Fed Indication on Bond Buying

On June 19, Chairman Ben Bernanke indicated that the Fed may slow its bond purchases later this year. Since that statement, the 10-year Treasury yield has increased 35bps from 2.20% on Tuesday, 6/18, to 2.55% on Wednesday, 6/26 (Treasury.gov), while the Dow Jones Industrial Average (DJIA) has dropped 408 points over the same period (Bloomberg.com). Keep in mind, the Fed only made a statement.

This raises some interesting questions for decision makers to consider, including:

If the rate increase is sustained…

- How might this impact loan volumes in the short and intermediate term? Could volumes increase in the short-term for fear of loan rates increasing? What impact would it have on longer-term loan demand?

- How might non-interest income be impacted?

- If you were counting on your callable bonds to be called, and now they may not be called, should you hold them or fold them?

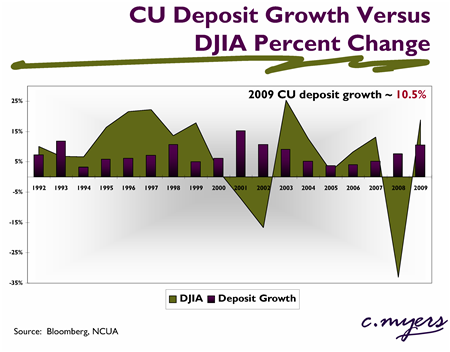

- Could you experience another flight to safety if the stock market continues to be volatile?

Treasury rates could come back down and the stock market will hopefully “right” itself at some point. Nonetheless, decision makers should consider the impact to financial performance if current trends continue. Running through different “what-if” scenarios of how the institution would react and testing them in forecasting and risk models can help decision makers be better prepared.