2010 Budgeting Process: Focusing On What You Control

There are only five levers that are pulled to arrive at an ROA, and every single one is under threat to some degree:

- Yield on assets is under attack from external forces as rates are at historic lows and loan demand is down.

- Cost of funds has been helped somewhat by low rates. However, it may take time for the cost of funds in many credit unions to decrease after they were blindsided by a flight to safety as they launched aggressive CD promotions and high interest-bearing checking accounts.

- Provision for loan losses for many are higher than their worst-case assumptions because of economic woes, increases in strategic defaults and inadequate underwriting policies or inadequate enforcement of otherwise sound underwriting polices.

- Non-interest income is mostly controlled by credit unions – for now. But at some point, possibly in 2010, the government may wrestle away some control of that lever. It is expected that the Consumer Financial Protection Agency (CFPA) will be created in the near future and likely will not be slow to wield its power. (Draft summary of CFPA legislation)

- Operating expenses appear to be the one lever over which you have the most control. However, that is also being threatened by the likelihood of additional assessments and mounting compliance requirements.

With these levers in mind, as you work on your 2010 budget, consider the following:

Understand the largest sources of your PLL and the processes in place that allowed it to be the largest source. While those “horses are out of the barn,” make sure appropriate steps are taken to avoid the same problem with all new loans going forward. Consider the following:

- If we never got into the business of making the loan that created the greatest losses for us, and we didn’t need the funds to support them so we paid a lower rate to slow growth, what would our PLL be today? Some credit unions are surprised to find out that over 90% of their PLL comes from just one loan product.

- Are our underwriting policies adequate?

- What are our decision drivers that got us into this loan product? Do we need to rethink our decision drivers? (As it is turning out, a high loan-to-asset ratio isn’t always the best decision driver.) For more on decision drivers, please see our white paper, Managing Success in a Changing World: Best Practices of Highly Successful Credit Unions.

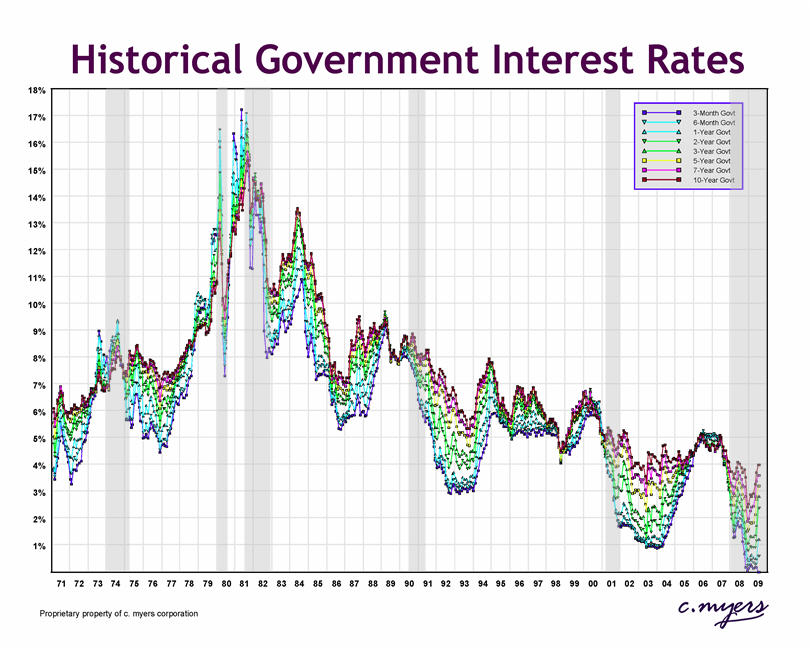

Do not compromise your tolerance for risk. None of us, our parents, or our grandparents have lived through such a low rate environment.

Test your decisions to make sure you’ll be as happy with them in a higher rate environment – and flatter yield curve – as you might be today. Remember that when the Federal Reserve started raising rates in June 2004 following the last recession (recessions shaded in gray in the above graph), they raised short-term rates 425 basis points while the 10-Year Treasury Rate moved up less than 100 basis points.

Look for inefficiencies in processes and projects throughout the organization. Investing modest effort identifying solutions to improve processes and to better allocate resources toward projects can have a quick, positive impact to ROA.