Trends in Auto Sales and Prices: Questions to Consider

Automakers have been informing investors for months now of a potentially difficult road ahead. Recent articles indicate trends that may present risks or opportunity to your credit union, depending on your situation.

Auto sales have declined the first three months of the year with the current, seasonally-adjusted pace annualizing out to 16.6 million compared to 16.7 million this time last year. Goldman Sachs Group, Inc. is now estimating demand for only about 15 million vehicles in 2017. Compare that to the record of 17.6 million set in 2016. (Source: Bloomberg)

For used cars, the National Automobile Dealers Association’s (NADA) price index dropped in February by the most since November 2008. Both General Motors and Ford have warned about lower used car prices as many cars come off leases and into the used car pool. (Source: Bloomberg)

Dealers Association’s (NADA) price index dropped in February by the most since November 2008. Both General Motors and Ford have warned about lower used car prices as many cars come off leases and into the used car pool. (Source: Bloomberg)

Additionally, auto loan delinquencies have increased across all credit tiers causing some lenders to tighten terms or pull back.

As you plan for the remainder of the year and beyond, the list below offers some great discussion topics for ALCO meetings and/or reforecast scenarios to consider:

If auto lending declines, what other avenues are available to us to grow loans? What investment opportunities are available?

- How might slower-than-expected auto growth impact earnings?

- If the average used car price falls, how many additional loans will need to be booked in order to meet budget goals? Given our current funding rate, how many more applications would we have to process in order to book those additional loans? How could we process more loan applications without adding expenses related to additional staff or overtime pay?

- What if we have to dramatically reduce offering rates or increase fees paid to dealers to get the volume?

- What if credit losses are higher than expected?

- Are there opportunities that could be created if competition pulls back? Should we take advantage of any such opportunity?

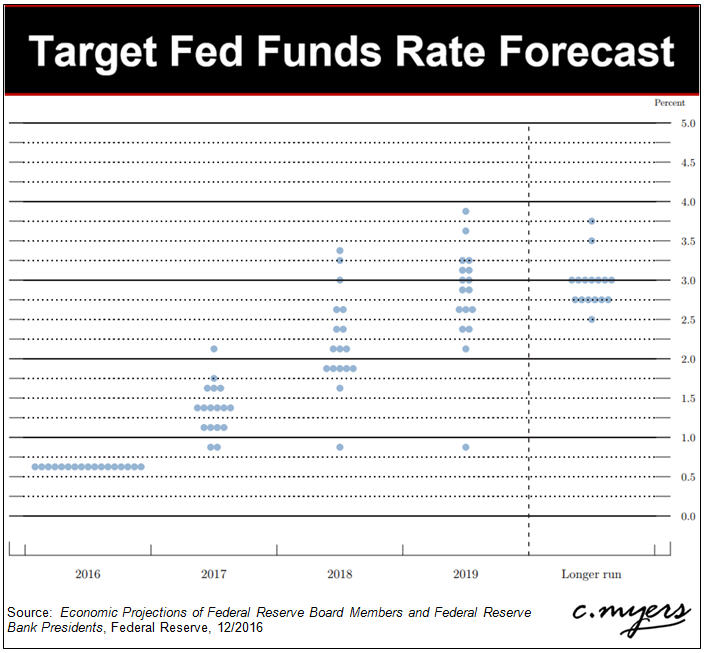

- How might loan demand be impacted if interest rates rise?

- What if interest rates rise, putting pressure on us to raise deposit rates, but fierce competition for auto loans leaves us unable to raise loan rates?

The list above is not all inclusive but is a great start. As with most things, there are both opportunities and risks to consider. The sooner you start to consider them, the better off your credit union will be.