Are Today’s Borrowers Finding Your Credit Union?

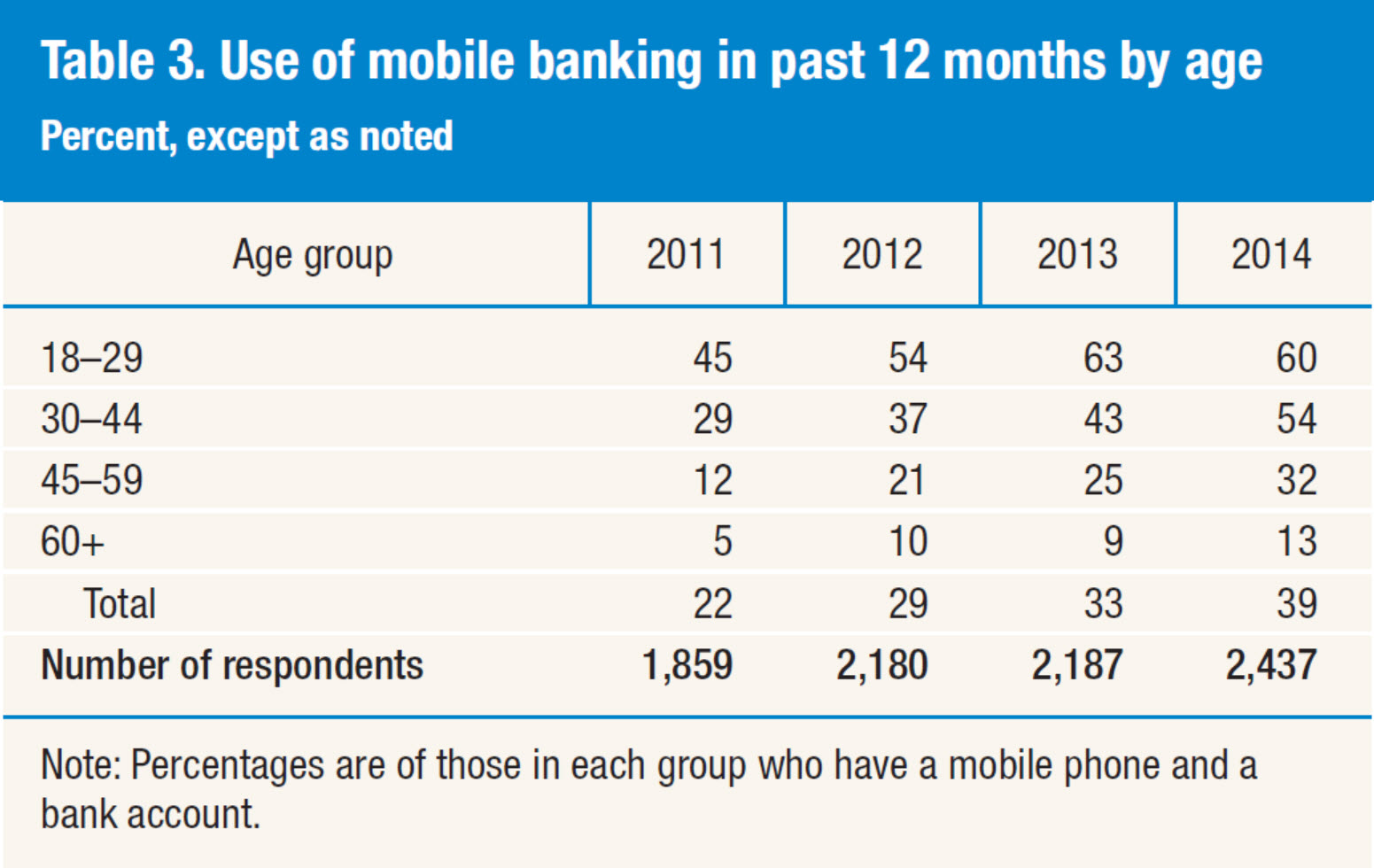

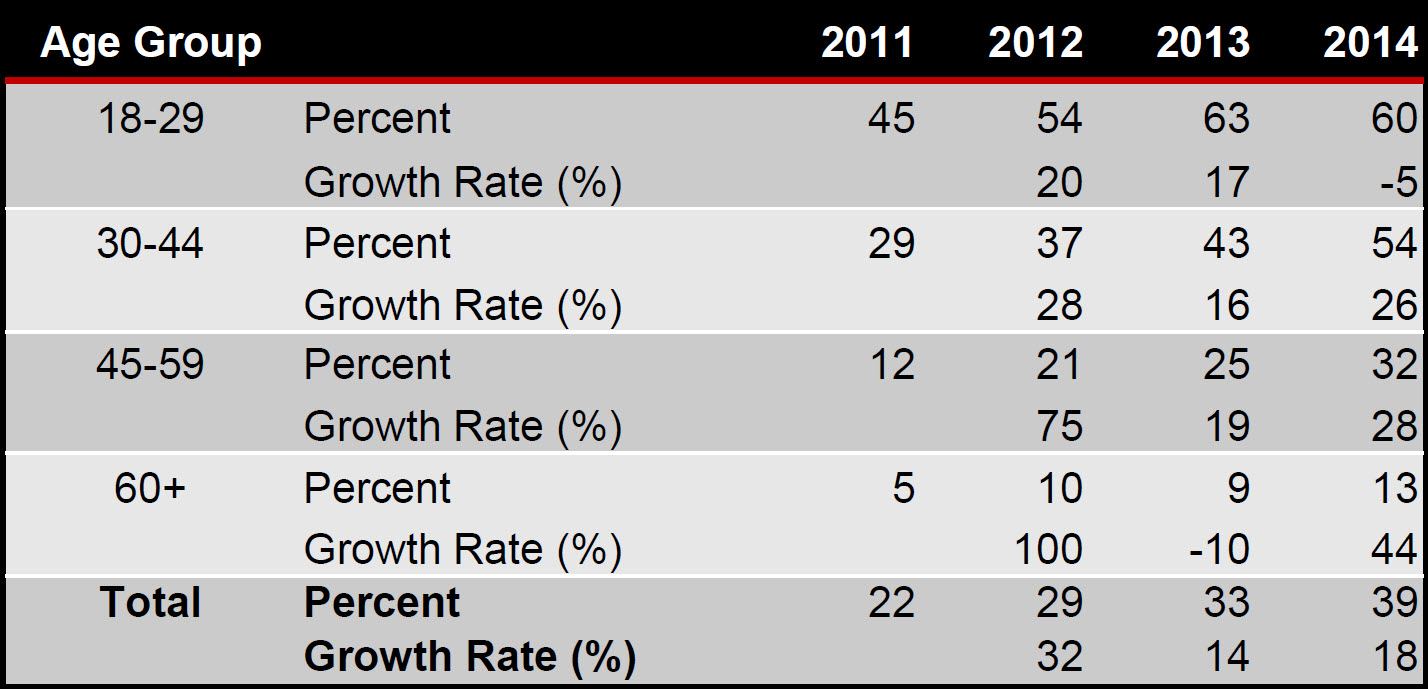

Today’s buyers shop differently than in the past. As the first generation of digital natives comes of age and begins to seek loans in earnest, research shows that they go about the buying process differently than previous generations, doing more research and getting more recommendations before interacting with sales people. The Zillow Group Report on Consumer Housing Trends (2016) provides the following insights into the home buying process specifically, but it seems likely that many of the conclusions from the home buying research could be applied to consumer borrowing, as well.

Half of home buyers in the US are under 36 years of age. Half. 42% are Millennials, age 18-34.

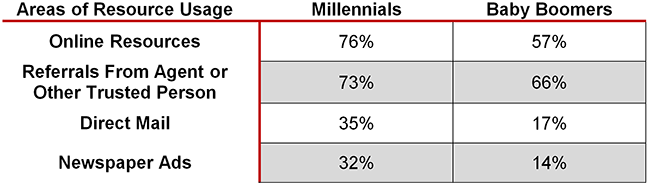

In many ways, younger people’s borrowing behaviors don’t vary much from previous generations. They still want to work with agents and value private home tours. But some of the areas where they differ can be useful when rethinking how to reach them. It’s interesting to compare the two biggest generational groups by population—Millennials and Baby Boomers—to highlight how things are changing. When it comes to finding a lender, it’s no surprise that Millennials use online resources more heavily than Baby Boomers, but some of the other areas of resource usage may be more unexpected:

How visible is your credit union to Millennials when they are tapping into these resources?

Millennials use more resources to educate themselves and do more research on agents and lending professionals than any other generation. They make more use of interest rate and affordability tools and mortgage calculators. Are your tools easy to use? Are Millennials finding good content from your credit union as they do their research?

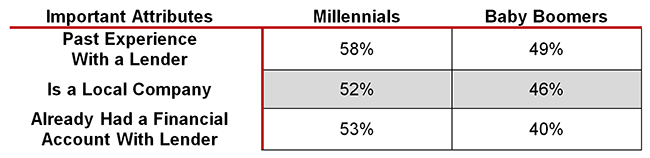

The sheer number of Millennials makes this group hard to ignore, but there are surprising statistics from the study that relate to loyalty—the thing that Millennials “just don’t have” according to some.

Important attributes when selecting a lender:

Before you can build loyalty, you have to be seen. Remember that research is key for Millennials, so making sure that your credit union is visible, provides useful content, and offers easy-to-use tools is important. At the same time, they’ll be looking for positive online reviews as well as referrals from people they know—so fast, friendly, and effective processes are required. Doing an outstanding job for this group might not only help profitability today, but could serve to build member loyalty for years to come.