Strategic Planning for Mobile Users

It is a safe bet to assume that many credit union strategic plans include a focus on engaging mobile users. One of the first steps in engaging a consumer is to better understand them.

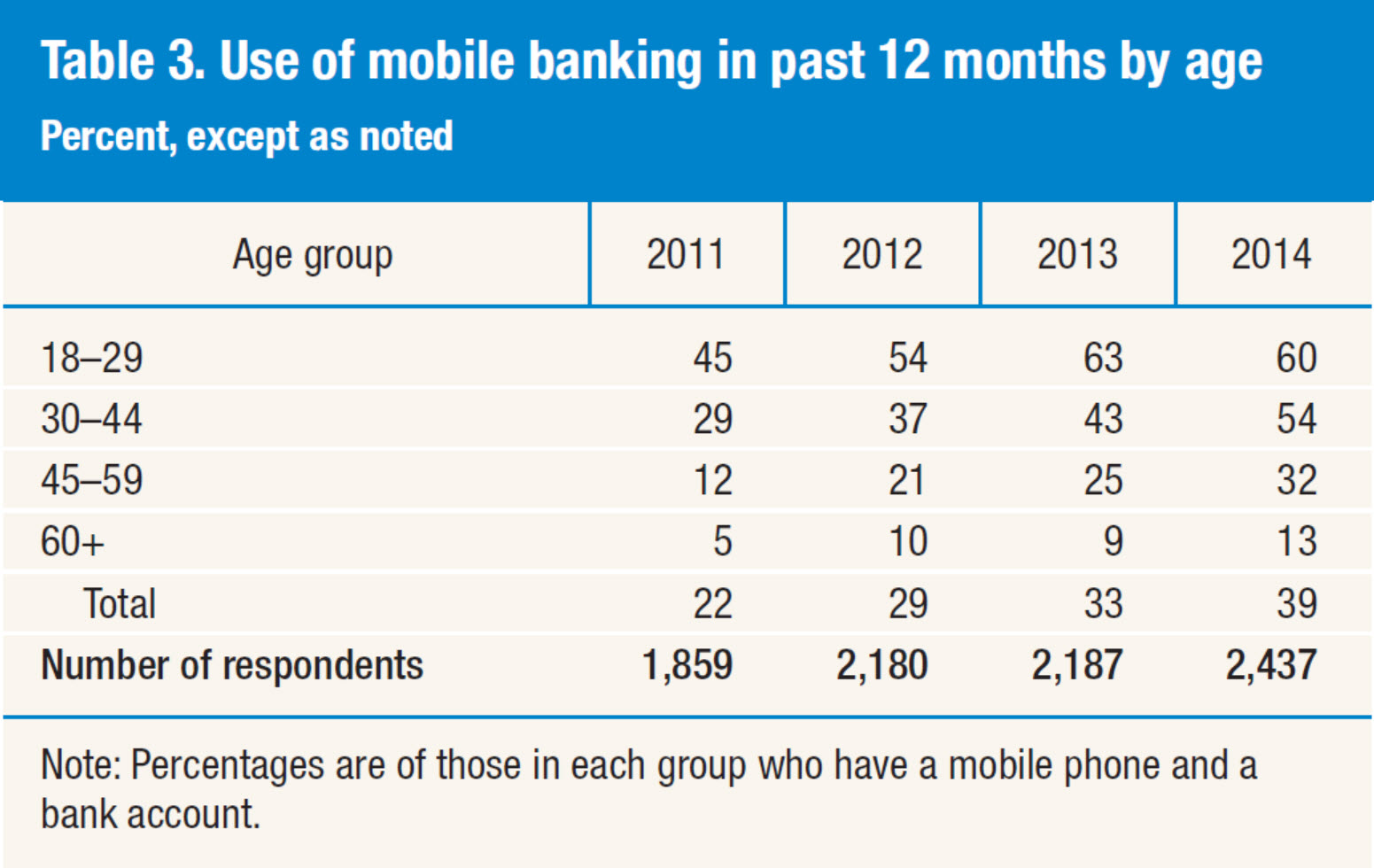

The Federal Reserve’s report, Consumers and Mobile Financial Services 2015, is nothing short of a treasure trove of data that has been reformulated into potential decision information. We’ll explore data about the various ages in which consumers use mobile banking.

Excerpt from Consumers and Mobile Financial Services 2015 Report

Table provided by Board of Governors of the Federal Reserve System

At first blush it may seem to confirm what we hear far too often – that Millennials should get the biggest allocation of marketing dollars – but it is important to not just view usage in absolute numbers. Understanding trends, including the rate of growth, can be eye opening. Viewing data from various perspectives can open doors for new opportunities.

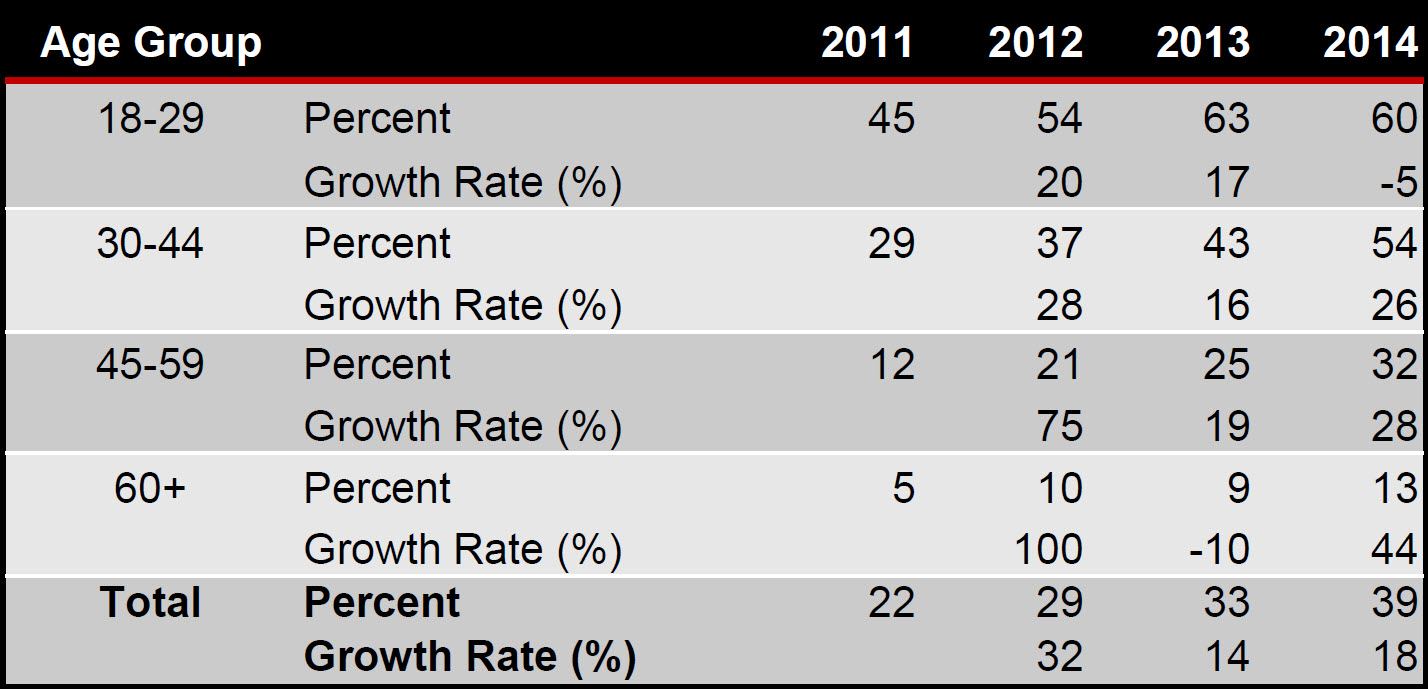

If you take the data from the table above and dig deeper, you will see that, while one year does not make a trend, it should not be ignored that the youngest group had a decline in usage (see below). Meanwhile, the age groups that tend to have deeper relationships with their credit union show a healthy rate of growth.

Take Advantage of the Treasure Trove of Data

If you haven’t started already, dig into the data your credit union has for your members. As we’ve seen with so many strategic planning clients, once you have reliable data about what your members are doing with your credit union, you can easily start asking more of the right questions. Answering these types of questions, based on relevant data, will likely result in actionable decision information.

Keep in mind the more questions you answer, the more questions you will have!

Just a few questions to ask when strategically planning for mobile banking:

- What are the behaviors of our members who are using our mobile banking at least 4 times per month for the last year?

- What trends can be turned into strategic opportunities?

- Do they have deeper, more productive, relationships than those who are not actively using mobile banking? If not, what can we do to deepen these relationships? For example, do mobile banking users tend to have more or less loans with us?

- What other delivery channels do our mobile banking users tend to use, and for what?

- If our mobile banking users are also consistently doing routine transactions in a branch or through the call center, why? Are there roadblocks that can be removed to make members’ lives easier that can also help us control costs?

- What is our NSF/ODP income average per member for mobile banking users versus non-mobile banking users?

- Some credit unions find that the average is lower for mobile banking users. If that is the case, then what does the credit union need to do to replace the inevitable decline in this type of revenue?

- What age groups are using mobile banking to transfer funds to another financial entity?

- Can we use this information to send targeted, relevant marketing messages to these members?

- If we offer the likes of Apple Pay and Samsung Pay, how can we determine if our cards are top of their mobile wallet?

Many credit unions have access to this type of invaluable data, without significant hard costs to access it. The biggest investment is the time to ask and answer the thought-provoking questions. However, investing time to tap into member data and turn it into relevant decision information to drive strategic discussions, decisions, and planning is no longer optional.