602-840-0606

Toll-Free: 800-238-7475

contact@cmyers.com

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Now is a Good Time to Prepare for a Recession

ALM, Budgeting, Featured Blog PostsThe following blog post was written by c. myers and originally published by CUES on March 13, 2019.

Thinking about how your credit union would weather an economic storm is helpful, whether the turndown arrives now or later.

The news is full of predictions that a recession is coming. The truth is that a recession is always coming–eventually. Whether you believe it’s imminent or more distant, it’s important to think through how your institution might weather the storm, and whether adjustments should be made to prepare for a tougher economic reality.

Visualize

Planning for uncertainty is best done as a team so a variety of views are tapped. Rather than going straight to the numbers, paint a picture of the recession to get everyone engaged. Create a story to help people visualize what could happen, so they can contribute in a meaningful way. Your story could start with describing what will trigger the next recession and include the effects on local employers and the local economy. Describe how different groups of members would be affected and how their behaviors would change as a result.

What could be different this time?

Many remember the Great Recession vividly, but rather than letting that drive your scenario, challenge each other to think deeply about what could be different this time. A few areas to start with are net interest margin and provision for loan loss.

Loan demand and rates both experienced steep declines as a result of the Great Recession. Loan income took a big hit, but according to data from Callahan & Associates, cost of funds for the industry also dropped 186 basis points (bps) over a span of 3 years. The net interest margin actually went up during that time. With cost of funds at 73 bps as of third quarter 2018, there isn’t room for that kind of relief today. Consider how this factors into your recession picture.

Provision for loan loss peaked at 1.07 percent in December 2009. Loan losses were a major factor during and after the Great Recession. In determining whether credit risk will be different this time, a good question to ask is how leveraged your members are. The Federal Reserve Bank of New York recently showed that household debt in the fourth quarter of 2018 is now higher than the previous peak in the third quarter of 2008 ($13.5 trillion vs. $12.7 trillion). At the same time, the Federal Reserve Bank of St. Louis shows that debt payments as a percentage of disposable personal income have never been lower (data collection started in 1980).

Harness the Power of Testing in Advance

Once your recession story is created, how concerned should you be? Before worrying too much, use the power of seeing what could happen in advance by modeling what-ifs.

Determine which areas are high-impact and test those to help focus your team’s thinking and discussions.

What Levers Can Be Pulled?

Now that the effects of your recession scenario are clearer, it’s time to decide how the institution could respond. Which of the five strategy levers do you have the most control over, and what, specifically, would you be willing to do to offset the effects of a recession?

A common lever to target is operating expense, since this is the lever that’s easiest to control. Cutting expenses can also hurt the business model, so protecting the ability to deliver the value proposition should be front of mind. Remember that operating expense ratios are 21 bps lower as of third quarter 2018 than they were going into the Great Recession, so there may not be as much room to adjust as there was last time.

Since there are many moving financial pieces in a recession, breaking the question down by the five strategy levers can simplify the thought process. These five levers represent everything that goes into return on assets.

What Levers Should be Pulled Today?

As recession responses are identified, step back to think through which should be implemented before a recession occurs. This is key, and one of the beneficial outcomes of recession planning.

The realization hits home that such responses as building efficiencies or shedding unprofitable products will not hurt today and will help prepare the institution to thrive through the next recession. This preparation can give new urgency to ideas that have been on the back burner for a while.

Preparing for a recession doesn’t mean you’ll have an accurate prediction of what will happen, but it can put you and your members on firmer ground as you face an uncertain future.

Keep it Simple and Effective

In reasoning through how a recession could affect your institution, the severity, length and characteristics of the downturn will make a difference. One approach is to consider a recession that you believe is likely and one that is severe. Then run what-ifs to model both versions, use the likely version as a basis for planning, and view the severe version as more of a survivability test. Combine relevant what-ifs to show an overall picture. Make sure the time frame of your view is long enough since the effects of a recession, especially slow loan growth, will be felt for longer than a year. Finally, less is more. With so many factors to consider, strive to keep your analysis as simple as possible by focusing on the biggest impacts.

Benefits of Focusing on Data Integrity

ALM, Budgeting, Featured, Process Improvement, Strategic Planning Blog PostsWe live in a data driven world, but the data is far more useful if it is accessible and reliable.

Ask yourself – do you view the reliability and accessibility of your data as a competitive advantage or a frustrating drag? Do you have multiple sources of information that sometimes show conflicting information, especially when you are facing a key decision?

We do a lot of work with institutions on strategy and process improvement, and have found that ease of access, and reliability of the data, often acts like an anchor, rather than an accelerator for moving the institution forward. The ultimate goal may be to create an environment where ALL the data you want is in a single spot, instantly accessible, and reliable. This endeavor can seem daunting, but keep in mind that the best way to get something big done, is to get started.

The first step, and often easiest step, is to take data that is already accessible and organize it to make it more useful. With emphasis on business intelligence, and CECL right around the corner, the time is now to enhance the integrity of your data.

Well-organized financial data, that is easily accessible, saves people a tremendous amount of time, and uncovers opportunities.

Clean and well-organized financial data for ALM simulations, budgeting, forecasting, and budget updates, or as a foundation for testing what-ifs, can be very beneficial. Just a few benefits include:

Even if you don’t have a data warehouse, it does not mean you can’t have data that is well-organized and easy to access. Simply putting relevant data points in one file can make a huge difference. Keep in mind, these types of data points exist. It is a matter of organizing the data for easy access and use.

Organizing the data that is currently accessible is an important first step towards data integrity, and positions you to address the next question, “What NEW data do we need to begin tracking to continue improving our use of business intelligence and optimizing our business?”

Keys to a Clear & Effective Objectives Statement for Your RFP Process

Consumer Behavior and Technology, Featured, Process Improvement, Strategic Planning Blog PostsAmong the many financial institutions that have implemented new loan origination systems (LOS), core systems, or other systems, a number of them find they’re really not getting what they wanted out of the new technology. Having heard so many implementation stories, we wanted to share a few of the lessons learned and, hopefully, save you some trouble.

One of three things we talk about in our published c. notes is to create a clear objectives statement.

Creating a clear objectives statement is not just an exercise in wordsmithing; it’s really about getting all the stakeholders to share the same vision. Problems occur when everyone thinks they’re on the same page, but they’re not. Institutions that have been successful in uniting everyone in the vision engaged in the productive dialogue necessary to agree on a clear objectives statement.

The beauty of establishing a clear and effective objectives statement is that it can and should be used diligently as a filter for the thousands of decisions to be made. It can help cut through the confusion and provide guidance throughout the entire selection and implementation process.

Of course, the objectives should tie to the strategy. If your strategy is to be an ultra-efficient master of lending or to create a fast, friendly member experience, the objectives of the implementation should support it.

An effective objectives statement is NOT…the software is installed and tested, and staff is trained and using the system.

The crux of the matter is that there is a reason for implementing new technology. It’s not simply to have the new technology or your staff using it. What is your reason? What do you want to get out of the new business processes that are supported by the new system? How will success be defined? How is it going to help the institution achieve its goals and execute the strategy?

If the reason for the new system is to book more loans, the implementation isn’t successful until more loans are being booked. The implementation is only complete when the objectives are met. This means that if the objectives aren’t being met, more work needs to be done until they are. The following objectives statement examples are of an LOS implementation for an institution wanting to be an ultra-efficient master of lending:

The second objectives statement supports the strategy of being an ultra-efficient master of lending and has defined measures of success that ensure the real reasons for undertaking the new LOS are realized.

This kind of clarity does not occur in a vacuum. Stakeholders need to come together in productive conversations to reach the necessary level of understanding and agreement. Note: Sometimes new technology is required for reasons not initially strategic, such as the need to address new compliance requirements, or for a system being phased out. But even “have to” projects often present choices in the solutions that can help support strategy. Rather than just solving the problem at hand, frame the possible solutions within the greater strategy.

Note: Sometimes new technology is required for reasons not initially strategic, such as the need to address new compliance requirements, or for a system being phased out. But even “have to” projects often present choices in the solutions that can help support strategy. Rather than just solving the problem at hand, frame the possible solutions within the greater strategy.

Read more of our shared tips and lessons in our c. notes.

New and Emerging Strategic Questions Surrounding Indirect Lending

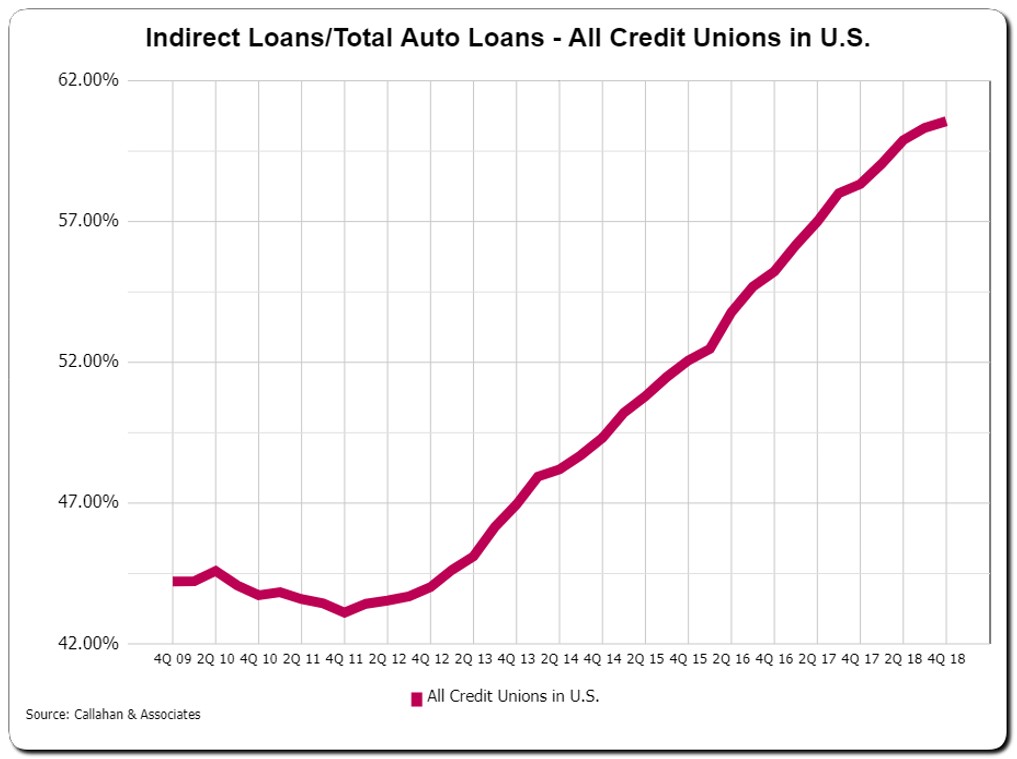

ALM, Consumer Behavior and Technology, Featured, Strategic Planning Blog PostsHigher auto rates, whispers of a potential recession, and rising prices of cars have made just a minor dent in recent credit union auto growth. While auto loan growth has been trending down, many credit unions continue to experience double digit auto growth.

While the resiliency of auto sales continues to be an opportunity for many credit unions, it is important to understand the potential business implications of how auto growth is being achieved, which is primarily from the point of purchase (indirect) channel.

*Indirect loans includes all types of indirect loans. Autos are the primary driver.

As mentioned in a blog post from October 2017, growth in indirect loans and members is not necessarily a bad thing – in many ways, the growth can be positive if it is managed appropriately and the right questions are being asked.

While the strategic questions from the blog referenced earlier remain relevant, there is a growing sentiment from credit unions that the consumer or member has spoken in terms of how it wants to conduct business. Clearly there appears to be a desire for the convenience of point of purchase transactions and additional questions are rising to the surface.

These thought-provoking questions are great scenarios to test drive with ALCO and/or management. Test driving the strategic implications and simulating possible financial outcomes can be extremely valuable to help inform timely adjustments that need to be made to optimize business models.

The Competency of Being Proficient in Identifying and Creating an Evolving and Sustainable Business Model

Featured, Strategic Leadership Development, Strategic Planning Blog PostsIn a past edition of our c. notes, we discuss the Key Competencies of a Strategic C-Suite Team. While in the c. notes we demonstrate 7 key competencies, in this blog we focus on the first competency – proficient at identifying and creating an evolving and sustainable business model.

Visualizing and articulating the long-term view is necessary, regardless of how fast things are changing. The speed of advancements, complexities, and interdependencies require decision-makers to be much more forward thinking to remain truly relevant.

Gone are the days of solely focusing on short-term financial goals. Strategic executives embrace the fact that thinking strategically is a constant pursuit and not limited to one planning session each year. They also take measures of success to a new level, and recognize that what the credit union decides to strive for in the short term can help or hinder in the long term.

So, they go big first. They actively wrestle with, and answer, tough questions such as:

What is our true value proposition?

Is our value proposition sufficiently compelling to attract enough of our target markets to do most of their business with us?

The answers to these critical questions should then drive what needs to be done in the short term to arrive at the desired future. This approach is very different from stopping at 1-year goals for traditional measures such as ROA, net worth, membership, and asset growth.

All along the way, strategic executives are assessing internal and external risks, weighing those risks, and ultimately aggregating key information from across the organization with what the institution needs to accomplish to remain relevant.

Read to learn more about the other 6 Key Competencies of a Strategic C-Suite Team.