3 Common Lending Misconceptions to Avoid

In a recent blog, we posed 4 questions that you should answer about your lending experience. Today, we want to drill down a little further into some common beliefs that have, more often than not, been disproven by the data.

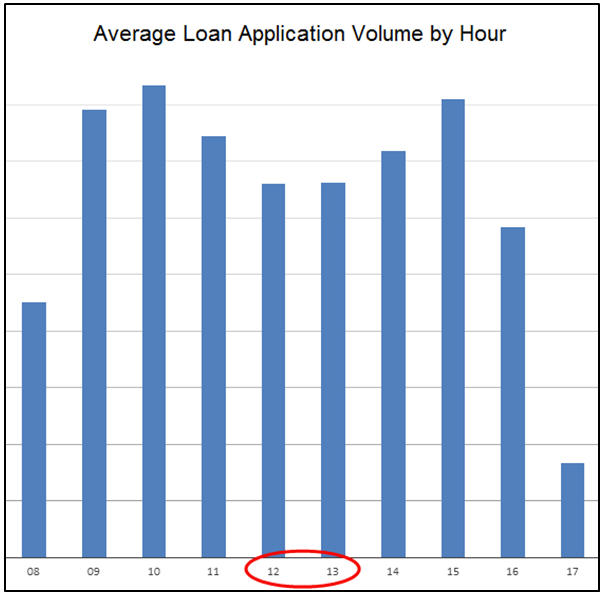

(apps) that come in during lunch time. This seems counter intuitive until you look at staffing during those times. People need to eat, so it is common for fewer representatives to be available just when members want to drop by at lunch to talk about a loan. A mid-day dip in loan apps could mean that members are walking away or hanging up because the wait is too long.

(apps) that come in during lunch time. This seems counter intuitive until you look at staffing during those times. People need to eat, so it is common for fewer representatives to be available just when members want to drop by at lunch to talk about a loan. A mid-day dip in loan apps could mean that members are walking away or hanging up because the wait is too long.The biggest challenge in validating assumptions is simply recognizing that they exist. Any time you find yourself saying, “Oh that’s because…,” pause for a moment to consider whether it’s actually an assumption.

There is a treasure trove of data at the fingertips of most credit unions that can be used to ferret out the truth about assumptions once they’re identified. The 3 misconceptions in this blog were uncovered by going beyond looking at overall funding ratios and other common high-level metrics.

Slicing and dicing the data that’s readily available by credit tier, product, delivery channel, branch, and time received, to name a few, and tracking trends over time creates actionable business intelligence that sparks the necessary questions. Expanding queries beyond lending to account opening and other areas could also reveal many meaningful, valuable process improvement opportunities.