Interest Rates Have Risen – Now What?

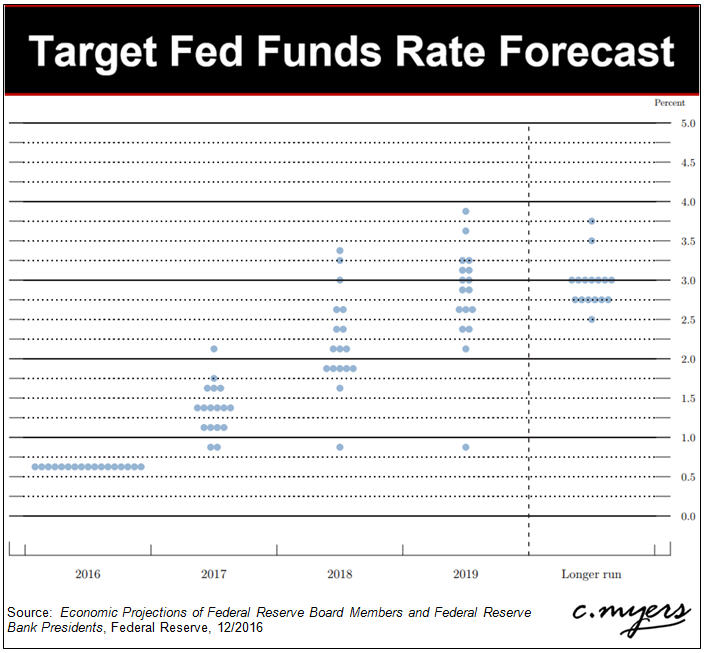

The 3-month Treasury rate has moved more in the last 8 months than it has in the preceding 8 years. For many who think of A/LM in a time of rising rates, it can be time to calibrate pricing strategies, non-maturity deposit withdrawal assumptions, or loan prepayment speed assumptions. Others may begin to consider strategic liquidity options, such as borrowings or locking in brokered CD funds to hedge against an assumption that rates may continue to rise. However, as a CFO, have you considered the following:

- How many of your senior managers have not had a role of responsibility when short-term rates have increased?

- How many of your key front-line staff have never seen a rate increase in their professional careers?

- Are you facing an uphill battle when trying to discuss risk management with others in the organization when earnings are up, loan demand is strong, and current economic indicators point to expansion?

A/LM is much more than inputting data into a model and generating report output. Strategic thinking CFOs understand it is more about the conversation surrounding running a business than it is about looking at reports – and they have structured their risk modeling around addressing business questions first. While there are many areas to consider, let’s touch on one – funding risks and how consumer behaviors driving deposit activities may be different going forward.

Consider that CD rates are up for many institutions – nationwide. Let’s now look at recent retail experience – consider that a recent Pew Research Center study, released in late 2016, found that 79% of adults in the U.S. have purchased online. Beyond just online, over half of those surveyed have purchased with a smartphone. Further, consumer purchases initiated through a social media link are increasing as well. In 2007, during a survey with comparable questions, only 49% of adults responded that they had made a purchase online (Source: Digital Commerce 360).

What does shopping online have to do with A/LM? Quite frankly, a lot. Consider how consumer borrowing behavior and credit union lending strategies have been impacted by online lenders and increased FinTech competition. Don’t just focus on the “A,” and lose sight of the “L,” in asset/liability management. The liabilities are critical to understand in the A/L equation – and how might member deposits react to rising rates now that nearly everyone has some established comfort level with making purchases online? In the mid-2000s, how many of your deposits were lost to (or how many of your deposit strategies were impacted by) the orange bouncing ball of ING Direct? Since that time, there has been a 60% increase in the number of adults making purchases online.

Beyond members, how might front-line staff react to members wanting to transfer funds or close CD accounts? Front-line staff are more than just those in-branch or at the teller window – how might staff members in the call center or ITM department respond to similar requests? For those staff members that are traditionally viewed as “back office” (such as the wire department or ACH/Electronic Funds department), are they now the new first line of interaction if members were to transfer funds to seek yield elsewhere?

A/LM goes well beyond just producing end of month or end of quarter reports from a model – it should be forward-looking, and it should help address risk-related business questions that decision makers are facing today. Ask yourself if you are proactively answering these business questions.