial Roadmap is Important, for more information.

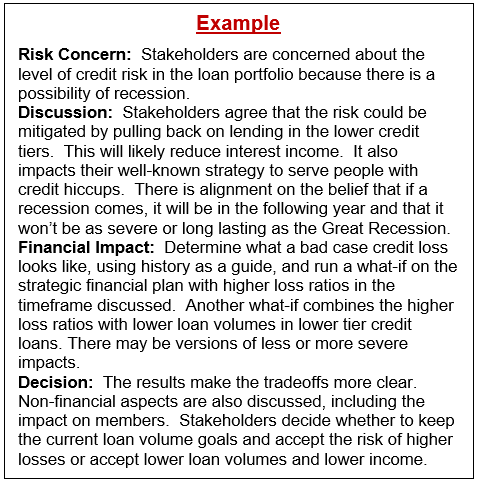

Step 3: Address the Highest Priority Risks

Armed with Steps 1 and 2, stakeholders can begin to address the risks that concern them the most. Questions for discussion include:

- What could we do (or what more could we do) to mitigate this risk?

- What are the costs or downsides of mitigation? How does mitigation impact the strategy?

- Is the risk already being addressed through the strategy or other means? What is the timeline for resolution?

- Is the organization on a path that will increase the risk? How much and how quickly?

- If the risk has not materialized yet but is a concern, how likely is it to materialize and when?

Using the strategic financial plan as a base, what-ifs illustrate what could happen to financial performance if risks are realized or mitigation actions are taken. Stakeholders can then have more complete information to base discussions and decisions on, which could include adjusting the plan. For insights on how to connect aggregated risks to strategic net worth, listen to our podcast, Maximizing Net Worth: Insights for Financial Institutions.

Risk evolves over time, so this process is not a “one and done.” Consider building in regular check-ins – revisiting risk questions periodically is appropriate and can help keep everyone on the same page.

This 3-step process enhances clarity and communication between Board and Management. It can help stakeholders get more comfortable with the directions the institution is taking and how it’s protecting against the most concerning risks. By connecting these dots, stakeholders are better able to balance their strategic path, risk tolerance, and financial performance, boosting confidence that they’re making better-informed decisions.