602-840-0606

Toll-Free: 800-238-7475

contact@cmyers.com

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Real-Time Financial Forecasting: The Fed Is on the Move

ALM, Economy, Featured, Financial Planning Blog PostsQ: When the Fed has significantly cut rates, how many times has the yield curve shifted in parallel?

A: ZERO!

What does this mean for you?

In a world filled with uncertainty, this is one thing you can count on. So, don’t rely solely on parallel shifts in the yield curve when modeling. Expand your analysis to capture more realistic scenarios.

It is important to show other decision-makers the financial outcomes depending on the shifts in the yield curve. Technology has advanced so that this dynamic is easy and fast to model.

In days gone by, this would have taken hours of hard labor to show the potential financial outcomes of yield curve shifts, especially over a time horizon of more than 1 year – hence the simplifying assumption of parallel shifts. See the graphs below as a reminder. They show the change in the yield curves since January 2020.

Here are just a few scenarios being requested by decision-makers to understand the range of possible outcomes:

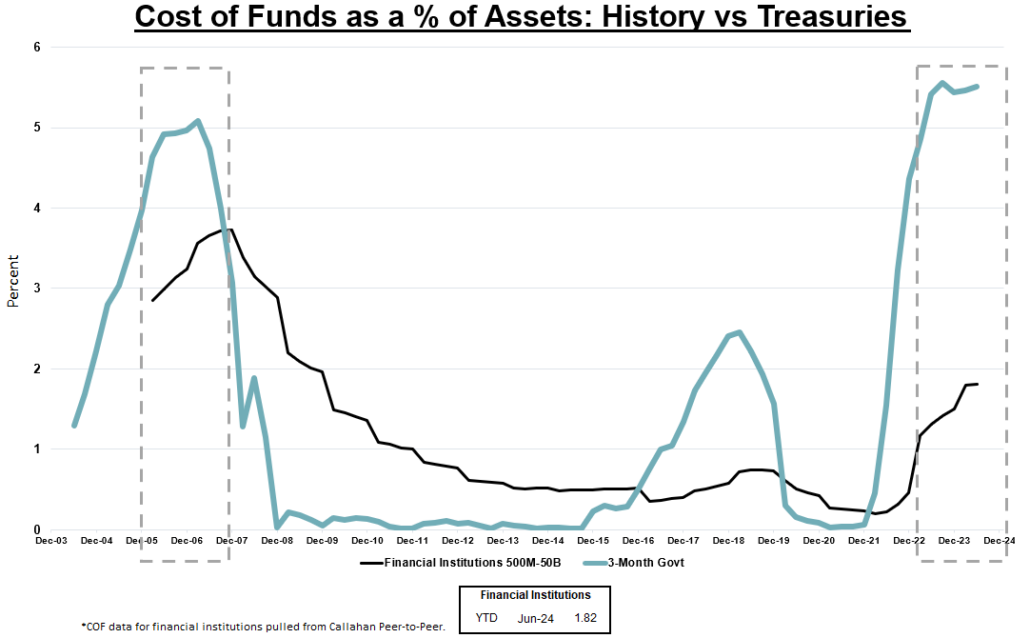

1. What if as rates come down, we experience FOMO on CDs, (like we have when mortgage rates ticked up) and our CD demand increases, putting more pressure on COF, before it declines? Learn from history, many financial institutions experienced this the last time rates were around 5% (2006-2007).

2. What if the yield curve continues to flatten? Long-term rates come down, refinancing kicks in significantly, and our COF does not decline the way we anticipated?

3. Same situation in number 2, but people don’t refi with us, and we have to invest?

4. What if our business lending hits a rough patch with respect to credit risk? As a result, do we respond by tightening our standards and volumes decline?

5. What if number 3 and 4 happen simultaneously?

6. What if our organization experiences a big mortgage refi boom – what portion should we hold or sell?

7. How do we hold up in the Fed stress tests?

8. What if the Fed cuts rates much faster than we anticipated and our prepayments on loans accelerate significantly beyond expectations? How might we need to adjust our KPIs to accommodate?

9. What if we need to achieve our KPIs by materially lowering our expected yields? Is the trade-off of volume vs rate worth it?

10. What if the situation in the Middle East causes inflation to ramp back up?

These scenarios can be run in front of the entire C-Suite team in a matter of 1-4 minutes. This can result in the decision-information being shared with the Board so everyone could be on the same page with respect to a range of potential scenarios and financial outcomes. This helps the organization be much more agile in optimizing their financial structures for many reasons. One key reason is a significant increase in appreciation for all the moving pieces.

Each quarter, take your current financial structure and run these scenarios to see how the outcomes can change. As appropriate, also add any significant emerging trends.

Leadership and Boards value what they refer to as real-time financial information. Some of them equate it to the push notifications they receive from their financial institutions and wealth-management advisors. It keeps them forward-looking.

Project Management – Avoid These 2 Common Misconceptions

Featured, Strategic Implementation Blog PostsBecoming an organization that is good at project management is not simple. While the basic concepts of project management are easily understood, there are a myriad of reasons why those concepts are not consistently and effectively put into action. Here are 2 of the most common misconceptions that get in the way:

A project management tool is invaluable for tracking tasks and clearly showing when projects are in trouble, but it can only do that when task statuses are reported realistically, and without undue optimism.

2) A good project manager will make us good at project management. Good project managers can be an important key to effective project management, but don’t expect automatic success. The greatest project manager won’t be able to shift the organization’s practices without the support and active involvement of senior leadership.

Investing in the Next Generation of Financial Leaders

Featured, Strategic Leadership Development Blog Posts3 minute read – With all the change in technology and evolving customer needs, one thing remains constant: the need for effective leadership. As financial institutions navigate through complex markets and unpredictable economic landscapes, the role of leaders becomes increasingly crucial. However, ensuring the sustainability and success of these institutions requires more than just identifying talent — it necessitates a deliberate investment in cultivating the next generation of leaders.

At the heart of this investment lies the development of three key attributes: financial acumen, leadership presence, and critical thinking ability.

With financial in the name, it is crucial leaders develop their financial acumen in order to understand how the business model and financial structure works. Understanding concepts such as the 5 strategy levers of ROA as well as the relationship between asset growth, capital, and ROA are foundational and will help leaders be more successful in their current roles. Increased financial acumen will help them connect the dots of their decisions and actions with the financial and risk impacts to the organization. By providing aspiring leaders with comprehensive training and exposure to real-world financial scenarios, institutions can nurture their financial acumen from an early stage. This can include structured education programs, mentorship opportunities, and hands-on experience in various financial functions.

As important as the numbers are, leaders need to possess more than just technical skill and expertise. In fact, leaders that are highly technically competent yet struggle with communication and presence often face more challenges in successfully sharing their ideas and leading others. Effective leaders often possess strong communication skills, emotional intelligence, and the ability to influence and motivate others. Helping to enhance these skills can empower future leaders to navigate through challenges with grace and authority, fostering a culture of collaboration and innovation within the organization.

Critical thinking is critical – to play on words. Leaders make numerous decisions day in and day out that determine the strategic progress of their organization. Elevating the ability to think critically helps leaders better connect dots, strategically and organizationally. Critical thinkers are able to keep the strategic objective of their work and projects front and center even as they are in the details of implementation. They also know that almost nothing they do exists in a vacuum.

Investing in the next generation of leaders for financial institutions is not just a matter of talent acquisition — it is an investment in the future sustainability and success of the organization. By focusing on cultivating financial acumen, leadership presence, and critical thinking ability, institutions can nurture a pipeline of competent and visionary leaders who are equipped to navigate through the complexities of the financial landscape with confidence and resilience.

c. myers live – The Evolving Role of Liquidity in Financial Institutions

ALM, Featured, Financial Planning, Liquidity PodcastsLiquidity management is more crucial than ever for financial institutions navigating today’s complex environment. In this episode of c. myers live, we explore key strategies for understanding your liquidity position, stress testing assumptions, and pivoting when things don’t go as planned. Additionally, we emphasize prioritizing your available levers and ensuring alternative liquidity sources are in place.

About the Hosts:

Sean Zimmermann

Learn more about Sean

Charlene Leland

Learn more about Charlene

Other ways to listen to c. myers live:

Avoid These Common Financial Misunderstandings With Your Board

Featured, Financial Planning Blog Posts4 minute read – Most Boards look for financial ratios and other measures of success to gauge their institution’s financial health and strategic progress, but many Board members don’t understand some of the nuances of the measures, especially when the dollars and the ratios appear to be telling different stories. Senior leaders are focused on sharpening their ability to communicate what’s really happening so the Board can see the situation clearly and focus on what’s most important.

Having observed hundreds of Boards and conducted financial education for many of them, we wanted to share some of our takeaways. Here are 3 points of confusion we’ve heard a lot about lately. Proactively explaining what’s happening can go a long way toward getting everyone on the same page.

1. Our losses are increasing too fast! Losses may be increasing faster than planned, but it’s important that other impacts to the ratios aren’t adding fuel to the fire. One source of confusion comes from changes in the denominator of the ratio – typically loans or assets – that can make the increases look worse than they are. It’s not unusual in today’s environment for loans or assets to shrink. The same dollars of losses will look worse with a smaller denominator. Don’t assume that all Board members are taking this into account when looking at losses as a percentage of loans or a percentage of assets. Pointing out what’s happening with the dollars and the ratios can help bring clarity.

2. Why are operating expenses so high? Similar to loss ratios, operating expense ratios can show increases even when the dollars are decreasing due to shrinking asset size. Helping the Board to see the dollars and the annual percentage increases in the dollars along with the ratios provides a few different ways to interpret what’s happening. Of course, if asset size is decreasing, it’s still a valid question to ask whether operating expense dollars can continue to increase at planned levels or if it’s hurting profitability too much. Looking at how the other components of ROA, which we call strategy levers, are being affected can help with this discussion.

3. Why did this ratio jump so much? Year-to-date (YTD) ratios tend to cause confusion in the transition from 4th quarter to 1st quarter. YTD ratios can blunt the magnitude of change throughout the year. In times of rapid change, the 1st quarter YTD ratios will fairly represent the current ratios, but Boards need to be reminded that 4th quarter YTD numbers are not meant to represent the current ratios, rather they reflect the entire year’s performance, and Boards must be warned if a big jump is coming.

Some experienced this jarring shift in the Cost of Funds ratio after it had been on a steep climb. Looking forward, if the current escalation in Charge-Offs continues, it could create a big jump in the Charge-Offs ratio as 2024 turns to 2025.

Here’s an example of an institution experiencing declining ROA throughout the year. This is the YTD ROA each month. By December it dropped from 1.00% to 0.45%:

What will the following January look like when the YTD ratio “resets” to only include January? It turns out that the month-to-date (MTD) ROA was declining by 10 basis points each month. YTD ROA jumped from 0.45% in December down to -0.20% in January:

Preparing the Board for big changes ahead of time and explaining why YTD ratios may not be great indicators for the next year can help eliminate unnecessary surprises.

Helping Board members avoid confusion can lead to greater fluency around the concepts, a common understanding, and better alignment. The resulting focus on the true situation is a key step toward more productive conversations and better decisions.