Recent Uncertainty Highlights The Importance of Evaluating Strategic Net Worth Requirements

The rapidly changing competitive environment and recent natural disasters are reminders of the importance of evaluating strategic net worth requirements.

A key component to understanding strategic net worth requirements is taking a deliberate approach to understanding aggregate risk. In a previous blog post we outlined an approach to help with this process.

Two types of risks that should be included in any effective aggregate risk process are interest rate risk and credit risk. While these two key risks need to be addressed, growing concerns on strategic risks to future earnings streams should also be discussed and incorporated into the aggregate risk estimate.

For instance, think about the potential reduction in future earnings as consumer usage of real-time financial management self-service alerts that can curb their spending increases. And options for how consumers pay for their purchases continue to rapidly expand beyond the traditional financial services industry – Amazon could be the next big player in this space.

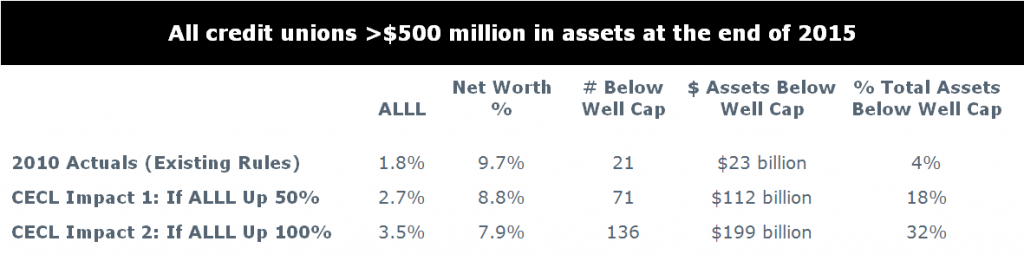

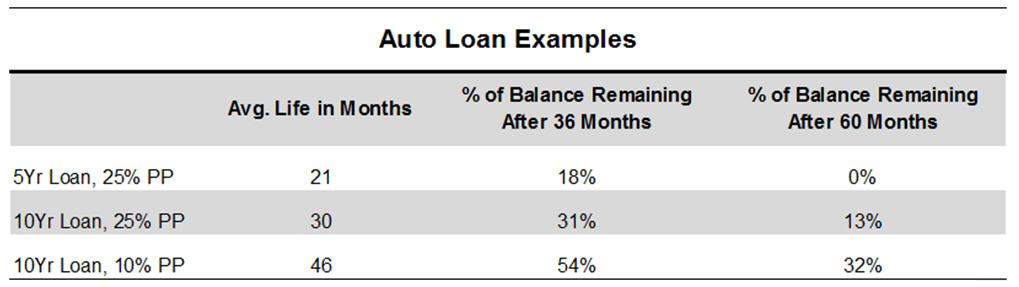

The Current Expected Credit Losses (CECL) standard is another example of how the environment is changing. CECL should not be viewed as just an accounting issue because it has the potential to impact both earnings and net worth. While 2021 may seem like a lifetime away, it is critical that decision-makers understand their credit union’s capacity to handle the impact of CECL.

Remember that being within individual risk limits does not necessarily indicate that the credit union is safe and sound. As history repeatedly teaches us, bad things don’t usually happen in isolation. The few pressures described above can occur while an unforeseen event comes out of left field, such as the Equifax data breach.

Another example of an unforeseen event is the string of natural disasters that have impacted the country in the past few months. For those affected, it is still too early to understand the fallout from these events. However, it is an unfortunate reminder that the unexpected can happen, and the net worth needs to be able to handle multiple risks happening simultaneously or bear the brunt of cascading events.

None of the risks above are easy to quantify, but that doesn’t mean risks should not be aggregated to gain an understanding of the aggregate risks relative to net worth. Starting with a list of your management teams’ top concerns is a great way to get the ball rolling. Keep in mind that the chance of being “exactly right” on your credit union’s aggregate risks is slim to none. The value is in the strategic discussions and the allocation of net worth to strategic threats and unforeseen events.