Liquidity – Evaluating And Understanding Your Contracts

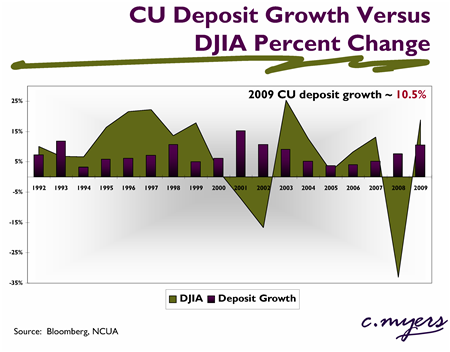

Most liquidity concerns today revolve around having too much liquidity without viable investment opportunities. However, after the recent (and sustained) flight to safety, some credit unions are beginning to consider the potential impact of liquidity leaving insured financial institutions.

In the short-term, a liquidity event may be significant deposit run-off or draws on unfunded loan commitments (i.e. HELOCs or credit cards). Responses to such events may include reducing member lines of credit, increasing borrowings, selling AFS investments, or some combination of the above. However, prior to relying on these actions, management teams should evaluate their contractual ability to exercise certain options. Some important considerations include:

- Can unfunded loan commitments be revoked? If so, what are notice or disclosure requirements? If the loan is business-purposed, are there any special considerations needed?

- If an unfunded loan commitment can be reduced, are there limiting conditions? For example, some real estate-backed lines of credit may be reduced without advance notice only if the collateral value has declined since the approval of the loan. If home values have appreciated, the credit union may not be able to reduce lines.

- What AFS investments, if any, are encumbered through line of credit contracts with a correspondent financial institution?

- If the credit union’s safekeeper also provides a committed secured line of credit, what operational concerns are there if the credit union advances funds through the line and also plans to sell investments?

- What is the cutoff time or advance notice requirement for drawing on a committed credit facility? Does the cutoff time or advance notice requirement change based upon the terms under which the credit union is requesting funds, even if through the same correspondent financial institution (i.e. repurchase agreement vs. term borrowing)?

Many credit unions may have materially more considerations to make than those noted above. Every credit union should evaluate liquidity options and understand potential courses of action well before they are needed.