Strategic Budgeting/Forecasting Questions: Consider Key Forces

This is the third entry in our 6 blog series about Strategic Budgeting/Forecasting Questions.

Question 3 – What key forces could impact our forecast?

Every good forecast should have a sound rationale and basis for the assumptions. If the current forecasting approach involves simply taking last year’s growth rates and assuming they continue, that will not be good enough going forward. A better approach is to identify key forces that could impact the budget/forecast and use this discussion as the rationale for the forecast assumptions.

It is important to understand that both internal and external forces have the ability to impact the forecast. Internal forces are largely driven by the strategic plan and initiatives set forth by the credit union, as well as the ability to execute (see the first and second blogs in this series for more).

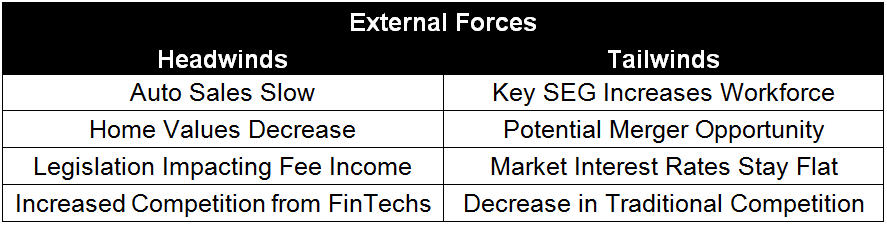

Then there are external forces that have the ability to act as headwinds, which put pressure on the strategy, or tailwinds, which help move the strategy forward. The focus here will be on external forces. What is going on in the world around the credit union that could impact the forecast?

Start by getting decision-makers into a room and brainstorming different external forces that could impact the forecast. The list of forces can be quite extensive, so go through a process of prioritization. Group the ideas into two separate categories, headwinds and tailwinds as seen in the table below.

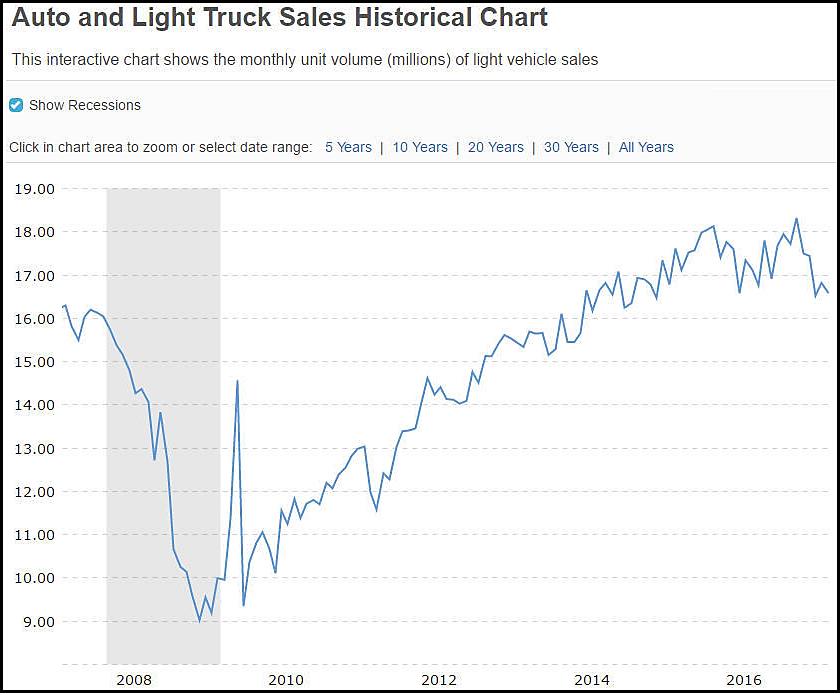

The value is always in the discussion. Take the top headwinds and tailwinds, study recent trends, and use this business intelligence to inform your forecast assumptions. Take the potential auto sales headwind as an example.

Source: macrotrends

Study historical data and discuss as a group. Auto sales have accelerated from 2010 to 2016. More recently, they have slowed. This trend should be incorporated into the forecast, especially on how it might impact the credit union’s strategic initiatives.

What about real estate? Are home values a key force that could impact your real estate lending and ultimately the forecast? Using the S&P CoreLogic Case-Shiller or another market source, decision-makers can understand what property values are doing in the area. If your area has experienced price increases well above national averages and prices are now above previous peaks, maybe that leads the group to assuming a slight decrease in new volume.

The combination of identifying key external forces, studying history, and having a discussion will better inform the forecast. Continue to use the what-if capabilities of your forecasting model to stress test the financial impact of changes in key market forces. Following this process will help decision-makers understand how external forces can impact the financial direction of strategic initiatives.