Where Is Your Deposit Growth Coming From?

Many financial institutions have become increasingly concerned about liquidity and for good reason. While deposit growth is often celebrated, where that growth is coming from can have important implications with respect to liquidity, A/LM, and future plans around membership and asset growth. Is your institution’s deposit growth coming primarily from growth in new accounts or growth in average balances?

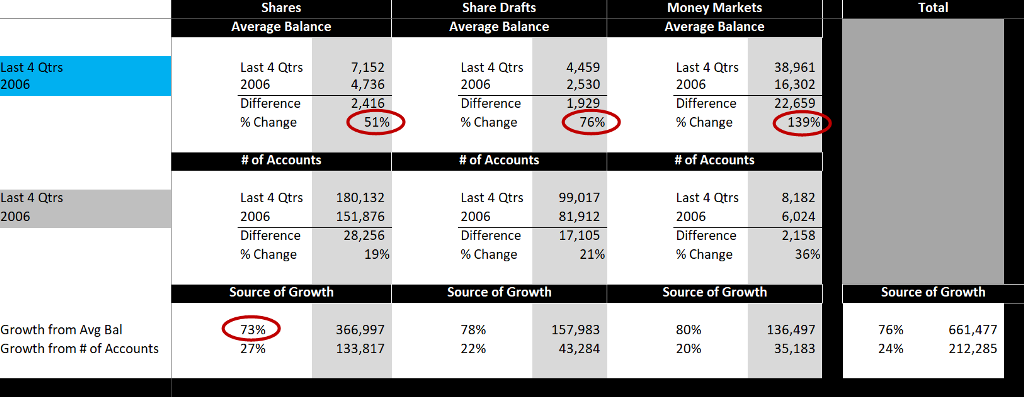

For some credit unions, the change in average deposit balance can represent a substantial risk to maintaining sufficient liquidity. The example data displayed below shows a credit union that over the last 10 years increased average share balances by 51%, share drafts by 76%, and money markets by a whopping 139%.

If you look at the lower portion of the matrix above, note that 73% of growth in shares was from increasing average balances, 27% of the growth was from new accounts. Money markets and share drafts were even more lopsided toward average balance growth. The vast majority of this institution’s deposit growth has come from increasing average balances, as opposed to adding new accounts.

Is this growth because relationships are deeper or is it that members are sitting on more money when the rate alternatives are so low? What could this mean for liquidity exposure, if rates go up or the market gets excited about keeping money somewhere else? Consider that share accounts could be materially more sensitive to moving money than they were in the past. Combine this information with the knowledge that in the last rising rate environment smartphones did not exist—liquidity risk has increased, as it is now easier than ever to move money.

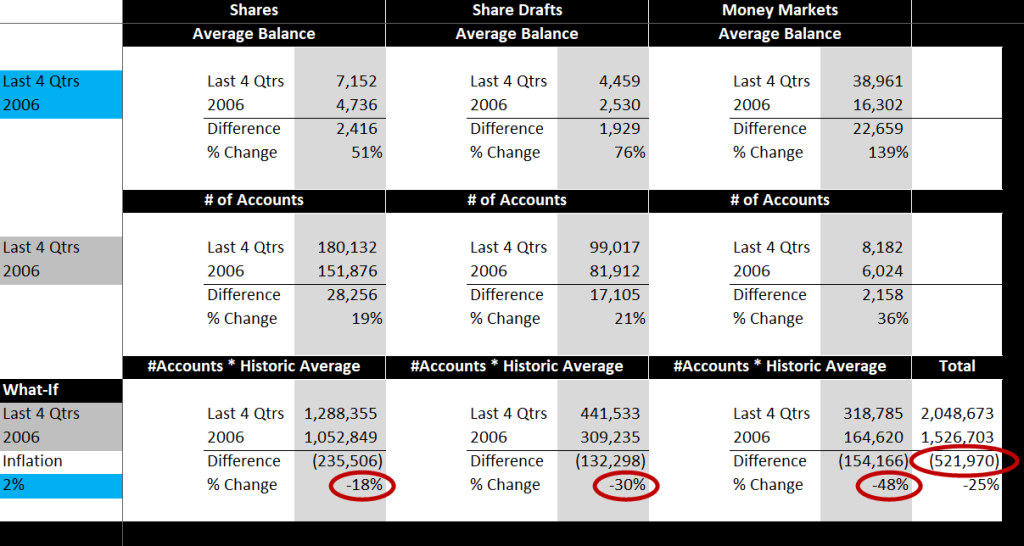

Another way to look at this could be to consider what the deposit growth matrix would look like if the growth were pegged to inflation (conservatively assuming a 2% inflation rate over the last 10 years). If average balances grew at a 2% annualized rate, the credit union would have accumulated 18% less in regular shares, 30% less in share drafts, and 48% less in money markets. This would represent almost $522M fewer deposit dollars over the same 10-year period.

Additionally, if a credit union has become more active in indirect lending, it is important to understand how indirect members are impacting average deposit balances (since indirect members often carry small or minimum share balances). If indirect account holders are excluded, the average share balance utilizing the same example credit union would have increased by 63% over the same period of time (compared to 51% including indirect members), and increases in average balances would account for 94% of the growth in shares as opposed to 73%. For some credit unions, the impact of indirect members could be more significant.

From a policy perspective, having this type of data readily available can help to inform contingency funding plans and how you stress your liquidity simulations. Some credit unions evaluate their bad case liquidity scenario by analyzing growth in average balances over time and assuming that a portion of that “excess” growth leaves the credit union. This can help put some historical context around your liquidity stress testing.

Financial institutions are potentially entering unprecedented territory with respect to the pattern of interest rates, and how members will behave is unknown. As you plan for liquidity, consider evaluating how your average deposit relationships have changed, what it could mean for your institution, and what you could do now to prepare.

C. myers has posted several entries on our blog over the last year about this important topic. Click here to see more.