Observations from ALM Model Validations: Extremely Profitable New Business ROA in Static Balance Sheet Simulations

In this installment of our series on observations from model validations, we’ll focus in on the results from traditional income simulations, specifically static balance sheet simulations. We often see results that show low risk despite the credit union having a material amount of fixed-rate, long-term assets.

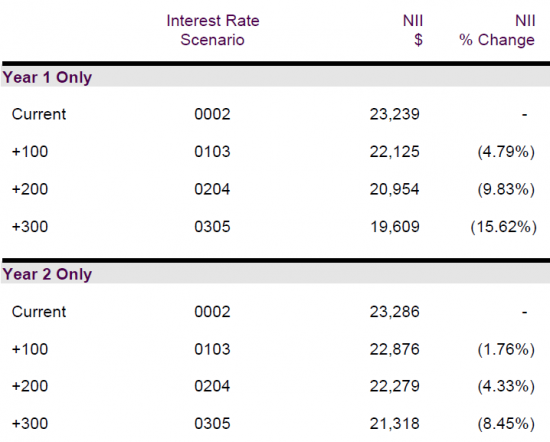

Take the example below which shows the NII results from a static balance sheet simulation. In year 1, the NII volatility is -15.62% in a +300 bp rate environment, which would be considered lower risk, and year 2 is even better at -8.45%. Keep in mind most policies have NII volatility limits of 20-30%, so this particular credit union looks pretty good. But why?

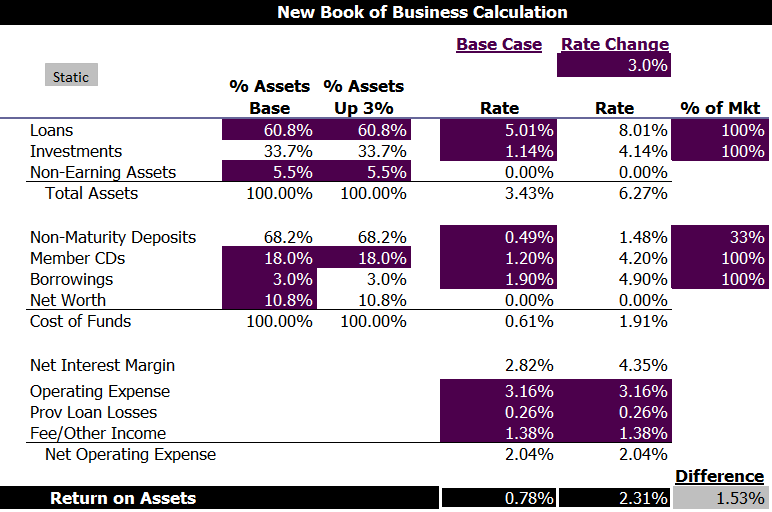

As we discussed in a previous blog, Observations from ALM Model Validations: Cost of Funds Back Testing, static balance sheet simulations assume that the deposit mix will not change as rates change, even though history suggests otherwise. It also generally assumes that a credit union could never have the loan-to-asset ratio drop, and often assumes the institution will be able to raise its loan rates 100% of the rate change.

Clearly, relying on a new business ROA north of 2% is not reasonable. These unrealistic assumptions about new business understate the risk of an institution.

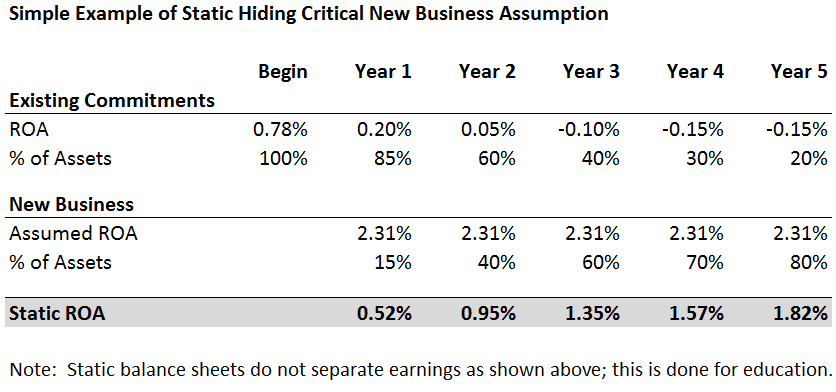

Often when presented with this evidence, the response is that there is no way that such a high ROA is being assumed because the results show a decline in ROA for the first year (see example below). The reason is that often places only look out one year, maybe two. So the new business impacts the results but is smaller than the existing business.

To prove this out, look out at year 5 in your static simulation. You may not fully see the ROA over 2%, since most institutions are having the strain from their existing commitments holding the ROA back, but it is likely you will see an ROA that is above a level the credit union has ever experienced. If you want to see an even less defendable answer, look out at year 5 for a +500, and you will most likely see an ROA that far exceeds the earnings experienced the last time rates were at 5% (2006-2007).

Seeing results from this perspective, it is hard to call a static balance sheet a risk simulation.