Betas – An Unintended Consequence of Simplifying Pricing Assumptions

Non-maturity deposits (NMDs) and their treatment in A/LM modeling is often a hot-button topic with examiners and management teams. While there are key risk characteristics of NMDs not addressed with many methodologies (see previous blog entries below), the topic of this blog concerns NMD pricing assumptions.

Pricing assumptions for NMDs can be called by many names – derived rates, betas, rate sensitivity factors (RSFs), etc. However, regardless of the name, the objective is to generate a model assumption for NMD pricing in a given interest rate environment.

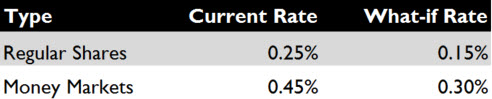

Pricing betas assume that the credit union will adjust non-maturity share pricing based upon some percentage of the overall movement in prevailing market rates (often indexing to short-term rates). While the methodology and approach may seem sophisticated, the implementation of such an approach reduces the flexibility of A/LM models to address changes in pricing strategy for the current rate environment and automatically results in assumption changes for rising rate environments. For example, consider running a what-if through an A/LM model adjusting today’s share pricing strategy:

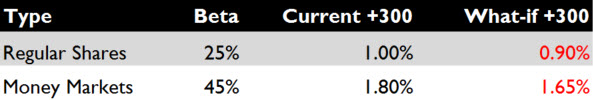

The unintended consequence of pricing betas results in a lower share rate in changing rate environments, as outlined below:

In the above example with a 45%beta on money markets, the +300 basis point (bp) rate is 0.15% less than the base case assumption for the same rate environment. Was the intention of running the what-if to test a 0.15% reduction in money market rates today, or was the intention to carry that same reduction in rates through all rate environments simulated?

Utilizing a prescribed pricing strategy, such as derived rates, allows management teams to develop a pricing assumption based upon the level of prevailing market rates – and does not result in unintended assumptions changes in key rising rate environments. If your model does not have derived rates capabilities, then the model should be re-calibrated frequently – minimally with each change in current pricing levels. Having derived rates capabilities adds control over model assumptions in risk limit rate environments and also can give management teams confidence that they are testing the impact of changing share rates today without automatically adjusting share rates in simulated rising or shocked interest rate environments.