Derivatives – Another Option For Helping Mitigate Interest Rate Risk

The Federal Reserve signaled their expectation to continue Fed Funds rate increases in 2017, but substantial uncertainty remains about when and where market rates will move. Credit unions can find it challenging to achieve a desirable ROA today while maintaining an acceptable level of risk should market rates increase. Decision-makers have a variety of options available for attacking interest rate risk challenges, and derivatives can be another useful arrow in the ALCO quiver.

Some of our clients are using or considering derivatives as a tool for mitigating interest rate risk. While c. myers does not sell derivatives, we regularly model their impact on our clients’ financial structures to show the risk and reward trade-offs.

Derivatives can be thought of as purchasing insurance. As an example, consider your purchase of an auto insurance policy. You pay a premium to provide protection for your car from accidents, theft, etc. The premium may be paid over the course of years. If the car is never damaged or stolen, the insurance protection is never used or realized. Overall of course, you’re probably happy that the insurance wasn’t needed. Was the insurance valuable? Was it worthwhile?

Derivatives operate similarly to protect against interest rate risk. There are a variety of derivatives available to credit unions. To illustrate some of the key attributes, let’s consider caps and swaps.

A cap is insurance purchased for a fixed price up front and provides protection for a specific time frame (the term) for market rates that go above a specific level (the strike rate). Credit unions establish a notional balance, say $100 million, which never exchanges hands but is used like a principal balance for determining the interest payments. If market rates increase to a point where they exceed the strike rate, the difference between the market rate and the strike rate is applied against the notional balance and paid to the credit union. The cost of this insurance is largely determined based on the strike rate and term desired by the credit union, but again it is known and fixed up front.

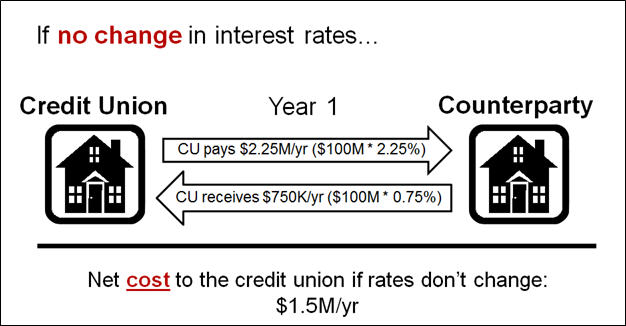

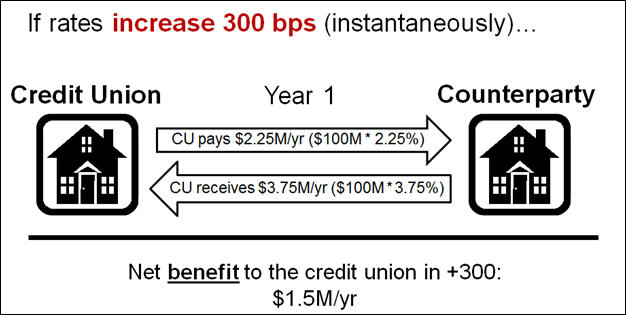

Unlike a cap, an interest rate swap is not purchased for a fixed price. In fact, there is no up-front cost for the swap. Rather, two parties agree to pay each other different interest rates on a given notional amount for the term of the swap. One party will pay a fixed rate, while the other will pay a variable rate based on an index such as LIBOR. The idea is that as market rates increase, the variable rate could at some point exceed the fixed rate payment and offer protection to the fixed rate payer. Consider the following interest rate swap example with a notional amount of $100 million, where the credit union pays a fixed 2.25% rate and receives

1-month LIBOR.

In this example, for simplification, an instantaneous rate change was assumed. However, the timing and direction of market rate changes will ultimately determine the resulting cost or benefit of the swap over its term.

Derivatives can be a valuable tool for credit unions to consider within their interest rate risk management strategy. When deciding whether to use derivatives, it is important to understand both the expected interest rate risk protection, as well as the potential costs within a range of rate environments. It also makes sense to ask how the protection may change over time and whether there are circumstances that might make the protection not as valuable. For more detailed information about derivatives and understanding key considerations, please see our c. notes paper, Considering Derivatives?