Rate of Growth and Loan Concentration Limits

As you consider establishing concentration limits on loans, it is important to know how the rate of growth could impact risk.

We understand that loan growth is anemic for many financial institutions. However, at some point, loan demand will increase and the rate of growth is something decision makers will need to consider. In fact, some credit unions may need to consider their rate of growth now as we are seeing a rapid increase in indirect lending (often called “point of sale” lending).

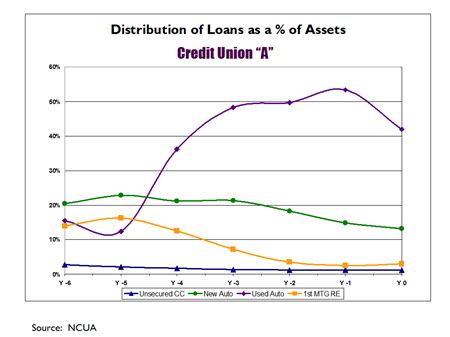

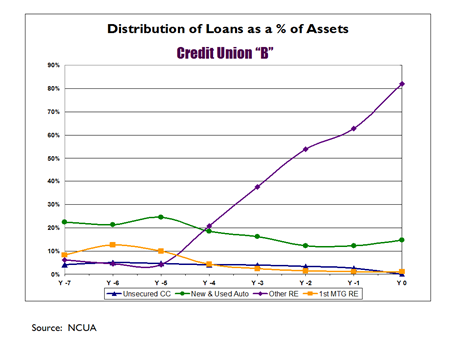

The following shows the change in loan concentrations as a percent of assets for two credit unions that no longer exist. Each experienced brutal losses in the portfolios that grew unmanageably.

Aside from absolute concentration limits, factoring in a threshold for change (growth) in concentration can serve as an early warning sign that a business line may threaten the credit union’s safety and soundness.

Taking the two example credit unions above, extraordinary growth was experienced year-over-year-over-year—yet no effective action was taken to understand the risk and/or stop the growth before it was too late.

As the economy improves and lending demand grows, it will be necessary to perform continuous, rigorous analysis as a portfolio is growing. Management should constantly step back and ask questions such as:

- Why is this portfolio growing so fast? Are we experiencing “too much of a good thing”?

- What is missing from our current analytics?

- Are our assumptions too optimistic? What if our assumptions are wrong?

- What forces are out of our control that could cause this business line to go south—and go south fast?

- Are we making more exceptions in our underwriting? Is there a pattern with a particular loan officer and/or third party?

- Are we relying on this line of revenue to the detriment of our other lines of business? What can threaten this line of business, and how fast can we recover should it be dramatically reduced?

- Are our internal controls rigorous? How can we test this to ensure we are adhering to our standards?

When evaluating options for concentration limits, credit unions should also consider establishing guidelines for portfolio growth. While we have shown only two examples, these situations occur all too often. The message is that rapid growth in a particular asset class can play a key role in creating unacceptable risk.