Three CECL Considerations For The C-Suite

8 minute read – The following blog post was written by c. myers and originally published by CUES on December 9, 2021.

The world is a vastly different place than when CECL was first imagined. At the time CECL was introduced, many in the industry raised concerns about the unintended consequences. The stakes are even higher today.

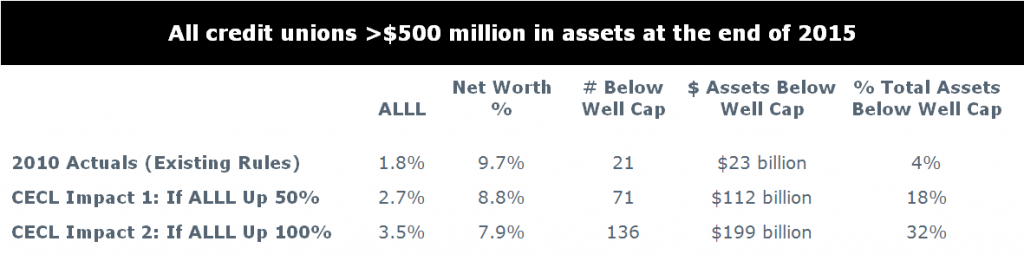

The following excerpt from the NCUA final rule on CECL and the material decline in net worth ratios punctuates this point.

“While the report affirms the Department of the Treasury’s support for the goals of CECL, it also acknowledged that a ‘definitive assessment of the impact of CECL on regulatory capital is not currently feasible, in light of the state of CECL implementation across financial institutions and current market dynamics.’”

The following shows the average net worth impact for institutions in each of these categories,

December 2019 vs June 2021.

As of June 2021, 17% of credit unions over $10 million in assets had net worth ratios below 8%, including 7% of credit unions over $1 billion.

Now is the time to encourage all stakeholders, as data, methodologies, and the technical aspects are put into place, to reevaluate potential strategic implications of CECL for their unique business models. As you do so, keep the following in mind.

ONE

A Mindset Shift Will Be Required. Don’t Let CECL and a New Accounting Rule Undermine the Strategic Focus of Your Business

One of the biggest challenges will be communicating what the transition will bring, both pre- and post-implementation, in a clear and easily understood way. There are many things about CECL that are not intuitive and, if not understood, can unintentionally change the strategic focus of your business.

If you want a more in-depth explanation of the following points read Life After CECL.

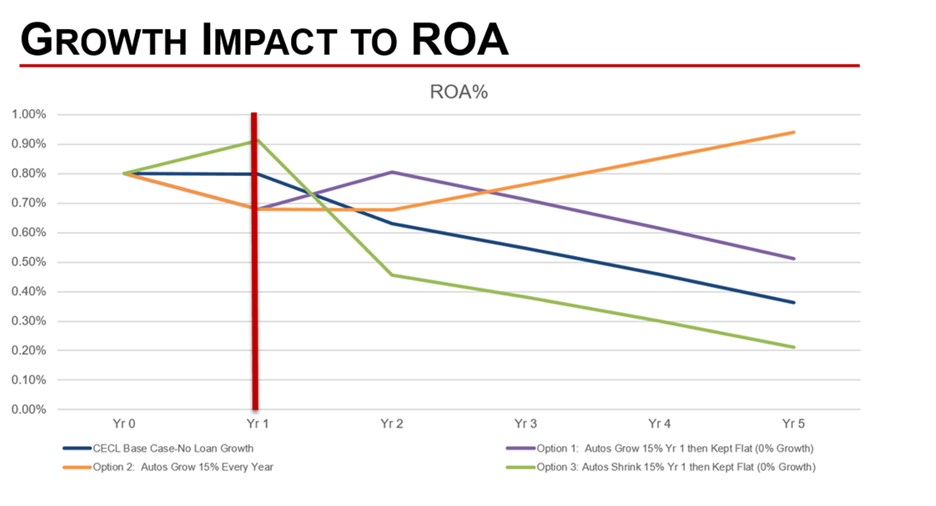

- Loan growth can actually hurt ROA and net worth in the short term. The strategic positioning with respect to credit risk can exacerbate this issue. It is essential to focus on lifetime net yield to avoid an unintended change in strategic focus.

- Loan growth toward the end of the year can hurt the current year’s financials more than growth earlier in the year. It would be good to remind your team to not get discouraged if that wildly successful loan promotion toward the end of the year hurts profitability. It’s just a timing issue. This means the next point should certainly become a way of life.

- The traditional one-year financial view can lead to missed revenue opportunities and diminished relevance. Longer forecasts are needed to see the benefits of loan growth.

- CECL can cause volatility in ROA and net worth. Traditional KPIs may not provide the appropriate balance of strategic progress, relevancy, and risk tolerance.

Remember, CECL stands for current expected credit losses. As your expectations for credit risk change, so will your CECL calculations.

A prime example is that no one really knows how credit risk will play out over the next few years because of the pandemic, supply chain issues, and the threat of sustained inflation. It can be beneficial to keep this in mind as you are assessing the initial CECL impact to net worth. Past experience, current conditions, and future predictions should all come into play.

TWO

Communication of Impact on Net Worth and Strategic Net Worth Requirements

Make sure to include the initial estimated impact to net worth in your assessment and ongoing communication of strategic net worth requirements. Discussions focusing on strategic net worth requirements are key to strategic momentum and optimizing opportunities and risk tolerance.

The finalized rule on the phase-in allows federally insured credit unions to spread the initial hit to Prompt Corrective Action (PCA) net worth over 3 years. For those who will experience a significant jolt to net worth from the initial shift to CECL, this buys welcomed time to rebuild, especially after the net worth-stressing asset growth experienced by so many during the pandemic.

With the phase-in, the credit union’s financials will show the full impact on Day 1, but NCUA will phase-in the impact on PCA net worth over 3 years.

The phase-in is not available for early adopters but is also not optional for those who adopt CECL for fiscal years beginning on, or after December 15, 2022. We encourage you to read the final rule for more detail.

For the first 3 quarters after transition (2023 for most), NCUA will include 0% of CECL’s impact on PCA net worth. Starting in Q4, it will include 33%. In Q8 it will include 67%, and in Q12, 100% of the impact will be included.

This will be confusing if the institution’s financials show one capital classification while NCUA is showing another.

Because this requires another mindset shift, it can be helpful to provide decision-makers with alternative views. For example, showing the view with and without the phase-in can help non-financial decision-makers keep the full estimated initial impact top of mind as they are contemplating strategic decisions.

As we approach CECL implementation, using visuals to illustrate can promote deeper discussions and enhance communication. Click here for examples of how to communicate impact to strategic net worth requirements from the initial impact of CECL.

Three

Find Opportunities

While CECL potentially creates a strategic distraction and volatility in traditional financial reporting, it can be a great motivator to uncover the opportunities. The following are just a few thoughts.

- A big opportunity is to turn all the work you have done with aggregating and analyzing CECL data into decision-information by syncing your learnings with your loan pricing, risk management, and packaging strategy. In other words, don’t just keep the CECL calculations in a silo to satisfy requirements; truly incorporate them into your decisioning.

- Leverage the need for longer-term forecasting to really hone your strategies by linking your strategic considerations with a financial roadmap. You and your team may discover you have more strategic capacity than you originally thought.

- Think critically about consumer markets that competitors may ignore or exit because of lack of understanding that CECL is a timing issue and traditional views of financial success must change. It is often eye-opening when having intentional and thought-provoking discussions around opportunities to serve these markets.

As with any rule change with potentially high impact, it can take time to adjust mindset and thinking. This is why it is essential to have discussions and decisions viewed through a strategic lens so that an accounting rule change does not unintentionally drive strategy.