Survey Says: 2 Insights on M&A Strategy

June 11, 2025

|

|

2 minute read – As part of our recent webinar, Finance at the Forefront of Merger & Acquisition Opportunities, participants took an exclusive survey on their decision drivers for M&A. Below, we share key highlights from the results of that survey.

Who Participated?

We heard from institutions of all different sizes, with over half of respondents representing organizations with assets of $5 billion and up. This mix captured a broad range of perspectives and insights.

Current Decision Drivers

During the webinar, participants explored several decision drivers and considerations, including their preferred M&A partner size and strategic priorities for exploring M&A.

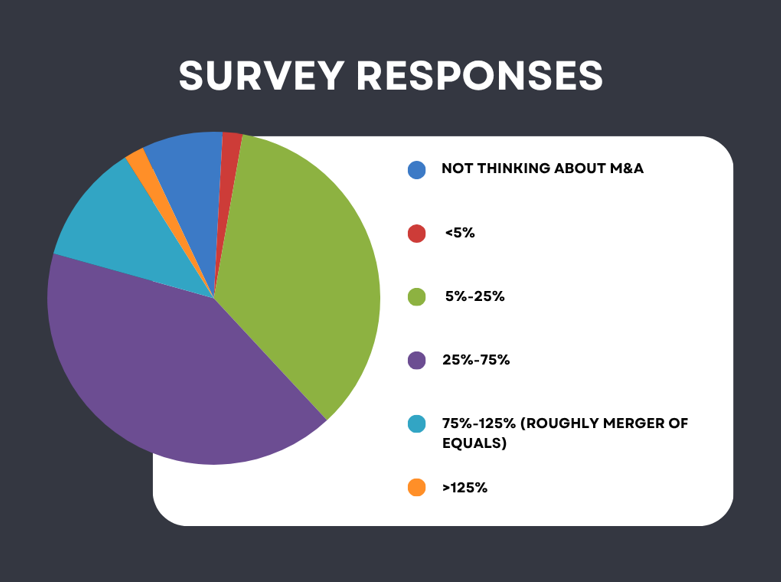

The first chart focuses on the asset size the participants were open to exploring relative to their own asset size.

Notice that only 2% of respondents were open to exploring an M&A partner that was larger than their current assets, and only 12% were open to exploring a merger of equals. This data reinforces the real challenge that most responders want to be the Acquiring institution, not the Acquiree.

As you and your teams develop your M&A strategy, one component that should not be skipped is to clearly articulate why an institution should choose you as an Acquirer, vs the multiple other choices they will likely have. In other words, what is your clear Value Proposition as an M&A partner?

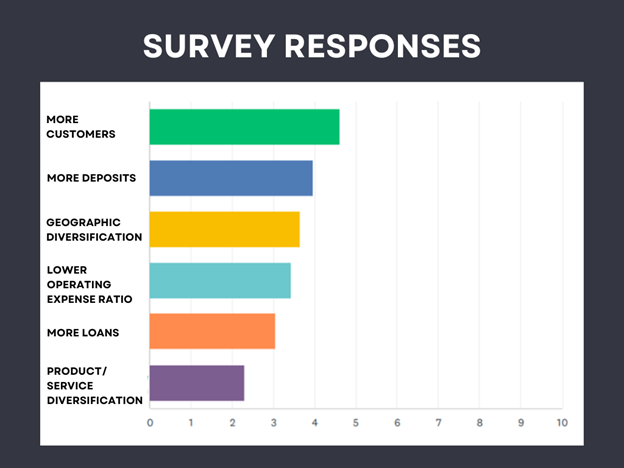

Participants also ranked desired achievements for a potential M&A.

The above data shows current priorities for strategically evaluating M&A options. This can be helpful as you and your team are initially identifying options for M&A and creating your Value Proposition for your identified options.

Want to Dive Deeper?

You and your team can watch the recording of our webinar Finance at the Forefront of Merger & Acquisition Opportunities, to see additional considerations for finance teams. Click here to watch.

*Portions of this blog were edited with the assistance of AI.