Concentration Risk Limits on Mortgage-related Assets and the Unintended Consequences

Not all mortgage-related assets are created equal. Therefore, using a one-size-fits-all approach in establishing concentration risk limits can lead to missed opportunities or a false sense of security.

Concentration risk policies are intended to reduce the impact a risk event could have on a credit union’s balance sheet, financial structure, and/or business model. The NCUA cites the Basel Committee on Banking Supervision when defining the concept, stating:

A risk concentration is any single exposure or group of exposures with the potential to produce losses large enough (relative to capital, total assets, or overall risk level) to threaten a financial institution’s health or ability to maintain its core operations.

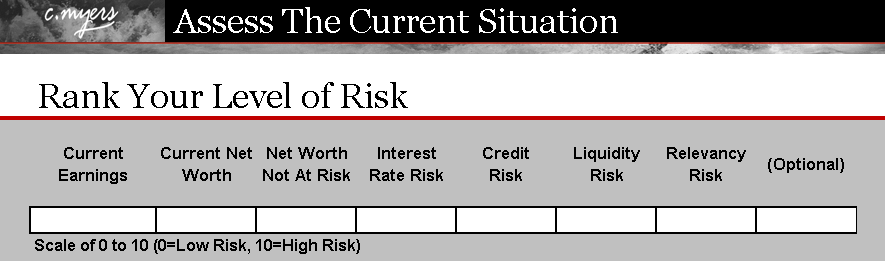

An effective risk management policy and process should incorporate an understanding of the aggregate risk exposure present in a credit union’s financial structure. This is key to ensuring that the overall risk level in the credit union’s financial structure does not exceed the institution’s risk threshold, nor does it place the overall health or viability of the institution at risk.

Supplemental to an effective aggregate risk management process would be limits on certain key areas, or “hot spots,” that fit the definition of a risk concentration, as referenced above from the Basel Committee. Frequently, mortgage-related assets are lumped into a single category and defined as a risk concentration based upon the underlying collateral (mortgages). However, the risk present across all types of mortgage-related assets is not the same. Consider the risks present in:

- Floating-rate Agency-backed CMO with a 6% lifetime cap

- 30-year conventional fixed-rate mortgage (80% LTV)

- 50% LTV first lien HELOC with a 15% average utilization rate

- 15-year final maturity seasoned Agency-backed MBS pool

- 95% CLTV second lien mortgage (first lien with another lender)

- GNMA MBS pass-through (which carries a 0% risk weight in credit union/bank RBC calculations to the extent they are unconditionally guaranteed)

Some of the above carry liquidity risk, some carry credit risk, others carry interest rate risk (IRR) – and some carry a little of all the listed risks. However, the degree of risk is different for each. The interest rate risk profile of a floating-rate collateralized mortgage obligation (CMO) is materially different than that of a 30-year conventional mortgage. The liquidity risk in a 50% LTV first lien HELOC with a 15% average utilization rate is materially different than the Government National Mortgage Association (GNMA) mortgage-backed security (MBS) pass-through.

Part of an effective overall concentration risk management policy is to document the risk(s) addressed by a particular limit. Instead of setting a single limit on all mortgage-related assets, management teams should invest the time it takes to identify the risk(s) across all types of mortgage-related assets, and set limits where it is determined a concentration exists. As mentioned above, setting a single limit on mortgage-related assets can lead to missed opportunities or lull decision-makers into a false sense of security. Having a robust process to identify and manage the aggregate exposure of risks that could significantly threaten a credit union’s net worth is a critical component of the asset/liability management (A/LM) process.

c. myers corporation is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

c. myers corporation is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: