Think Critically About Your ALM Conversation & Decision-Making

August 3, 2023

|

|

4 minute read – Unprecedented. We hear this word used every day. However, if you are a student of history, you know that there are no new stories and we’ve read a version of this story before, except now it has new economic twists and technological turns. The questions being asked, and the assumptions being made about risk and opportunity in ALM, need to be changed to reflect the changes in the world in which this story is unfolding today.

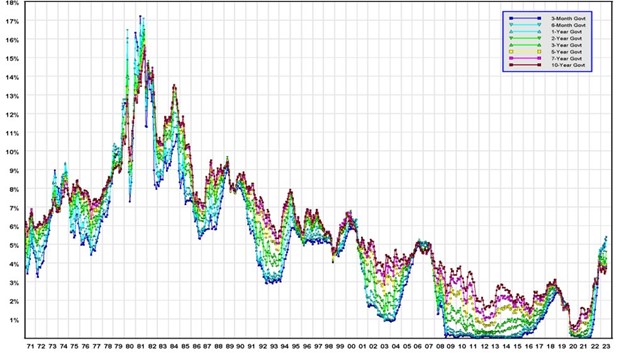

Historical government interest rates:

Looking back at historical government interest rates, we know that short-term rates have risen over 300 bps fourteen times since 1971, four of those instances since 2000. In the early 80s, rates went up 1000 bps in eleven months – compare that moment in history to the 500 bps over the last year. We’ve seen money move for rates, and we’ve seen money move from fear. We’ve seen the yield curve twist. What we didn’t see in the past was the ability for consumers to move money with a few swipes on their phones. We didn’t see FinTechs cutting into deposits at traditional depository institutions. And we didn’t see internet pop-ups advertising high-rate CDs at financial institutions thousands of miles away. So now we must walk into the future with the wisdom of the past in our pocket and awareness of current happenings.

Consider the following as you engage in critical conversations around ALM with your leadership team:

- Be proactive. Run What-ifs throughout the year, practice scenario planning, and evaluate risks beyond 1 or 2 years. As you assess risk, understand absolute levels of rates rather than just relative shifts. Plus 300 from 1% is a far different situation than plus 300 at 5% rates. Don’t get laser focused on rates continuing to go up. There is enough uncertainty that you need to keep your eyes on the down rate environment as well. Anticipate potential challenges – like credit risk – even if they aren’t causing problems just yet. We can’t always guess the end of the story, but we can think through a range of possibilities.

- Reevaluate your KPIs. As the environment changes, assess the relevance of your KPIs. Will the KPIs of last year or five years ago indicate what you need to understand today or tomorrow? ROA and Net Worth can show you part of the picture but what else do you need to know? For example, many institutions have goals related to loan production – are those goals leading to unprofitable loans?

- Scrutinize assumptions. How might the story take a different direction if you see your deposit mix shift from non-maturity deposits to CDs? What is your risk of withdrawals? Delve into the connection between deposit migration and deposit pricing assumptions. How might different pricing strategies impact your effective cost of funds? What will be the impact on your reputation as you navigate credit risk, liquidity risk, and interest rate risk?

- Illustrate the horizon of pain. History has taught us that sometimes things work themselves back into balance. Exploring multiple potential paths can help you understand when to take action and when to let the story play out. Gather data and increase frequency of monitoring to reflect the quick twists and turns of the economy and environment.

- Play out the story. The numbers behind ALM build a framework, but spend time asking the whys. Why are the numbers doing what they are doing? Including the critical thinking of the leadership team in the strategic discussions around ALM can help bring the story out of the numbers and lend a variety of perspectives to the situation.

By understanding the past and challenging assumptions about the present, your organization can better prepare for the future. Balancing strategy, risk tolerance, and desired financial performance while learning from the past, can contribute to a more informed and proactive approach to navigating the uncertainties of today and beyond.