Thought Leadership

You are here: Home1 / Thought Leadership2 / Update to the NEV Supervisory Test Framework Brings Relief and New Pre...

602-840-0606

Toll-Free: 800-238-7475

contact@cmyers.com

602-840-0606

Toll-Free: 800-238-7475

contact@cmyers.com

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Update to the NEV Supervisory Test Framework Brings Relief and New Pressures

ALM, Featured, Interest Rate Risk Blog Posts6 minute read – The NCUA recently released an update to its Interest Rate Risk Supervisory Framework that specifically addresses the NEV Supervisory Test. In short, while the update provides some relief for credit unions, it also increases the amount of judgement in the exam process. This will require credit unions to make sure they have a strong understanding of their ALM results, earnings potential, and sources of risk.

As a reminder, the test has created a challenge for many institutions, as rates have increased this year. Their risk classifications increased significantly in the NEV Supervisory Test, which did not always align with the changes in their balance sheets and overall financial structures. However, the increased risk classifications brought corresponding examiner pressure. This was especially true for those in the extreme risk category where the NCUA manual would call for a DOR (or other supervisory action). DORs would then require a de-risking plan. (See: https://www.cmyers.com/thought-leadership/ncua-nev-supervisory-test-heads-up-now/).

In an effort to relieve this pressure, the NCUA removed the extreme risk classification (see below for updated classifications).

The NCUA’s intention is to relieve pressure on the industry and to give credit unions time to adjust to this new environment. However, this may cause a different pressure to emerge, as there is now more discretion in the exam process to determine the level of risk and what actions may be needed. Indeed, many of the subtitled sections in the update speak to the increased discretion in the exam process:

As always, the heart of the NCUA’s concern is the risk any one institution poses, and even here there is some level of discretion when looking at the examples for when a DOR should be considered:

The bottom line is that there is now more burden of proof on the part of the credit union. This also comes at a time when many in the industry, examiners included, don’t have experience going through a stress event like the one being experienced today with high inflation and rising rates. It’s easy to imagine how these factors have the potential to create misunderstandings and increased examiner pressure. This is why it is critical for credit union leaders to understand and be able to explain their IRR position from different angles, as well as the sources of risk and the associated return trade-offs that have been taken.

This is where there is some silver lining to the new pressures created by the update. The NCUA has, in many respects, provided a roadmap (and the impetus) for credit unions to be more prepared for their exams and, more importantly, better equipped for this environment.

As a first step toward becoming better equipped, ALCOs should be highly engaged. Committee members should be asking more questions and having deeper discussions about the institution’s structure, its sources of profitability and risk, and the risk/return trade-offs of different decisions.

As part of these conversations, it could be helpful to ask: Do we need to broaden our view of where rates will go? Primarily focusing on rising rates can cause the organization to lose out on opportunity if rates go down. This is where it’s helpful to turn the focus from one rate environment (think +300 bps) to a range of rate environments and think of optimizing for that range. Expanding conversations in this way will help during the exam, as leaders will have a deeper understanding of IRR and their institution’s approach.

Ensure that the focus is not limited to NEV, rather, the discussions should focus on understanding the impact to earnings and net worth. This is especially true if there are concerns around insolvency. In essence, the key is to show that even with high-risk NEV Supervisory Test results, the institution will remain a going concern, assuming it can demonstrate an ability to generate earnings and build or protect net worth. Even in cases where an institution has negative earnings, it can often identify ways to protect net worth and remain solvent while it addresses its earnings issues. A key to this is to have sufficient liquidity, so as to not have to turn unrealized losses into realized losses. Testing and understanding liquidity strength along with contingent options is critical if the risk profile is tight. Liquidity risk can change quickly, especially as institutions have seen assets lengthen and some have seen deposits decreasing.

Internally, institutions may also face questions and pressure from different decision-makers, as there is no ‘right’ answer to appetite for risk. Some may not like the level of risk indicated in the NEV Supervisory Test and push to de-risk. It can be easy to request that risk be reduced quickly, but there are always trade-offs. Whether for the examiners or internal pressure, taking steps to de-risk can cost millions of dollars in earnings and net worth. This is where it is important to have the board and ALCO understand the risk/return trade-offs so they can make informed decisions that help move their strategy and financial structure forward.

Without understanding the risk/return trade-offs, decisions could be short-sighted, unnecessarily restricting earnings and impacting net worth levels. This could then interfere with strategic initiatives and moving the business forward. This is why decision-makers, with different areas of responsibility, will want to take the time to build a solid understanding of ALM, have productive conversations, and connect the decisions to the potential financial and strategic impacts.

6 What-Ifs for Your Financial Reforecast

ALM, Budgeting, Featured, Financial Planning Blog Posts5 minute read – The Fed rate increases have been more aggressive than most anticipated back in 2021 when institutions were preparing their financial forecasts. As a result, you may be looking at a financial reforecast. In a 3–5-year forward-looking view, these what-ifs can help tell the story of which forces your structure can withstand well, and which might call for mitigation strategies. Note that if you’re only updating the 2022 budget, these what-ifs won’t have as much impact, which is why a 3–5-year forecast is so beneficial.

Consider these what-if ideas:

The industry is facing uncertainty on several fronts and the what-ifs are intended to test what could happen if some of the uncertainties materialize. Team conversations can start with these areas of uncertainty:

Deposit Balances

Deposits grew at unprecedented rates after the pandemic, but what will happen next is in question. Customer deposit balances could dwindle as the result of inflation as people spend more on almost everything. It’s also possible that a recession could cause deposit balances to grow through a flight to safety, putting more pressure on already-diluted net worth ratios.

Deposit Rates

Many organizations do not currently need deposit growth to support lending, so they don’t expect to increase deposit rates much, now that market rates are rising. But there are some that do need deposits and will likely increase rates to get them. If a major competitor in your area increases rates, ask yourself if you would increase rates to stay aligned with your value proposition and/or reputational purposes, or let some deposits go. If you’ll let some go, also ask how much before you’d take action to stop it.

If you need deposits, consider that competitors that don’t need deposits might raise their rates to stay in line with the market and/or their value proposition, which could mean your organization having to raise rates higher than planned in order to get needed deposit growth.

Lending

Mortgage lending predictions have been revised downward as mortgage rates have risen and the market has remained stubbornly low on inventory. Some could see an increase in home equity products, as people who might have moved stay put in order to keep their low-rate mortgages. But consumer lending is facing uncertainty as well. With inflation eating into disposable incomes, many could put off that new car or other purchases. At the same time, volumes could shift more toward unsecured and credit card lending if people are struggling to make ends meet.

Credit Losses

It seems like the industry has been waiting for the other shoe to drop on credit losses since the pandemic hit. It’s possible that government stimulus postponed that, but inflation could push some people over the edge. Don’t forget to factor in the impact on CECL.

Market Rates

The buzz is all about rates going up, but if recessionary forces begin to take hold, the Fed could pull back on rates. For a long time, the only direction rates could go was up, so don’t forget the other side of the equation.

The value in modeling these types of what-ifs is in the team conversation and thought process, as well as the forecast results. Part of the conversation should revolve around any risks the team thinks need to be addressed, identifying options, and determining timing for implementing the options, if necessary.

Your situation is unique so be sure to think about other what-ifs that are relevant to your organization. Also combine the what-ifs you think could happen concurrently to get a view of the aggregate effects.

One way to meet the uncertainty of the environment is to play out major possibilities through what-ifs. You won’t be able to anticipate everything that might come along, but looking head-on at various possibilities can bring calm and confidence. It also helps teams to move into action cohesively to mitigate risks where needed.

Approach Talent Challenges As If They’re Permanent

Featured, Strategic Leadership Development, Strategic Planning Blog Posts4 minute read – The competition for talent has been raging for the past few years. While it seemed to come to a head after the pandemic, the demographic underpinnings have been at play for decades.

As teams work to meet today’s talent challenges, approaching the situation as if it’s permanent can recast the thinking, bring new solutions to the surface, and potentially better position the financial institution for future success.

While there is potential for a recession, which could bring relief on the talent front, the relief may only be temporary, given long-term demographics trends.

In April, there were 0.5 unemployed workers per job opening, illustrating just how hard it is to find people, let alone the right people. But this is a continuation of a longer-term trend.

The question many institutions are faced with is, Where did all the workers go? Most are aware that the Baby Boomers created a big chunk of the population that are now retiring and some of those retirements were accelerated by the pandemic. Millennials now make up the largest portion of workers, with Generation Z following closely behind.

Additionally, the US population has been slowing for years, setting the stage for the current challenges and reinforcing why they may be with us for the long term. According to the US Census Bureau, the 2021 growth rate was slower than any other year since the founding of the nation. The trend is the result of women having fewer children and decreasing net international migration, combined with increasing mortality due to an aging population.

This leaves us with fewer youngsters and more retirees. Some have theorized that more people have simply decided not to work. According to the Bureau of Labor Statistics, the labor force participation rate for people 16 and older declined from 2010 to June 2022 (that’s the percentage of the population that is working or actively looking for work). But when you break it down by age, it tells a more nuanced story. For ages 25-54, which represents people in their prime working years, the participation rate is about the same. But that age group now makes up about 3% less of the workforce and people 55 and older make up about 4% more. When you factor in that older people participate – or work – at much lower rates, it explains how the overall participation rate has decreased.

The conclusion? The talent challenges may not be going away soon. David Kelly, the Chief Global Strategist of JPMorgan’s asset management division, was quoted in a Business Insider article saying that some firms could go out of business. “It’s very Darwinian – those who can efficiently use labor will succeed and those who cannot adapt to this environment will fail.”

As Baby Boomers poured into the workplace along with women, there was plenty of ready-made talent to choose from that was educated and trained. Talent practices formed around this reality. The question is how to create new practices that will work going forward.

As an exercise to stretch your thinking, try brainstorming around this scenario: It’s 2026 and the talent challenges of 2021 and 2022 are still with us. Knowing this is the case, consider the following questions, how you would answer them differently than today, and how your emphasis on each area would shift:

Chances are that you’ve already been working on talent recruitment, development, and retention. The challenges won’t be easy to resolve and will likely require foundational change. Thinking about it as a permanent situation can help your team develop more transformational ideas that could be key to your long-term success.

Linking Revenue Opportunities with Appetite for Risk

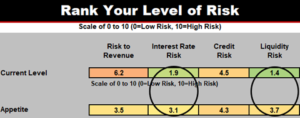

ALM, Budgeting, Featured, Financial Planning, Interest Rate Risk Blog PostsA helpful exercise is to survey decision-makers individually on the level of risk they perceive the institution is currently taking in specific areas and their desired level or appetite for risk in those same areas. A rank of 10 indicates a high level of risk and a rank of 0 means low risk.

As individual responses are averaged, clarity and alignment will begin to take shape for the leadership team. A next-level discussion is to dig into the range of individual responses to gain a better understanding of each individual’s perspective.

In the example table below, the average risk rank for Risk to Revenue is currently at 6.2 out of 10. This is the highest risk rank, meaning it is the top concern for this group. Comparing this to the average of 3.5 on appetite for risk is an indicator that the team wants to lower their Risk to Revenue.

So where is there potential opportunity to do so? Are there other areas of the business or structure that could be leveraged to decrease the pressures facing revenue?

As seen in the table below, the team’s appetite for credit risk is almost the same as the current level of risk. However, both interest rate and liquidity risk reflect an appetite to take more risk. These results often stimulate thought-provoking discussions around questions like how much, and in what range of rates.

With greater clarity, different departments can take action and begin implementing tactics to take advantage of the opportunities. For example, Finance might decide to deploy short-term liquidity into longer-term investments to increase revenue, since there is appetite for more interest rate risk. This may mean there is room to portfolio mortgages, instead of selling, to steady the revenue stream over time.

Consciously choosing to take more risk in specific areas is one avenue for increasing revenue streams. Of course, policy limits must be taken into account, along with a combined view of other risks the institution has accepted. Frequently performing risk level assessments like the exercise above, while also quantifying risks in aggregate against capital, can help decision-makers feel more comfortable with their choices.

Note, the table above is an excerpt of the categories that you will want to consider. It is good to have the categories cover the different parts of your business model, as this can help bring more clarity to your team.

For more resources, our Strategic Capital Requirement tool can be found here.

c. myers live – Take Crypto as a Learning Opportunity for Your Institution

Consumer Behavior and Technology, Featured, Financial Planning, Strategic Planning PodcastsIt is no secret that the world of crypto is constantly changing and challenging decision-makers to think outside the box. Amongst this new terrain, there is a multitude of learning opportunities to better understand this complicated market and its impact on financial institutions. Joining us to share her expertise is special guest, Patti Wubbels, from SRM (Strategic Resource Management). Patti is the SVP of SRM and a member of the Digital Assets (Crypto) Advisory Services Team at SRM.

For over 30 years, SRM has helped 1,000+ financial institutions add more than $5 billion of value to areas such as payments, digital transformation, digital assets, core processing, and digital information. Their Digital Assets Advisory Services educate financial institutions on digital assets and assist with strategic advice on vendor selection and compliance considerations.

Brian McHenry

As one of five owners of c. myers corporation, Brian works daily with CEOs and C-Suite teams to help them identify and prioritize necessary changes to continuously adjust their business models and remain highly competitive. When working through the strategic process, CEOs regularly praise Brian’s calm communication style and ability to authentically engage anyone he interacts with.

Learn more about Brian

Patti Wubbels

Patti Wubbels is Senior Vice President and member of the Digital Assets (Crypto) Advisory Services Team at SRM (Strategic Resource Management), an independent firm that advises financial institutions in executing business strategies and strategic sourcing initiatives.

At SRM, Patti’s responsibilities include speaking engagements and educating financial institutions around the growing ecosystem of digital assets. This includes Distributed Ledger Technology, Blockchain and Smart Contracts, and of course, Cryptocurrency.

Patti helped launch SRM’s Digital Assets Advisory Team, delivering education and strategic planning services for financial institutions integrating cryptocurrency and blockchain concepts and technology. She is a Certified Cryptocurrency Expert (CCE) via MIT Media Lab and the Blockchain Council.

Patti also advises on strategies for cost savings, revenue opportunities, and process efficiencies when it comes to vendor selection. She has over 20 years of business development experience, with 17+ years in the banking industry.

Other ways to listen to c. myers live: