Planning for the Unexpected?

August 22, 2018

Although the economy is humming along nicely right now, a survey of U.S. economists conducted by the National Association of Business Economics in May of 2018 suggested things could be changing. The results revealed that a full two-thirds of those surveyed believe the U.S. will experience a recession by the end of 2020. Numerous potential causes were cited, such as higher energy costs and asset prices, trade conflicts, and budget squabbling, among other factors.

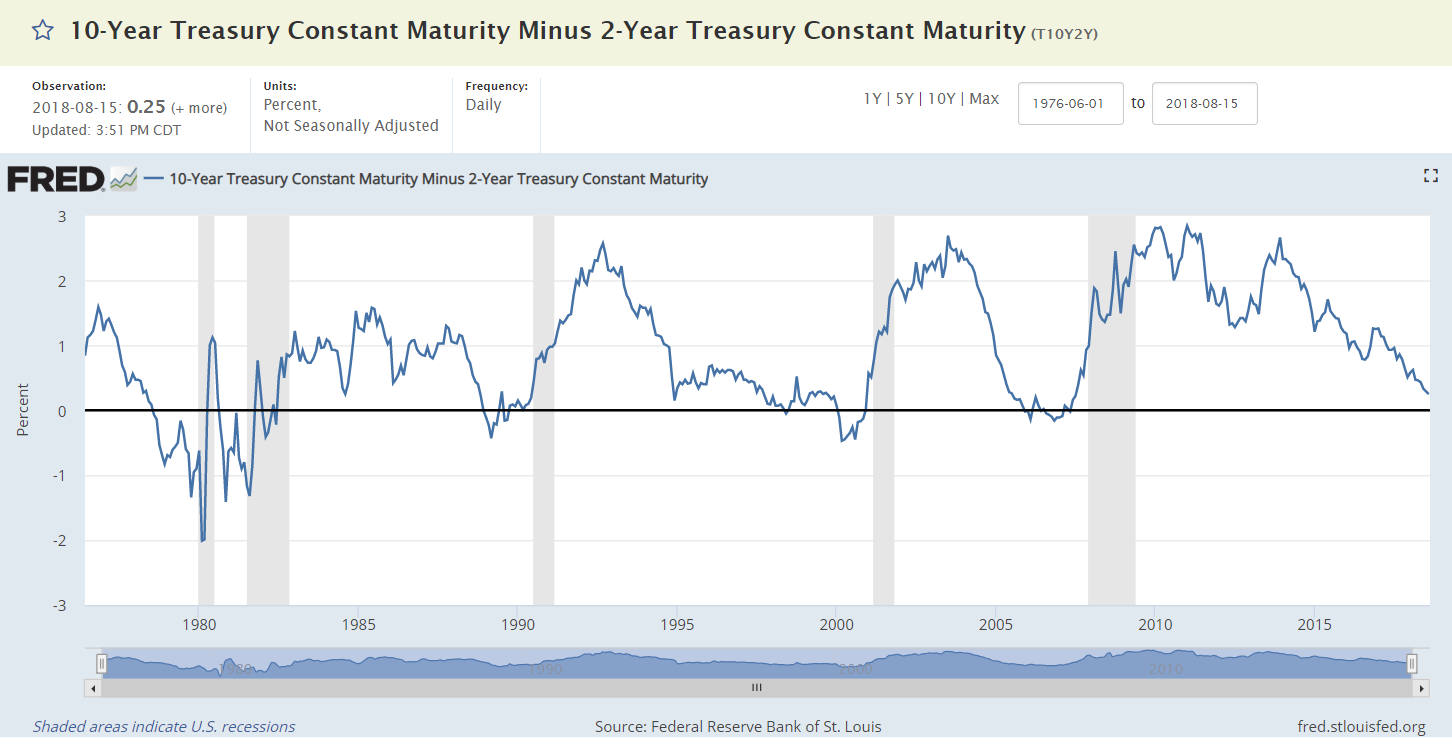

Why does that matter? According to the Federal Reserve Bank of San Francisco, every recession in the last 60 years has been preceded by an inverted yield curve.1 In the graph above, note that yield curves’ inversion in 2007 happened less than a year before the recession began in 2008. While there are many different versions of the yield curve, in the graph above, note that the yield curve inversion depicted is the difference between the 2-year and 10-year CMT. So for many market prognosticators, the continued narrowing of the curve could also be signaling a future economic slowdown. So what are some things credit unions could be doing to prepare?

As you enter budgeting season, if you are concerned about an economic downturn then consider investing time to discuss the following questions:

- What kinds of trends did your credit union experience during past recessions?

- How and why could your experience be different this time?

- How could a recession impact your approach and adjustments to your CECL calculations?

Questions lead to more questions. As appropriate, consider modeling the potential impact of your answers to help you and other decision-makers get an idea of the potential magnitude and timing of such events.

While no one can predict the future, having some of these conversations as you enter the 2019 budgeting season will prepare your team to better respond, whether it is continued economic growth, or an economic slowdown that many have argued is long overdue.

Please read our article Elevate Your Budgeting Process for more tips on how to elevate your budgeting process.

1 What’s the Yield Curve? ‘A Powerful Signal of Recessions’ Has Wall Street’s Attention, The New York Times, 6/25/18.