When is Worst Case?

In risk analysis, it is important to make realistic assumptions about potential bad scenarios that could play out—large increases in interest rates and credit risk exceeding expectations are just a couple that come to mind.

While interest rates are at an all-time low, credit risk is at an all-time high for some credit unions. In preparing for your future, don’t mistake an all-time high with worst case.

For example: back in August 2007, the Associated Press reported that foreclosure filings had soared 93% from July 2006 to July 2007 and that the national foreclosure rate stood at 1 filing for every 693 households. Then in the first quarter 2008, CNN reported that, according to the Mortgage Bankers Association, the number of homes in foreclosure had topped 1 million.

Given this unprecedented level of foreclosure activity, it certainly felt like it couldn’t get any worse. However, according to RealtyTrac’s 2009 year-end report on foreclosures, there were over 2.8 million homes, or 1 in 45 households, with foreclosure filings in 2009 alone.

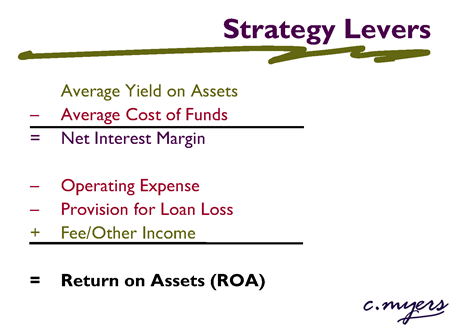

The bottom line is that, in risk planning, it can be very dangerous to assume that just because things are bad they can’t get any worse. It is important for your management team and board to understand the potential impact on your operations if things do get worse. It is likewise important for you to have well thought out plans—today—as to how you will pull your strategic levers to manage your credit union through even rougher times.

Hope for the best, but plan for the worst… or at least minimally prepare for the worst.