c. notes – Continuous Process Improvement Supports Strategy

WESTCONSIN CREDIT UNION: A PROCESS IMPROVEMENT CASE STUDY

If you grew up in western Wisconsin, you probably knew this credit union as a great place to bank that’s full of friendly, helpful people. It has celebrated a long history of successes starting with its agricultural roots and continuing to today’s modern mix of urban and rural membership. Meet $1.1 billion WESTconsin Credit Union (WESTconsin), headquartered in Menomonie, Wisconsin. This organization is focused—and one of the things they’re focused on is process improvement. Why process improvement? Well, there’s efficiency and expense control, but for WESTconsin, process improvement is more than that.

is focused—and one of the things they’re focused on is process improvement. Why process improvement? Well, there’s efficiency and expense control, but for WESTconsin, process improvement is more than that.

Superior processes are an integral part of the strategy. In 2015, the credit union decided that, in order to deliver meaningful member experiences, it must develop a new core strength: Simple, streamlined processes for members and employees. Clearly, this translates into more than improving some key processes. To make it a true core strength, the credit union must establish an organizational framework for continuous process improvement across the enterprise. Think of it as a process for:

- Determining which processes to improve and when

- Executing on process improvements

- Monitoring and communicating key metrics

- Determining when processes are revisited

This framework keeps the organization focused on continuous process improvement.

When WESTconsin decided to make processes a strategic area of focus, they asked c. myers to help with a pilot process improvement for consumer lending. That was a little over a year ago. Today, the credit union has a process improvement/project management specialist in place and is working with c. myers to establish its enterprise process improvement framework. WESTconsin is still on its journey, but we recently checked in with Mark Willer, Chief Lending Officer (CLO), to get his perspective on the experience so far.

WHAT DOES IT TAKE TO MAKE “SIMPLE, STREAMLINED PROCESSES” A CORE STRENGTH?

Willer explained that for WESTconsin, process improvement is perfectly aligned with its mission, core values, and value proposition. Simple, easy, and fast are part of a  quality member experience, which is part of the strategy. This link between process improvement and the credit union’s highest-level strategy translates to unwavering support from the senior team for the process improvement strategic initiative.

quality member experience, which is part of the strategy. This link between process improvement and the credit union’s highest-level strategy translates to unwavering support from the senior team for the process improvement strategic initiative.

Commitment from the top is one of the keys to success for incorporating process improvement into the very essence of the credit union. It is not uncommon to see organizations hire a process improvement specialist only to find success evasive because the support at the top isn’t strong enough or focused enough.

The fact that the process improvement mandate comes from the top signals its importance. Part of that support means that each major process improvement endeavor has an executive sponsor that sees it through to completion.

Executive sponsor key roles:

- Assuring the improvements align with business goals

- Supporting the team and removes obstacles

- Acting as a vocal and visible champion

GETTING STARTED

As a first step toward simple, streamlined processes, WESTconsin tackled consumer lending, creating a clear objective: Improve and optimize the consumer lending process, resulting in x% of qualified A & B consumer loans being decisioned within x minutes. The objective was directly related to the credit union’s strategy.

The specific piece of consumer lending the  credit union wished to improve when engaging c. myers was the vehicle lending process. This piece wasn’t broken—not by a long shot—but in considering the competitive environment, leadership asked themselves some questions:

credit union wished to improve when engaging c. myers was the vehicle lending process. This piece wasn’t broken—not by a long shot—but in considering the competitive environment, leadership asked themselves some questions:

- How can we create a more rewarding member experience?

- How can we create a more rewarding employee experience?

- How can we compete more efficiently, doing more without needing to add staff?

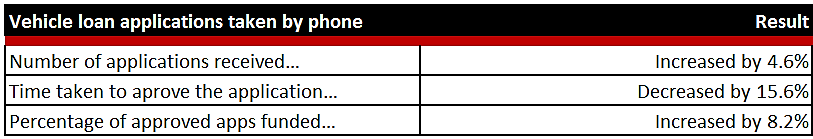

Within months of completing their process improvement, they saw the following progress in their vehicle lending numbers:

Figure 1: Year-over-year percentage change measured 6 months after process improvement engagement

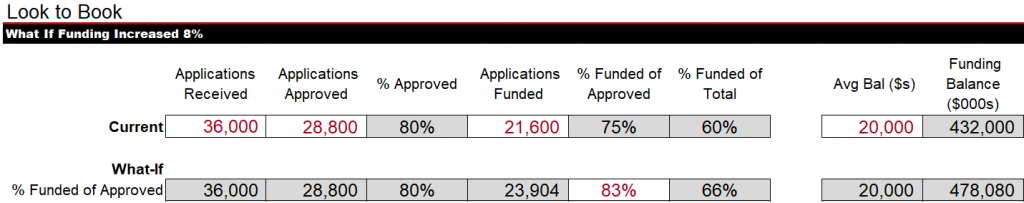

There is often a strong correlation between faster approval times and higher funding ratios, because faster approval times represent an important aspect of the member experience. The following example doesn’t reflect WESTconsin’s numbers, but consider the impact to the bottom line that an 8% increase in funding of approved applications (apps) can have. In this example, the credit union receives 3,000 apps per month (36,000 per year), approves 80%, and funds 75% of the approved apps. Using an average loan balance of $20K, this results in $432M in fundings per year. If the percentage of approved apps funded increases by 8%, from 75% to 83%, the credit union funds $46M more per year.

The additional funding represents a boost to the bottom line without bringing in or processing any more applications.

THE RECIPE: SUCCESSFULLY IMPROVING A PROCESS

WESTconsin used a proven method for effective process improvement that included the doers in order to:

- Understand what was really happening in the process

- Generate creative solutions

- Create buy-in for the identified improvements

The team was excited about the changes and helped make them stick. Moreover, no additional staff was added to support the new process.

In addition to involving the doers, keys to successful process improvement include having a clear objective, clearly documenting the decisions that are made along with the rationale behind them, creating a game plan to help with execution, and using metrics to monitor the process.

In addition to involving the doers, keys to successful process improvement include having a clear objective, clearly documenting the decisions that are made along with the rationale behind them, creating a game plan to help with execution, and using metrics to monitor the process.

ADVICE FROM WESTCONSIN CREDIT UNION

When asked what advice Willer would give to other organizations that are considering process improvement, here’s what he offered:

- It starts at the top. Senior management needs to be solidly behind any process improvement initiatives

- Don’t hesitate. Do it now. Look at what’s coming up behind you—how quickly the competition is evolving

- Don’t try to do it on your own, initially. Partner with someone who has been successful. Otherwise, it’s easy to get stuck in the details

- Don’t go into it thinking of cutting staff. Think in terms of adding capacity

- Use the 80/20 rule when designing processes. Focus on what will work best in 80% of situations

- Be prepared to communicate continuously, repeating the message often, especially when shifting staff roles

- Leaders need to be prepared to take the necessary time and make some tough decisions

Emphasis on an exceptional member experience has long been a driver of WESTconsin’s business model. Nevertheless, the definition of an exceptional member experience continues to evolve. Just a few years ago, the ability to conduct business on a smartphone at any hour of the day, or to be able to complete a loan without setting foot in a branch, was not on anyone’s radar screen, and it certainly  wasn’t an expectation. But both traditional and non-traditional competitors are redefining consumer expectations. Providing an experience that members are excited to share with others requires regular evaluation of what that experience is, in addition to actually providing it.

wasn’t an expectation. But both traditional and non-traditional competitors are redefining consumer expectations. Providing an experience that members are excited to share with others requires regular evaluation of what that experience is, in addition to actually providing it.

INTO THE FUTURE

As WESTconsin continues on its journey toward making simple, streamlined processes for members and employees a core strength, many more processes will be improved and an enterprise process improvement framework will be put in place. In the meantime, the benefits of process improvement are already being felt.

By choosing to create a strategic focus on  process improvement, this highly successful credit union is positioning itself to continue delivering exceptional member experiences far into the future—even as the definition of “exceptional member experience” changes over time.

process improvement, this highly successful credit union is positioning itself to continue delivering exceptional member experiences far into the future—even as the definition of “exceptional member experience” changes over time.

ABOUT C. MYERS

We have partnered with credit unions since 1991. Our philosophy is based on helping clients ask the right, and often tough, questions in order to create a solid foundation that links strategy and desired financial performance.

We have the experience of working with over 550 credit unions, including 50% of those over $1 billion in assets and about 25% over $100 million. C. myers helps credit unions think to differentiate and drive better decisions through facilitating more than 130 Strategic Planning, Strategic Leadership Development, Process Improvement, and Project Management sessions each year, and providing A/LM, Liquidity, and other financial analyses.