One Financial Institution’s Evolution – A Success Story

Client Objectives:

- Engage our people to rally around the strategy and build a bridge to successful implementation

- Create a foundation of the right people in the right seats to take us into the future, while delivering outstanding and efficient experiences

Things were going well, yet leadership was certain that the institution was capable of more. Considering how hard everyone was working, there wasn’t as much forward progress as expected, and it wasn’t clear how to fix it. They were looking for a partner with extensive industry experience to help provide insights and help the leadership prioritize so the organization could meet its full potential at their desired speed.

The Approach: Continuous Business Model Optimization

Using our multi-faceted Continuous Business Model Optimization approach to help them reach their objective, we started by asking deep questions to fully understand the situation and identify any gaps.

One of the many reasons for their success on this transition is that the organization really grabs onto productive change and is great at supporting new approaches. Together, we created processes and practices specifically for their organization, all of which were customized to fit their environment, structure, and culture.

Strategic Planning: Clarity and Alignment

One of the first steps was Strategic Planning to help the Board and Management get clarity and alignment around the strategic direction for the institution. Despite the pandemic, we were able to execute successful virtual sessions, working with Management first as they re-examined their business model and worked as a cohesive team to create longer-term strategic priorities and shorter-term action steps.

When the Board was brought into the next session, they considered the extremely uncertain environment and decided that they would adopt most of Management’s ideas and not “hunker down” or shy away from serving their lower-credit customers. They did increase their focus on, and frequency of, monitoring measures of success to ensure that the rapidly changing environment would not take them by surprise.

Strategy as the Decision Filter

The strategy was used as a driver and a decision filter for subsequent solutions as they were put into place. This is incredibly important—the strategy truly served as the north star for all other activities.

A key decision filter was the alignment of strategy and desired financial performance. Understanding a range of outcomes for where the strategy is leading from a longer-term financial perspective (Strategic Financial Planning) helps give all stakeholders —including the Board —perspective and a foundation for informed decisions. The client had a good handle on this and was able to provide useful scenarios throughout the planning process. This continues on, as the Board and Leadership engage in Strategic Planning annually to ensure the direction is strong and make any adjustments as necessary.

Uniting the Organization Around the Strategy

Leadership was looking for a way to get everyone to rally around the strategy and row in the same direction in order to move the strategy forward at their desired pace. This is often a head-scratcher for organizations. Like many others, they had many of the pieces in place, but it wasn’t always working as well as they thought it should, and they were facing a certain level of burnout, saying yes to everything.

Strategic Implementation: Turning the Plan into Action

Ensuring that the strategic plan becomes a reality, which we call Strategic Implementation, was a major focus.

While they had a Project Management Office (PMO) and individual projects were being tracked and managed well, some important elements were missing. We introduced specific practices and processes to keep the organization focused on the most important strategic priorities throughout the year, especially as the inevitable adjustments and course corrections occurred.

We started by helping them establish a Project Governance Committee (PGC) that included senior executives and the PMO to carry out those duties. We also helped them establish practices for living up to their long-term commitment to effectively track and report their measures of success.

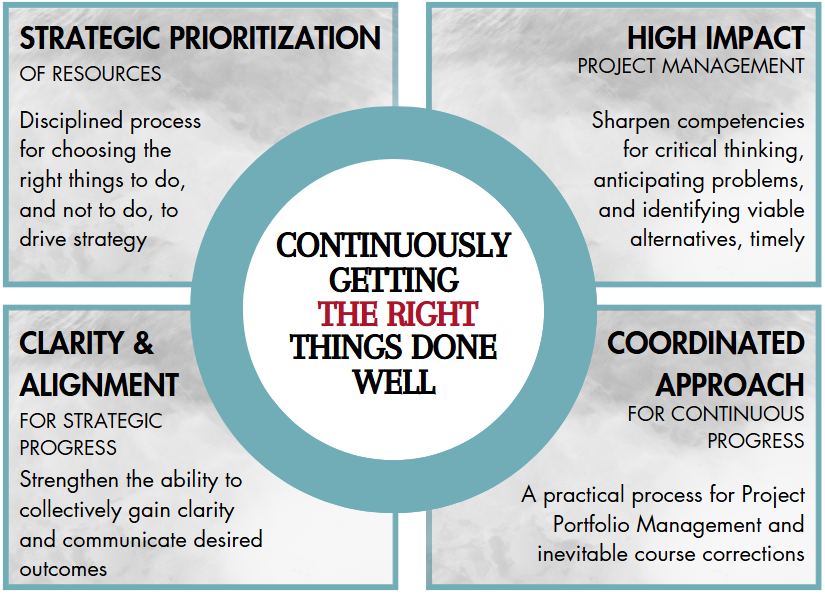

Effective Strategic Implementation involves multiple areas, which can be roughly broken down into the following four essentials. We used this model to help frame the organization’s unique needs:

Process Improvement: Prioritizing Efficiency

The need for Process Improvement was identified during strategic planning. Consumer lending efficiency and improved account opening experiences were priorities. Initially, they worked on making consumer lending more efficient for the slam-dunk applications so there would be more time to handle the large volume of more challenging, lower-credit applications. In subsequent phases, the process for the more challenging applications was revamped, along with the account opening process, creating better experiences for all customers, as well as employees.

We mapped the processes as they existed at the time, ensuring that people who performed the processes—managers, compliance, system experts, and executive sponsors—were part of the process improvement engagement. Collaboration with the right people is foundational to viewing the process from multiple important perspectives, including the customer experience, employee experience, efficiency, and risk perspectives. Additionally, linking Process Improvement to Project Governance helped to oversee these initiatives, ensuring alignment with resource management and other projects within the institution were being properly prioritized.

Part of our role is to challenge the participants to recognize non-value-add steps and friction. The rough spots in the processes were eye-opening as the hoops they’d been asking their customers to jump through came to light, such as asking high-credit customers for references. As friction points were identified, the team collaboratively came up with ways to improve, ultimately saving staff time and delivering quicker decisions, resulting in more loans on the books. The team found their ability to substantially improve the processes to be empowering and it began to shift the thinking away from “that’s the way we’ve always done it.”

Once they experienced Process Improvement, they realized that cultivating Process Improvement capabilities internally was the clearest route to improving many more processes on an ongoing basis. They sent some of their people to c. myers’ Process Improvement Education to learn our methodology, which has been designed for—and tested in—the real world of financial institutions. Beyond methodology, we also focused on using strategy as a guide, facilitating process improvements, measuring successes, the role of business intelligence, and effective execution.

Continuing down this path ultimately leads to a Culture of Continuous Process Improvement, which builds Process Improvement into the DNA of the organization by tracking and prioritizing ideas for improvements and committing resources toward Process Improvement every year.

Strategic People Planning: Building the Future Leadership

The CEO transition highlighted the need for Strategic People Planning. The incoming CEO wanted to reimagine a forward-looking leadership structure.

We facilitated decisions related to how the organization needs to be structured for the future and the competencies that will be needed for key positions. The thought process is geared toward where the industry is headed and how the strategic importance for areas such as Business Intelligence, Marketing, Human Resources, Customer Experience, and Payments will continue to change over time.

The new CEO made structural changes to the C-Suite and the next level over the first few months to better set the organization up for success. The changes were significant, so we helped establish clear working agreements and met with them frequently to check in as the team jelled over the next year and began hitting their stride.

Leadership Development and Continued Growth

To ensure the new structure would bring the anticipated benefits, the people slated to fill the roles needed to be ready. They needed to strengthen the competencies that were identified for their new positions, and they needed to function well in their new teams.

The CEO participated in CEO Readiness and especially appreciated having dedicated time to think about the organization’s strategy, needs, culture, and how the first 90-180 days would ideally play out. It can be a lonely transition to become a CEO. Having a partner to ask questions of and bounce ideas off was valuable during that first year.

Other key people were entered into our Strategic Leadership Development programs. Some development was customized for individuals to build their desired leadership competencies, while other sessions were designed to help teams work better together. They started with Senior Leadership and have continued working through the organization.

It’s important to note that some of the successes represent culture change. It takes sustained effort to shift how people think and act. Even if you’ve developed perfect processes and practices, the necessary changes in mindset will not happen overnight.

The Ongoing Evolution

The evolution at this institution continues as more individual and team leadership development is underway along with ALM Education. As one of their competitive advantages, they are working on ways to support people during the onboarding process, incorporating Agile Methodology into the management of some of their projects, and working to ingrain continuous process improvement into the culture as they focus on sustainability.

The organization reports, “Enterprise project timelines, on average, have reduced by 6 months since working with c. myers to launch our Project Governance Committee, including resource tracking, process improvement, and an agile approach.”