Strategic Budgeting/Forecasting Questions: Connect Strategic Initiatives with Financial Direction

Strategic initiatives impact results – members may be better served and membership may grow, assets may grow, and earnings and net worth may increase. Some strategies may cause temporary or long-term reductions in membership, assets, earnings, or net worth. Budgets and forecasts should incorporate the anticipated impacts of strategic initiatives and establish common expectations for results. Connecting the dots to better understand the financial implications of strategic initiatives can lead to greater success.

In this and subsequent blogs, we will review 6 questions strategic boards can discuss during the budgeting and forecasting process to better connect the dots. These 6 questions are merely a starting point and will undoubtedly lead to more questions during the process, creating more thorough communication and a greater understanding of strategic plans.

Question 1 – What is the expected financial direction of each strategic initiative?

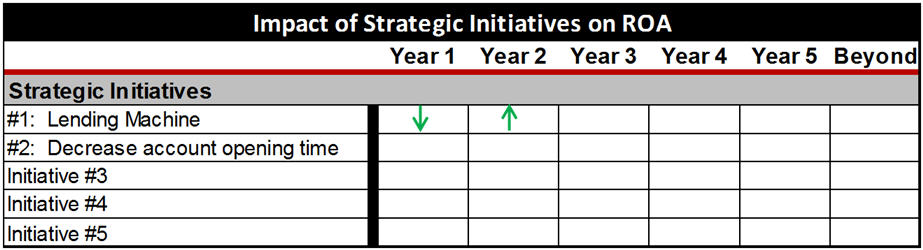

Begin with a simple, high-level assessment of strategic initiatives. Identify each strategic initiative with a short description. Then, consider what you believe will be the earnings impact next year and in the following years. For this exercise don’t focus on the numbers, just consider the direction of the impact. Draw a quick table or use a spreadsheet as follows:

Consider that not all strategic initiatives will generate increases to earnings. The important point is to understand why. Some initiatives may hurt earnings in the short term to achieve longer-term improvements, while others might only reduce earnings. For example, a strategy might be to increase member giveback through reduced overdraft fees or installing additional ATMs for improved member access.

In this example, initiative #1 is to become the lending machine – perhaps to make the process more efficient and create capacity – or to generate more loans for the credit union. This initiative may include a project to implement new technology or acquire talent. In Year 1, the project is expected to incur costs that would reduce earnings, or the ROA. We indicate that in the chart with a downward arrow. By Year 2, however, we expect to see some additional loans or experience cost savings that would improve ROA. We show that with an upward arrow.

Continue to complete the chart.

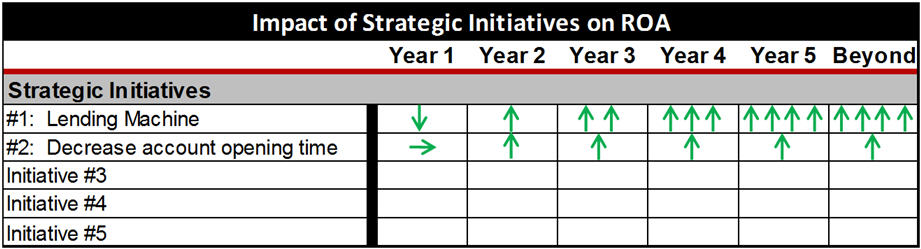

In Year 3 and beyond, the impact to ROA of the lending machine strategic initiative is expected to continuously increase. We can use multiple arrows to show the additional impact expected.

For strategic initiative #2, to decrease account opening time, there’s no hard dollar costs in Year 1 as the credit union conducts an internal review and designs process improvements. In Year 2 and beyond, the efficiencies are expected to lower costs and drive some additional new accounts, thereby increasing ROA.

Beyond looking at each strategic initiative, notice that now the aggregate expected impact of all initiatives can begin to be understood. If all or a significant number of initiatives have negative ROA impacts, that can be an indication of needing to consider other, offsetting strategies to generate additional revenue. Or, it may make sense to accept lower earnings for some period. That would be important to recognize and to make sure that everyone, including the board and management, is on the same page with the expectation so there are no surprises.

After completing this exercise, board members and management can be better prepared to review the budget with a high-level expectation for how it may look. If projections don’t align with expectations, more “why” questions can be asked and differences understood. As financial results occur and new budgets are created, this can be a great tool to keep as a reference. Strategic initiatives can be reassessed for what was originally expected versus what actually happened, and to determine what changed and why.