Grow or Die – A Strategic View of Growth

Grow or die. We hear this quite often. But what does it really mean? The game has changed. Credit unions are no longer just competing against other financial institutions. Non-traditional competitors are taking away non-interest income, especially sources such as interchange income. At the same time, non-traditional competitors, such as Lending Club and Sofi, are attacking margins by changing consumers’ definition of banking from a “one-stop-shop” of financial services to de-bundled boutique product offerings.

With serious threats to relevancy, the “grow or die” statement needs to be deeply considered. It is critically important for decision-makers to have clarity on what they mean by growth. What gets measured gets attention – meaning strategic focus and financial resources.

Growth comes in many forms: Growth in assets, deposits, loans, membership, revenue, etc.

Growth in assets, deposits or membership does not necessarily translate into growth in revenue, income, or growth in members that contribute, or are highly likely to contribute, to the cooperative.

Consider just a few of the many options available to measure success for membership growth. Should the measure of success be:

- Membership growth?

- Growth in contributing members?

- Growth in products and services per member?

In this limited example, a credit union’s strategy, initiatives, and allocation of brain power and financial resources would be different depending on what is determined to be important.

If the measure of success is membership growth, then the type of membership growth should be a topic of strategic discussions. A credit union can quickly grow its membership through youth campaigns, targeting 20-somethings, offering incentives, and of course indirect autos or CD shoppers.

Digging deeper, let’s use the 20-somethings to address just a few of the many questions that come to mind:

- How long will it take for the youth and 20-somethings (often called pipeline members) to become contributing members to the cooperative?

- It is not uncommon to see 30%-50% of the new membership growth come from those less than 30 years old. In light of this:

- Does the credit union have enough contributing members to offset the net cost of the youth and 20-somethings until they become contributing members?

- How should asset growth goals be adjusted since this group does not yet have a ton of money to save?

- Does the credit union’s appetite for risk align with the needs of the 20-somethings? If not, what brand damage might be created by inviting them in and saying “no” to their needs?

The above provides just a sliver of the critical and strategic thinking that should be done with respect to measuring growth.

The next time someone says, we need to grow or die, consider asking, what exactly do you mean?

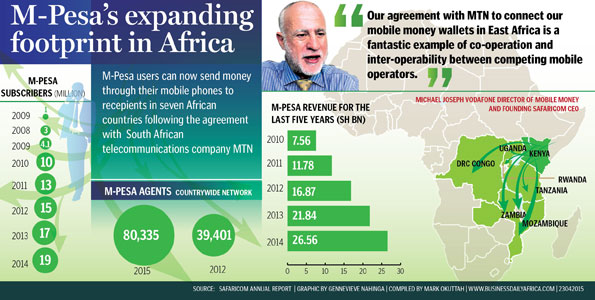

60 Minutes recently aired a segment on M-Pesa, an alternative currency, which is the preferred method for financial transactions in Kenya. In essence, M-Pesa allows cell phones to perform nearly all financial transactions without the use of a bank account or credit card. The full segment, which goes into more detail than this blog, is located

60 Minutes recently aired a segment on M-Pesa, an alternative currency, which is the preferred method for financial transactions in Kenya. In essence, M-Pesa allows cell phones to perform nearly all financial transactions without the use of a bank account or credit card. The full segment, which goes into more detail than this blog, is located