Forward Curve Back Testing

Our last blog, NEV Does Not Equal NII, drew questions from some of our readers. Specifically, some questioned our comment about a forward curve’s inability to predict interest rates. This is fair, since some in the industry seem to treat it as a foregone conclusion that a forward curve will come true.

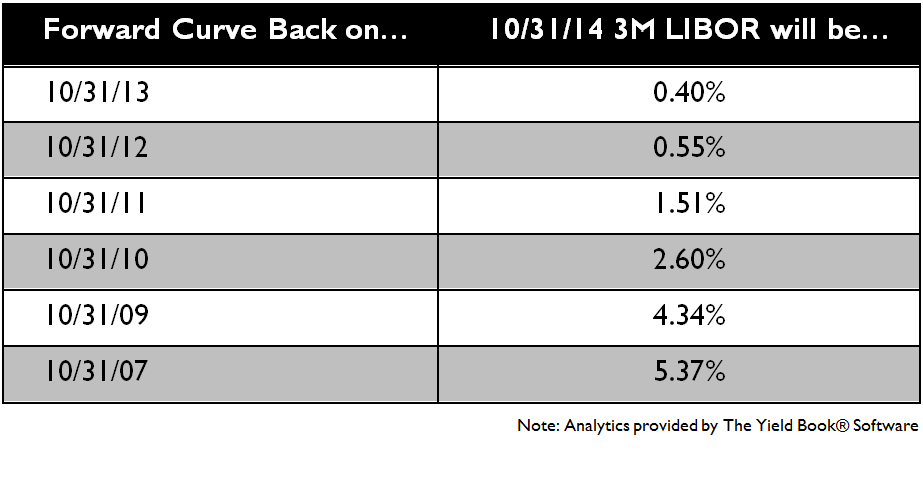

We hear a lot about back testing so let’s back test a forward curve. The table below looks at the 3-month LIBOR forward curve on the last day of October each year going back to 2007 for its “prediction” of where the 3-month LIBOR rate would be on October 31, 2014. The numbers have changed a little bit since then, but the message remains clear: a forward curve has not proven to be a good predictor of interest rates.

For example, the forward curve as of October 31, 2007, “predicted” that, as of October 31, 2014, the 3-month LIBOR would be 5.37%. As of October 31, 2013, the forward curve was indicating the 3-month LIBOR to be 40 bps on October 31, 2014. The actual rate as of October 31, 2014, was about 23 bps.

Does your IRR process use a forward curve to predict rates?

Baseball legend Yogi Berra is credited with saying “It’s tough to make predictions, especially about the future.” We couldn’t agree more! Predicting rates can be good as part of the budgeting process but, when it comes to risk simulations, history has taught us that a forward curve is poor predictor of future rates. If your IRR process assumes the base rate environment will follow a forward curve, you could be missing risk. Understanding the risk of rates staying flat or not following a forward curve are lessons that should not be ignored. For this reason, we run IRR analyses that analyze potential earnings against the backdrop of all the interest rate environments including all of the yield curve twists that have happened in the last 60+ years.