Optimize Your Budget Business Intelligence

Given all of the time and rigor that typically go into the annual budget process, it makes sense to consider how that process might be improved and generate greater business intelligence for decision-makers. Beyond creating a base budget, following these 6 steps can help take the budgeting process to the next level and provide leaders a significantly better understanding of potential outcomes.

1) Begin with the Baseline Budget

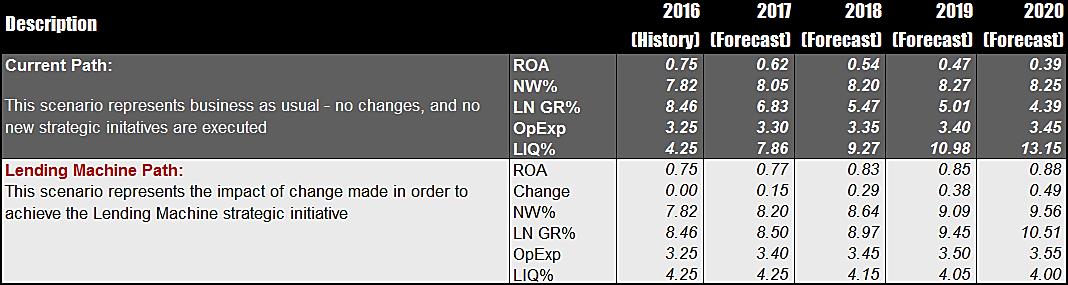

The baseline budget should provide a solid foundation for understanding how the primary strategy is likely to impact financial results. Building upon the credit union’s strategic directions, the budget assesses the impacts of expected new business goals, deposit generation, investment strategies, non-interest income, and operating expenses. The budget establishes the fundamental expectations for the core strategy and how it will impact the financial measures for success such as return on assets (ROA) and net worth ratio.

2) Use a Long-term View

Looking beyond the next fiscal year acknowledges that the budget is not a destination, but a path to the future. It can be useful to see the longer trending impacts of decisions made today, even while recognizing that uncertainty increases when projecting further into the future. Our clients tell us they find long-term financial forecasts showing impacts over the coming 3-5 years provide valuable information and an early warning while not wading too far into the uncertain future.

3) Understand the Impacts of Changing Rate Environments

Asset/liability management (A/LM) should be an integral part of the budgeting process. After understanding the baseline budget, assess the sensitivity of the budget to interest rate risk (IRR).

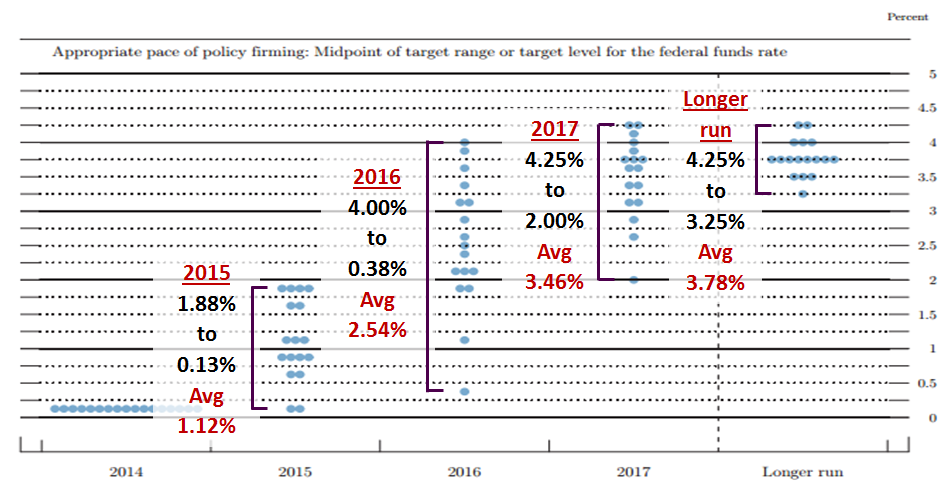

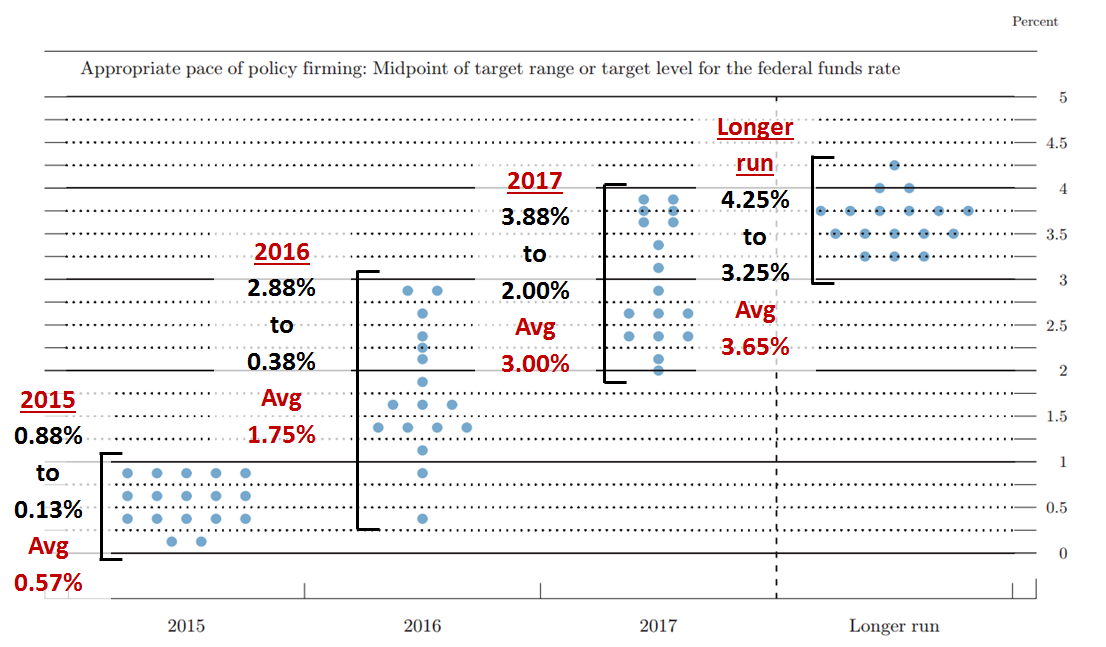

This process begins with choosing the market rate assumptions in the baseline budget. We recommend credit unions develop baseline budgets assuming market rates remain at current levels. By so doing, the impacts of the strategic assumptions can be isolated from the potential benefit or detriment of changing market rates. Otherwise, the market rate changes may hide risks and opportunities driven by the core strategic assumptions.

Once the baseline budget impacts are understood in the current rate environment, play through a variety of likely and potential market rate changes, with rates increasing and decreasing, and where short- and long-term market rates move independently (i.e., twisted yield curves). How sensitive is the structure to those changes in rates? And what other decisions might be made today that remain consistent with the overall strategy but may reduce potential net income volatility in changing rate environments?

4) How is the Credit Union Positioned for IRR if the Budget is Successful?

Regardless of how far forecasts look into the future, targets are typically established for the coming fiscal year for measures such as growth in members/assets/deposits, ROA, net worth, etc. While assessing the impact of changing rate environments along the way, how well-positioned is the credit union for future IRR in 1 or 2 years if the budget is achieved?

Using the target financial structure implied by the budget, how would the A/LM modeling assess IRR at that point in the future? Is the credit union better prepared for market rate volatility, or did the credit union increase its risks? Are IRR policy limits and guidelines still being met? If not, understanding those risks today and weighing options with the board and management could be critical.

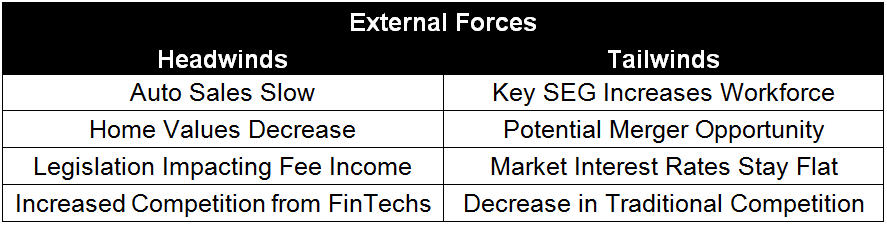

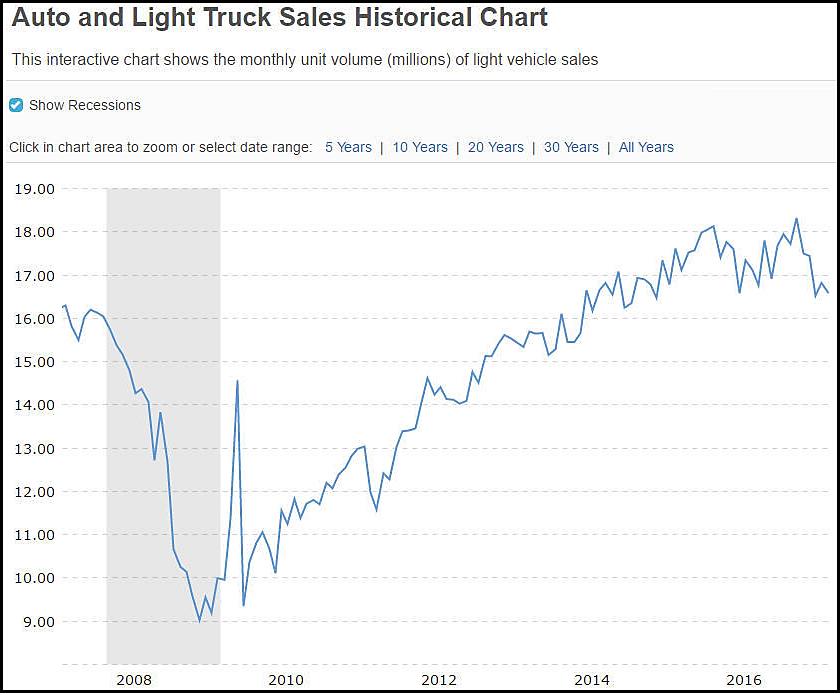

5) Consider Alternative Scenarios beyond the Base Budget

Most would agree that having a clear picture of the future would be a welcome gift, especially during budget season. Unfortunately, predicting that future can be a tricky business. Instead, we often look to recent trends to inform us of likely market directions and pressures.

When trends appear likely to impact the credit union’s business model or strategy, it can be valuable to consider the extent of those impacts and likely responses the credit union may take. Ask how trends might impact the business model, and develop what-if scenarios to understand the potential financial implications while also testing mitigating strategies.

For example, what if the trend data suggested mortgage volumes may slow, and a growing opportunity for more home equity loans? What challenges or opportunities might that present? Similarly, what if some regulators warned about the risks of low-cost funding sources going away, and at a time when long-term assets in the industry have been increasing? What if funding costs increased more rapidly than anticipated? If concerns exist for the credit union with regard to long-term assets, what options might exist today (i.e., before more of the industry might face similar pressures) to mitigate the risk in some way?

Considering alternative scenarios can better prepare management and boards for potential impacts, and create more informed strategic dialogues. Modeling such scenarios early can better prepare the credit union to pivot from current strategies should those trends continue by creating awareness and understanding.

6) Effectively Summarize the Results

The value and power of this additional business intelligence can be lost if buried in an array of detailed reports. However, by being clear on the critical measures to evaluate, we have found that the results can be typically summarized in a 1- or 2-page document. Using a brief description of the budget and what-if options, the measures can be included in table form. This allows decision-makers to quickly assess the different outcomes of each of the various options and how they compare.

For many credit unions, the investment in the annual budget is significant. Perhaps because the effort can be monumental, many do not focus on generating the additional value that can come from these steps. However, with the powerful tools available to credit unions today in budgeting and A/LM software, steps 2-6 should require a fraction of the typical budgeting time while delivering exponentially greater business intelligence to decision-makers. Tools today can allow for fast-paced what-if scenarios, building on and creating more value from the baseline budget. Using these tools, credit unions can do more to rehearse many possible tomorrows today.