Strategic Budgeting/Forecasting Questions: Representation of Strategic Initiatives in the Budget and Forecast

The second entry in our 6 blog series about Strategic Budgeting/Forecasting Questions builds on an understanding of Question 1. Having identified the financial direction of each strategic initiative, decision-makers are better positioned to look at the budget and see how the initiatives are represented and, of course, ask “why” questions.

Question 2 – How are strategic initiatives represented in the budget and forecast?

Take, for example, a strategic initiative of being the lending machine. One of the first areas decision-makers would look to see how this initiative is represented in the budget is loan growth. Given the initiative, one would expect to see loans increasing compared to previous years. But, what if the loan growth in the budget was the same as previous years? Would that be reasonable? It depends, and what’s key in answering this question is understanding the “why.”

Example 1: Why is loan growth the same as the previous years? Answer 1: There are headwinds the credit union is facing when it comes to loan growth (more on this in the next blog in this series about Question 3 – What key forces could impact our forecast?). Without the lending machine initiative, loan growth would actually decrease in the following years. So the impact of the initiative is actually keeping the loan growth steady. This may be a reasonable answer.

Example 2: Why is loan growth the same as the previous years? Answer 2: The trending from the current year is carried forward into the budget. This is not a reasonable answer and is not representing the strategic initiative. In this case, the budget should be adjusted to reflect the initiative.

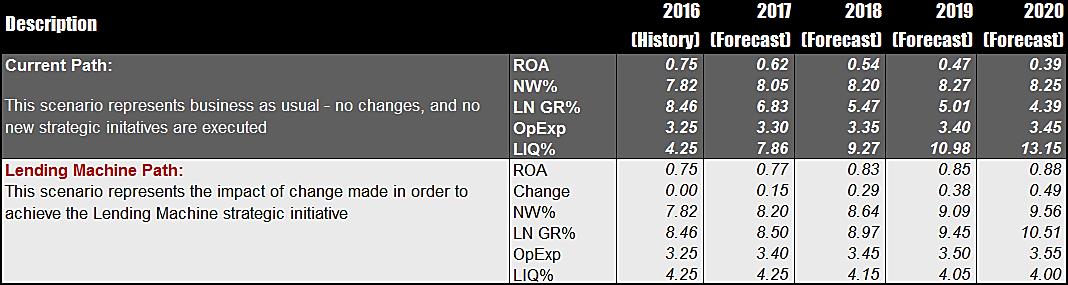

What can also be helpful is looking at the budgeting/forecasting trends with and without the impact of the initiatives. Start with a current path where the strategic initiative(s) are not incorporated and it is “business as usual.” Then run a path where the initiative(s) are included and compare the two.

Using the lending machine example, the chart below shows how loan growth and ROA would decline in the current path without implementing the initiative. With the initiative, loan growth stays steady in 2017 and rises in the years after, thus, increasing ROA and net worth. This comparison creates an opportunity to ask and discuss many “why” questions and see how the initiative is represented in the budget/forecast.

Again, the key is understanding the expected financial direction, looking for how that’s represented in the budgeting/forecasting, and then asking why. Even if the representation of the initiative in the budget is reasonable, it’s important to have strategic conversations on the “why” which will help create clarity among decision-makers.