Strategic Budgeting/Forecasting Questions: Establish Appropriate Measures of Success

The fourth entry in our 6 blog series about Strategic Budgeting/Forecasting Questions addresses measures of success, and how they should connect to the budget or forecast.

Question 4 – Are our financial measures of success handcuffing the credit union strategically?

There are many examples of appropriate and inappropriate measures of success as they relate to the budget and strategy. Some measures even come with unintended consequences. Measures should reflect, as closely as possible, what the credit union is really trying to accomplish, such as more engaged members or a profitable structure. Sometimes, measures that have existed in that past are kept as a matter of habit and simply aren’t updated in accordance with the plan.

Let’s assume that a credit union has a strategy to target members in their mid 20s to 30s to serve as a pipeline for the future. Beyond ROA and net worth, here are examples of some common measures of success:

- Low delinquency: Choosing to target younger members is likely to come with more credit risk, so a measure of success that keeps delinquency at the same or lower levels may be in conflict with the plan. Not all younger members have higher credit risk, but focusing on low delinquency could lead the credit union to say no to the very members it is trying to attract, damaging its reputation with this group who likes to share their experiences. Setting this measure to realistic levels at the outset also helps stakeholders be more comfortable when higher delinquencies appear. It may be reasonable, in this situation, to budget a higher PLL

- Products per member (PPM) or products per household (PPH): A strategy that aims to bring in new members is likely to reduce PPM and PPH. New members tend to have fewer products early on. An organization that is trying to increase PPM and PPH will be intent on getting existing members to do more business with the credit union, which could create little motivation to capture the target group. Consider measuring new members or households separately if measuring PPM or PPH

- Member satisfaction/Net Promoter Score (NPS): A credit union that is successful in attracting younger members could find their overall member satisfaction or NPS dropping. Many credit unions find that, after segmenting by age, scores for younger members are much lower than for older members. Telling the organization to improve member satisfaction or NPS could work against the strategy to attract younger members. Consider measuring score trends segmented by age

- Asset growth: Younger members usually don’t bring a lot of deposit dollars and deposit growth usually drives asset growth. If the asset growth measure requires special effort to be successful, those efforts will reasonably be focused on older members, pushing the target group to a lower priority

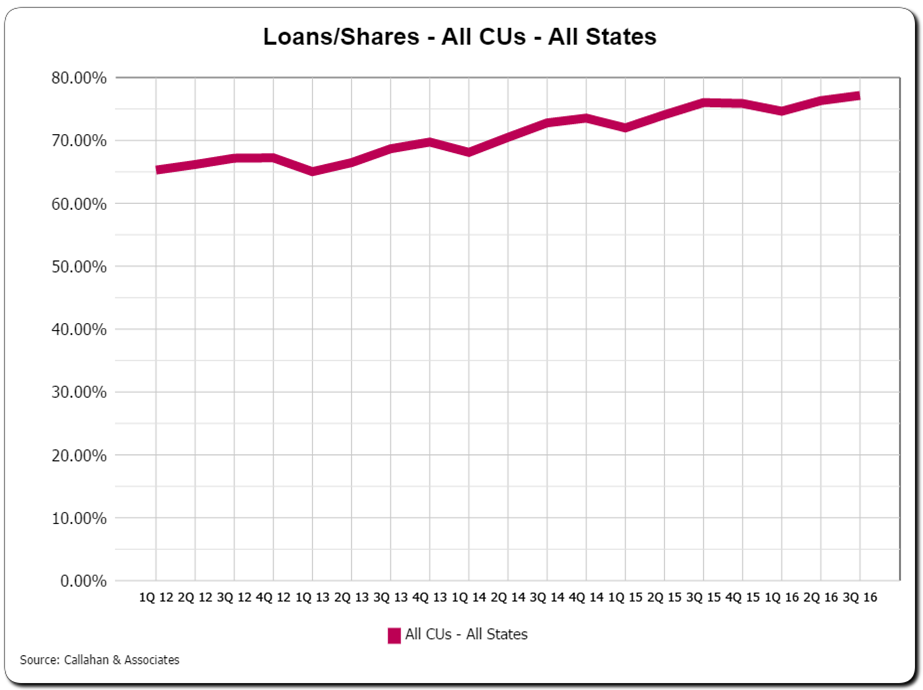

- Loan growth: Similar to asset growth, younger people usually don’t bring a lot of loans to the credit union. Loan dollars borrowed per member is usually heaviest for people in their 50s. A push for loan growth will also push the target group to a lower priority

Other considerations to keep in mind when setting measures of success:

- Member growth: When measuring the number of new members, remember that it’s easy to grow $5 member accounts, so consider whether that’s really success when setting measures for this strategy

- Member growth and indirect lending: Growth in indirect lending could increase membership in the target group, but is that a good thing? Indirect members often have a single product (an indirect loan) and it is commonly acknowledged that it is difficult to convert those members to “real” members who use other credit union products. Including these members in member growth measures could show an uptick while failing the strategy of filling the pipeline. Consider measuring members that come from the indirect lending channel separately from direct members

- Member growth and PPM/PPH loopholes: By not purging inactive members, growth will look better. At the same time, purging inactive members can make PPM and PPH increase without accomplishing anything. Consider adding caveats to measures that can be easily improved without actually getting any closer to the strategy

- Member engagement: Don’t just focus on products when evaluating engagement; consider services, especially those from other areas of the credit union, such as insurance or wealth management

Assuming the budget reflects the strategic initiatives, which we discussed in the second blog in this series, stakeholders should view the measures of success through the lens of the budget. If it’s not clear how the budget leads to the measures, or if the measures are in conflict with the budget or the strategy, stakeholders should be asking questions. The goal is for everyone to emerge from the budgeting and strategic planning processes with a realistic view of what success looks like.