Don’t Just Focus On Interest Rate Risk – Yield Matters

While interest rates have been fluctuating over the last few months, some feel rates will consistently begin to move up based on indications from the Fed. But what if they don’t? As you discuss your earnings and interest rate risk, it is important to not just look at the risk. Credit unions should pull it all together and look at the overall risk/return trade-offs, because yield does matter.

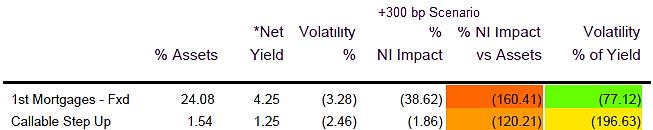

Take, for example, the two assets shown below. Mortgages are considered to carry a relatively high potential for interest rate risk, and for good reason. Mortgages can increase a credit union’s interest rate risk. The column labeled “% NI impact vs Assets” displays the relative risk of each asset to the average risk of the institution.

The baseline in this report is 100%. If an asset class shows more than 100%, it carries more interest rate risk than the average risk of the institution. If an asset class shows less than 100%, it carries less interest rate risk than the average risk of the institution.

In this example, the 1st Mortgages have risk equal to about 160% of the credit union’s average risk, while the Callable Step Up has risk equal to about 120% of the credit union’s average risk. For this credit union, then, 1st Mortgages have more relative interest rate risk than the Callable Step Up.

But understanding the risk is only a piece of the picture. Yield relative to risk certainly does matter.

The last column – “Volatility % of Yield” – relates the risk of the asset to its yield: the risk/return trade-off. It is this last analysis that lets the credit union see that all risk is not created equal.

The interest rate risk of the Callable Step Up is about 197% of its yield, whereas 1st Mortgages have risk of about 77% of its yield. The interpretation of this is that while the Callable Step Up carries relatively less risk for this credit union’s structure, the 1st Mortgages represent the better risk/return trade-off.

The objective of this example is not to say that mortgages are always a better risk/return trade-off than Callable Step Ups or to suggest that credit unions should load up on mortgages. The objective is that in areas where you feel your credit union may be able to take on more risk, why not understand where you are able to get the best risk/return trade-offs? We wrote a c. notes on this topic in 2016.