Now is the Time to Strategize on Investments

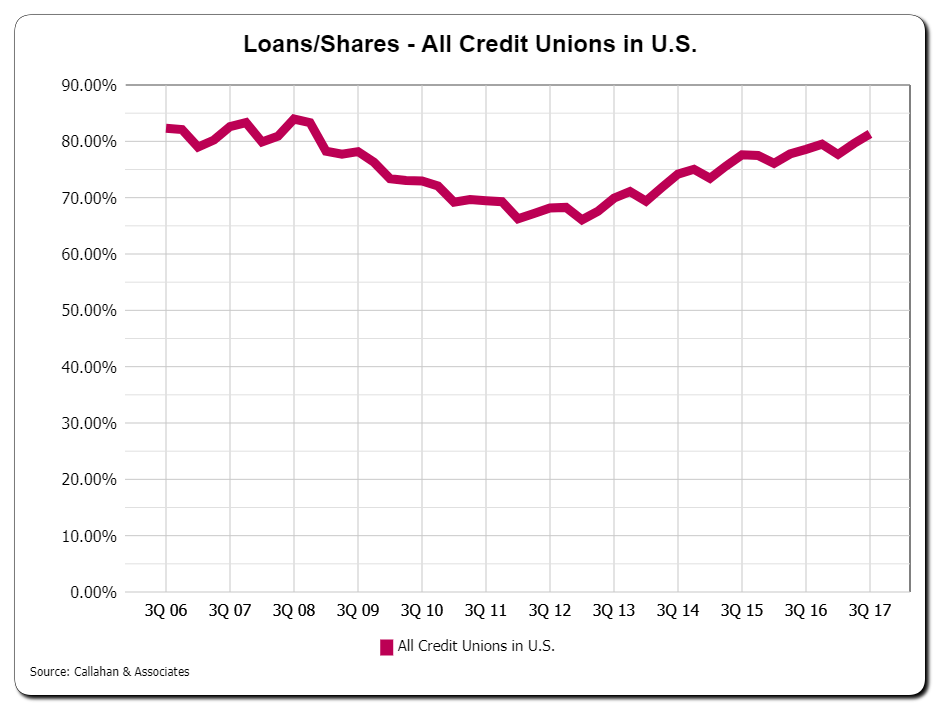

After the Great Recession, credit union loan-to-share ratios declined steeply and didn’t begin their long, slow recovery until 2013. It has taken 4 more years to approach pre-crisis levels. Now, credit unions are beginning to face very different questions than they have since the financial crisis.

Even if your credit union isn’t feeling a liquidity squeeze, now is the time to strategize on the investment portfolio you’ll want to have if loan growth continues to outpace share growth.

The type of investment portfolio that works well for an institution with 35% of shares in investments will likely be quite different from one that has 10% in investments. Large investment portfolios often shoulder a hefty profitability burden for the institution. As loan balances grow, investments may need to serve more of an interest rate mitigation function. Of course, liquidity needs are also a factor.

Here are some things to keep in mind as you think through the possibilities:

- If loan growth patterns continue, will the loan portfolio shift toward having more or less interest rate risk? Will the loan growth cause the yield on loans to increase or decrease? This can help guide the structuring of investments to balance risk and profitability for the institution as a whole

- How does the future loan portfolio align with risk limits? For example, if loan growth is pushing the balance sheet up against interest rate risk limits, can the investment portfolio be used to offset the additional risk? At the same time, if there isn’t much interest rate risk in the loan portfolio, there might be more room for interest rate risk, and the higher returns that usually accompany it, in the investment portfolio

- What will be needed for liquidity? While there are a variety of levers to pull for liquidity, be sure to consider how much of the investment portfolio strategy will be dictated by liquidity needs

- How might selling investments help to rebalance risk or increase liquidity even if those investments are sold at a loss? Selling at a loss does not mean the investments were “bad.” Looking at the total interest earned in comparison to the loss can help provide perspective on how the investment performed for the credit union. Also factor in what the funds will earn when they are loaned out (and serving members). Often the loss is a small price to pay to address greater strategic needs

- Test, test, test! Test drive your ideas by modeling various future structures in a wide range of interest rate environments

Thinking through what your structure could look like if current trends continue will help lead to better investment decisions today in preparation for tomorrow. Taking the time to strategize now and form a clearer picture of the future can only enhance the sustainability of your business model.